Last Update 01 Dec 25

Fair value Increased 0.15%RGLD: Recent Acquisitions And Precious Metals Rally Will Support Stronger Returns

Royal Gold’s analyst price target has increased slightly to $248.55. Analysts cite portfolio enhancements, ongoing M&A momentum, and supportive market conditions as key factors behind their updated outlook.

Analyst Commentary

Recent updates from Street research have provided a nuanced view of Royal Gold's outlook, with a majority of analysts expressing optimism while maintaining some caution in their assessments. Below are the key perspectives shaping sentiment on the stock:

Bullish Takeaways- Bullish analysts have highlighted upward adjustments to price targets, reflecting confidence in Royal Gold's enhanced portfolio and recent successful acquisitions.

- Ongoing M&A activity, including the closure of the Sandstorm Gold and Horizon Copper transactions, is viewed as a clear growth catalyst. This adds diversification and extends portfolio duration.

- Precious metals prices are seen as continuing to rally amid global trade and geopolitical uncertainty, which provides a supportive macro backdrop for valuation.

- Capital returns remain a focus, and continued corporate momentum is expected to support improvements in medium-term earnings per share and net asset value.

- Bearish analysts maintain that challenges persist due to slowing commodity demand from China. This could weigh on broader sector performance and impact valuation.

- There is some caution around the sustainability of the macro-supportive environment, especially given volatility in global economic conditions.

- Despite portfolio enhancements, certain analysts retain more cautious ratings. They cite a need for further demonstration of execution on recent acquisitions and consistent returns.

What's in the News

- Royal Gold's Board of Directors has approved an increase in the annual common stock dividend by approximately 6%, raising it from $1.80 to $1.90 per share for 2026. The new quarterly rate of $0.475 per share will begin on January 16, 2026 (Key Developments).

- A Special/Extraordinary Shareholders Meeting is scheduled for October 9, 2025, at 9:00 AM US Eastern Standard Time. The meeting will address the approval of share issuance and the potential adjournment or postponement of the meeting (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from $248.18 to $248.55, reflecting a modest uptick in overall fair value estimates.

- Discount Rate has increased marginally from 8.09% to 8.12%. This indicates a minor rise in perceived risk or cost of capital.

- Revenue Growth projections remain virtually unchanged at approximately 27.63%. This signals analyst expectations are stable for top-line expansion.

- Net Profit Margin is steady, holding at roughly 47.08%. This shows minimal change in profitability outlook.

- Future P/E ratio has edged up slightly from 38.84x to 38.93x. This suggests a small adjustment in valuation multiples assigned to Royal Gold.

Key Takeaways

- Strategic acquisitions and project investments diversify assets, reduce risk, and enhance exposure to gold and copper, supporting stable, long-term growth and margins.

- Increased scale and diversification attract broader investors, reinforce robust cash flows, and underpin consistent dividend growth and valuation strength.

- Heavy reliance on gold, operational setbacks at key mines, rising debt from acquisitions, premium deal competition, and geopolitical risks threaten profitability and revenue stability.

Catalysts

About Royal Gold- Acquires and manages precious metal streams, royalties, and related interests.

- The strategic acquisitions of Sandstorm Gold and Horizon Copper will significantly diversify Royal Gold's asset base, reducing single-asset risk and increasing exposure to long-term growth projects, which should drive more stable and growing revenue streams and improve net margins.

- Recent investments in projects like the Kansanshi gold stream (with a multi-decade production profile) and the Warintza copper-gold-moly project (large-scale development potential in the early 2030s) position Royal Gold to benefit from increasing demand for gold (as a hedge against inflation and geopolitical risk) and copper (driven by electrification and renewable energy adoption), supporting higher long-term revenue and earnings growth.

- The combination with Sandstorm and Horizon portfolios will make Royal Gold more attractive to passive and generalist investors due to greater scale and diversification; this could drive a larger investor base and valuation re-rating, positively impacting share price and EPS growth.

- Continued consistent reinvestment of robust free cash flows into new royalty and stream acquisitions, along with sector-leading geographic and asset diversification, supports stable or growing net margins and underpins the ability to raise dividends over time.

- Royal Gold's business model, with no direct operational exposure and a debt-free balance sheet (pre-acquisitions), enables strong cash flow resilience even through inflationary or cost pressures facing miners, supporting reliable earnings and dividend growth.

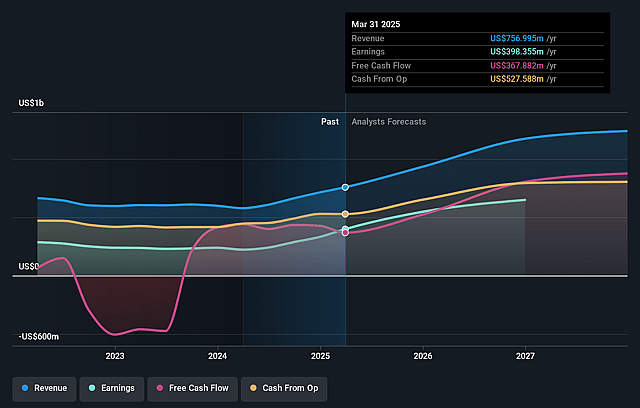

Royal Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Royal Gold's revenue will grow by 21.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 56.8% today to 62.0% in 3 years time.

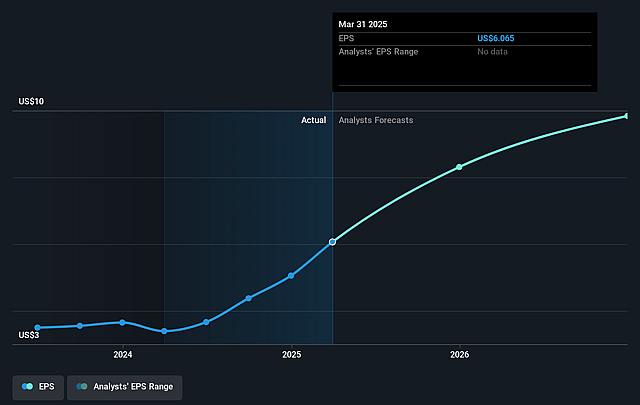

- Analysts expect earnings to reach $877.9 million (and earnings per share of $13.33) by about September 2028, up from $449.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, down from 27.1x today. This future PE is lower than the current PE for the US Metals and Mining industry at 22.5x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.37%, as per the Simply Wall St company report.

Royal Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Royal Gold's revenue and margin growth is heavily reliant on gold, which represented 78% of total revenue this quarter; a long-term decline in global investment demand for gold or lower gold prices-potentially driven by a shift toward digital assets or global decarbonization reducing gold's appeal as a hedge-could significantly impair both topline and earnings.

- Multiple key assets, including Mount Milligan, Andacollo, and Xavantina, are experiencing production underperformance or reductions in guidance, and while management cites portfolio diversification, persistent operational or regulatory setbacks at a handful of large mines could materially reduce royalty revenue and earnings consistency.

- The planned Sandstorm Gold and Horizon Copper acquisitions will require the use of Royal Gold's revolving credit facility, increasing leverage to at least $1.2 billion; if integration benefits are delayed or anticipated cost and revenue synergies do not materialize, higher interest costs and debt could negatively impact net margins and constrain future dividend growth.

- Intensifying competition for high-quality royalty and streaming deals, as evidenced by recent portfolio actions, may force Royal Gold to pay premium pricing for new transactions, compressing future deal returns and threatening long-term profitability.

- Expanding exposure to African jurisdictions, such as Zambia and Botswana, adds heightened geopolitical and regulatory risk; increased political volatility or policy changes could disrupt local mine operations, reduce or delay royalty streams, and ultimately impact revenue predictability and bottom-line results.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $211.429 for Royal Gold based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $237.0, and the most bearish reporting a price target of just $182.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $877.9 million, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 7.4%.

- Given the current share price of $185.01, the analyst price target of $211.43 is 12.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.