- United States

- /

- Metals and Mining

- /

- NasdaqGS:RGLD

How Sandstorm and Horizon Acquisitions Will Impact Royal Gold (RGLD) Investors

Reviewed by Sasha Jovanovic

- In recent weeks, Royal Gold announced the acquisitions of Sandstorm Gold and Horizon Copper, expanding its portfolio across gold and copper royalties and streams.

- This move is expected to significantly diversify Royal Gold's asset base, reducing single-asset risk and broadening its exposure to major long-term growth opportunities in the precious metals sector.

- We'll explore how the Sandstorm and Horizon acquisitions may reshape Royal Gold's investment narrative through enhanced diversification and growth prospects.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Royal Gold Investment Narrative Recap

To be a Royal Gold shareholder, you need to believe in the company’s ability to turn increased scale and diversification, in particular, via large royalty and streaming acquisitions, into sustained earnings growth and revenue stability. The recent Sandstorm Gold and Horizon Copper deals bolster a major short-term catalyst: broader asset and commodity exposure, but also amplify the biggest current risk, as higher leverage and integration complexity could weigh on net margins if expected synergies are not quickly realized.

Among recent developments, Royal Gold’s expansion of its revolving credit facility, which now allows up to US$400 million in additional borrowings and an extended maturity, is especially relevant. This move directly supports the financing of its latest acquisitions, reinforcing the importance of effective capital management as the company seeks to balance growth opportunities with the disciplined use of debt.

In contrast, investors should be aware that an increased debt burden comes with...

Read the full narrative on Royal Gold (it's free!)

Royal Gold's outlook anticipates $1.4 billion in revenue and $877.9 million in earnings by 2028. This is based on a 21.4% annual revenue growth rate and an earnings increase of $428.4 million from current earnings of $449.5 million.

Uncover how Royal Gold's forecasts yield a $223.62 fair value, a 9% upside to its current price.

Exploring Other Perspectives

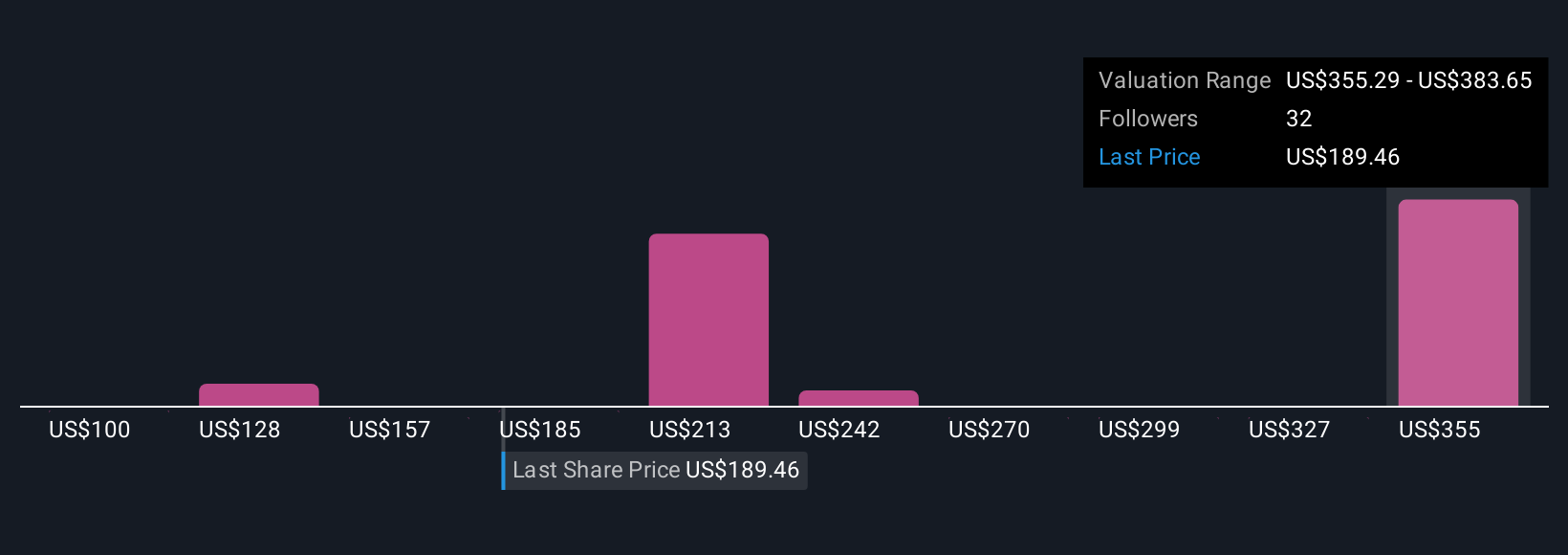

Thirteen individual fair value estimates from the Simply Wall St Community for Royal Gold range from US$100 to US$318.32 per share. While many see upside in diversification, using debt to finance acquisitions may affect profitability in ways the market could reprice, consider reviewing all viewpoints before deciding.

Explore 13 other fair value estimates on Royal Gold - why the stock might be worth less than half the current price!

Build Your Own Royal Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royal Gold research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Royal Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royal Gold's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGLD

Royal Gold

Acquires and manages precious metal streams, royalties, and related interests.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives