- United States

- /

- Metals and Mining

- /

- NasdaqGS:RGLD

Is Investor Optimism in Royal Gold’s (RGLD) Royalty Model Reflecting a Shift in Valuation Perspectives?

Reviewed by Sasha Jovanovic

- Royal Gold recently saw a significant boost in investor interest, driven by favorable sentiment in the gold market and renewed attention to royalty-based business models as a way to access upside from rising metal prices with less risk.

- An intriguing aspect is that some valuation models suggest Royal Gold may be meaningfully undervalued, even as other measures imply its shares could be more expensive, fueling debate among investors.

- We’ll explore how rising optimism toward gold royalty models repositions Royal Gold’s investment narrative and growth outlook for the future.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Royal Gold Investment Narrative Recap

To be a Royal Gold shareholder, you need conviction in gold’s enduring role as a store of value, and in the royalty model’s ability to capture commodity upside with less operational exposure. While the recent surge in Royal Gold’s share price highlights rising optimism toward gold royalty businesses, it does not fundamentally shift the importance of gold market trends as the most immediate catalyst, or diminish the risk posed by potential production underperformance at key revenue-generating mines. Among recent announcements, the addition of Royal Gold to the Russell 1000 Defensive Index stands out. This move could attract new institutional and passive capital, reinforcing the company’s investment case at a time when broader index inclusion may support shareholder returns, but it does not materially offset the ongoing operational risks at large partner mines. However, beneath the surge in investor enthusiasm lies the ongoing concern that if production at major mines remains inconsistent, investors should be mindful of the possibility that...

Read the full narrative on Royal Gold (it's free!)

Royal Gold's narrative projects $1.4 billion in revenue and $877.9 million in earnings by 2028. This requires 21.4% yearly revenue growth and a $428.4 million earnings increase from the current $449.5 million.

Uncover how Royal Gold's forecasts yield a $220.75 fair value, a 12% upside to its current price.

Exploring Other Perspectives

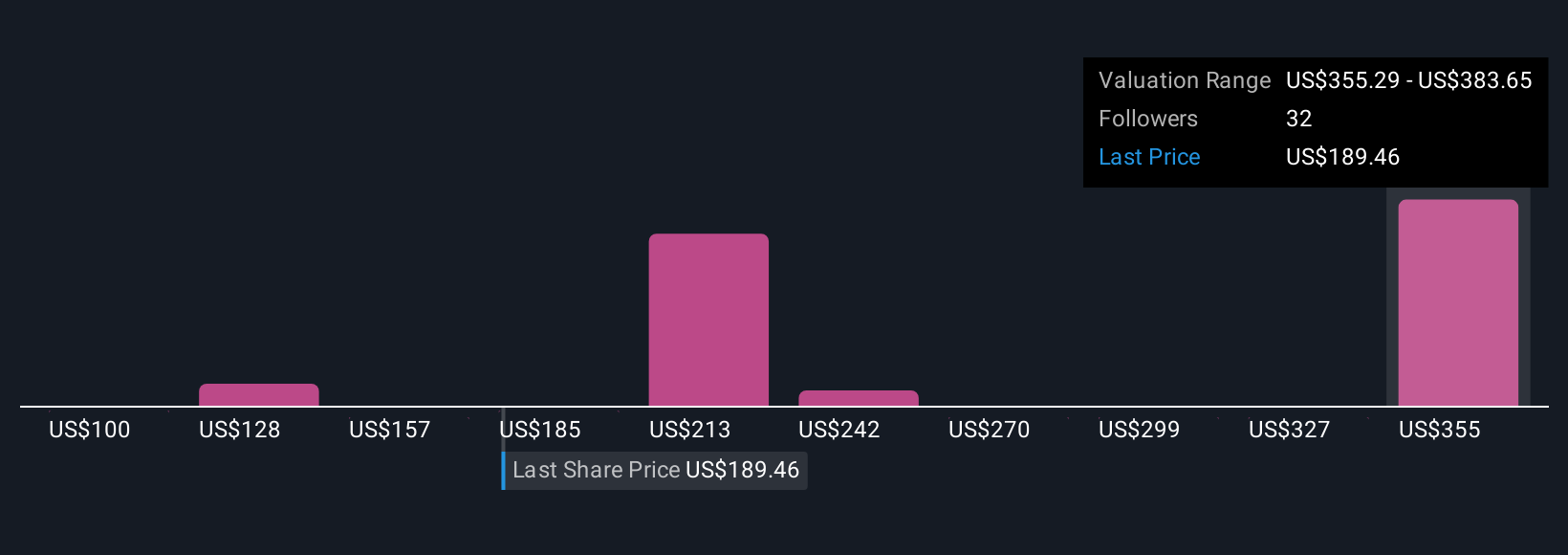

Fifteen members of the Simply Wall St Community estimate Royal Gold’s fair value anywhere from US$100 to US$384 per share, reflecting a broad spectrum of outlooks. Consider how ongoing mine performance challenges might shape your own view as you compare these perspectives.

Explore 15 other fair value estimates on Royal Gold - why the stock might be worth as much as 95% more than the current price!

Build Your Own Royal Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royal Gold research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Royal Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royal Gold's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGLD

Royal Gold

Acquires and manages precious metal streams, royalties, and related interests.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion