- United States

- /

- Basic Materials

- /

- NasdaqCM:SMID

If You Like EPS Growth Then Check Out Smith-Midland (NASDAQ:SMID) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Smith-Midland (NASDAQ:SMID). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Smith-Midland

Smith-Midland's Improving Profits

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Smith-Midland's EPS went from US$0.52 to US$1.61 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

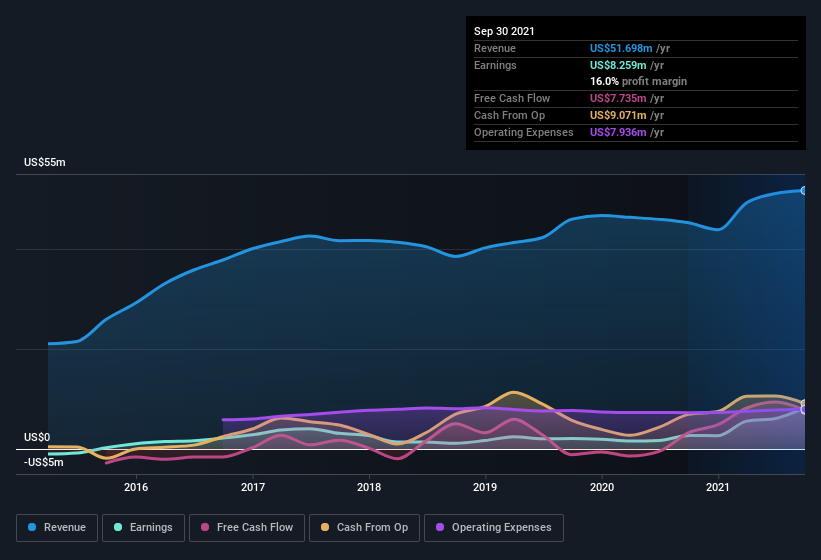

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Smith-Midland shareholders can take confidence from the fact that EBIT margins are up from 7.9% to 15%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Smith-Midland is no giant, with a market capitalization of US$123m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Smith-Midland Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Smith-Midland shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Chairman Ashley Smith bought US$20k worth of shares at an average price of around US$17.75.

The good news, alongside the insider buying, for Smith-Midland bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$23m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 19% of the company, demonstrating a degree of high-level alignment with shareholders.

Is Smith-Midland Worth Keeping An Eye On?

Smith-Midland's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. Because of the potential that it has reached an inflection point, I'd suggest Smith-Midland belongs on the top of your watchlist. You still need to take note of risks, for example - Smith-Midland has 2 warning signs we think you should be aware of.

As a growth investor I do like to see insider buying. But Smith-Midland isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SMID

Smith-Midland

Smith-Midland Corporation invents, develops, manufactures, markets, leases, licenses, sells, and installs various precast concrete products and systems.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives