- United States

- /

- Metals and Mining

- /

- NasdaqGS:RGLD

3 US Stocks That May Be Undervalued By Market Estimates In January 2025

Reviewed by Simply Wall St

As the U.S. stock market approaches record highs, buoyed by strong earnings reports and recent policy moves, investors are keenly observing opportunities that may be overlooked amidst the broader rally. In this environment, identifying undervalued stocks can offer potential for growth as market participants reassess their valuations in light of evolving economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlantic Union Bankshares (NYSE:AUB) | $38.27 | $75.53 | 49.3% |

| First Solar (NasdaqGS:FSLR) | $183.51 | $357.85 | 48.7% |

| Berkshire Hills Bancorp (NYSE:BHLB) | $28.72 | $56.94 | 49.6% |

| German American Bancorp (NasdaqGS:GABC) | $39.76 | $78.06 | 49.1% |

| Heartland Financial USA (NasdaqGS:HTLF) | $66.48 | $130.08 | 48.9% |

| Equity Bancshares (NYSE:EQBK) | $43.76 | $85.93 | 49.1% |

| Privia Health Group (NasdaqGS:PRVA) | $22.73 | $44.59 | 49% |

| Verra Mobility (NasdaqCM:VRRM) | $26.08 | $52.02 | 49.9% |

| Equifax (NYSE:EFX) | $272.27 | $534.41 | 49.1% |

| Coeur Mining (NYSE:CDE) | $6.37 | $12.61 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

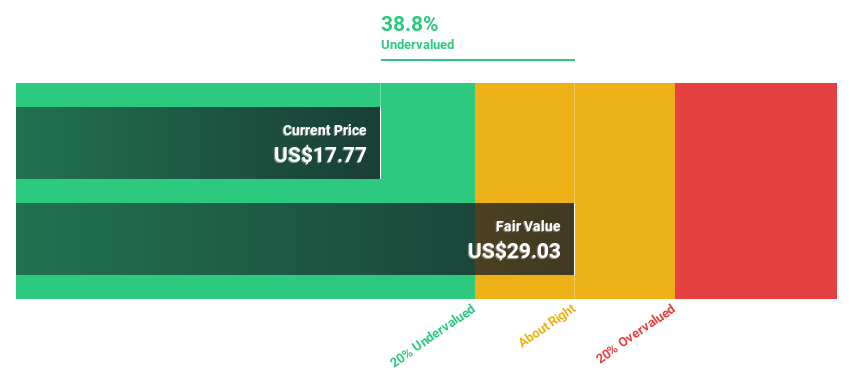

Mobileye Global (NasdaqGS:MBLY)

Overview: Mobileye Global Inc. develops and deploys advanced driver assistance systems and autonomous driving technologies worldwide, with a market cap of approximately $12.99 billion.

Operations: The company generates revenue primarily from its Mobileye segment, amounting to $1.76 billion.

Estimated Discount To Fair Value: 43.2%

Mobileye Global is trading at US$16.67, significantly below its estimated fair value of US$29.35, suggesting it may be undervalued based on cash flows. Despite recent volatility and substantial operating losses, the company's earnings are forecast to grow rapidly and become profitable within three years, outpacing average market growth. Recent collaborations with Lyft highlight Mobileye's strategic advancements in autonomous vehicle technology, potentially enhancing its revenue prospects amidst ongoing global mobility projects.

- Our expertly prepared growth report on Mobileye Global implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Mobileye Global's balance sheet health report.

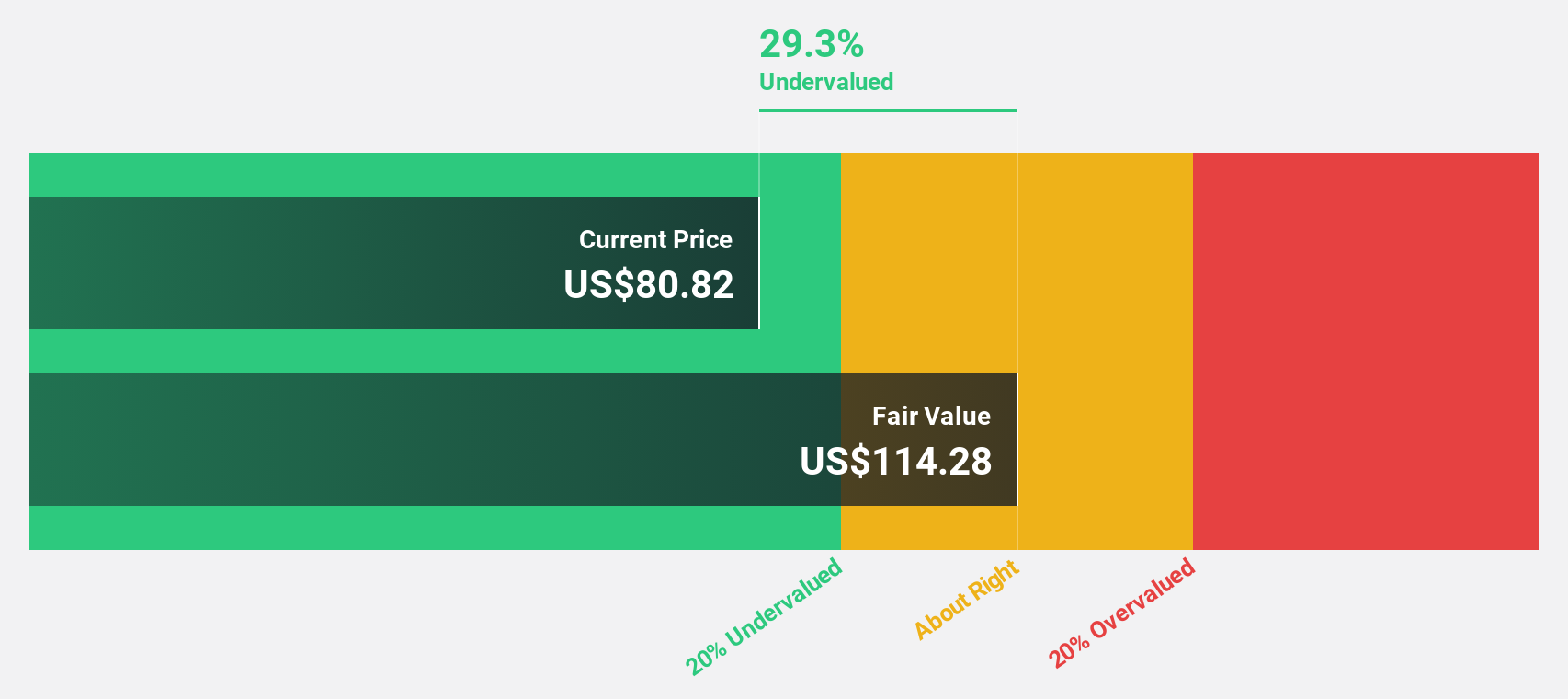

Royal Gold (NasdaqGS:RGLD)

Overview: Royal Gold, Inc. is a company that acquires and manages precious metal streams, royalties, and related interests, with a market cap of approximately $9.11 billion.

Operations: The company's revenue is derived from two main segments: Streams, contributing $456.83 million, and Royalties, accounting for $205.76 million.

Estimated Discount To Fair Value: 42.2%

Royal Gold is trading at US$140.73, well below its estimated fair value of US$243.54, indicating potential undervaluation based on cash flows. The company has demonstrated solid earnings growth of 23.3% over the past year and is expected to continue growing at 22.86% annually, outpacing the broader market's profit growth rate. Recent dividend increases and strategic presentations at key conferences underscore Royal Gold's commitment to enhancing shareholder value and maintaining robust financial health amidst evolving market conditions.

- According our earnings growth report, there's an indication that Royal Gold might be ready to expand.

- Get an in-depth perspective on Royal Gold's balance sheet by reading our health report here.

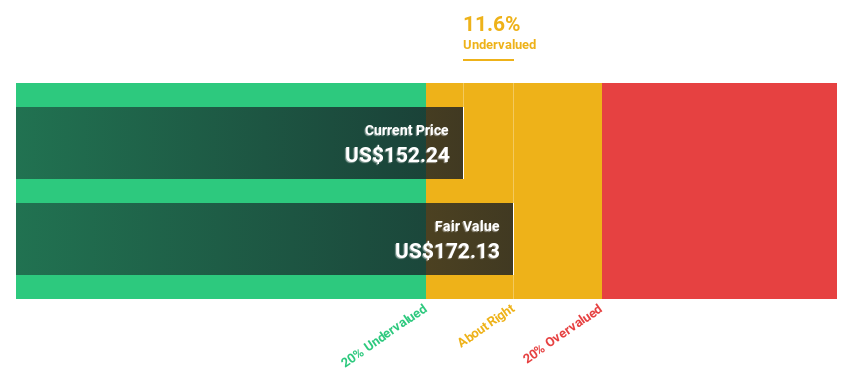

Fidelity National Information Services (NYSE:FIS)

Overview: Fidelity National Information Services, Inc. (NYSE: FIS) is a global provider of financial technology solutions, with a market cap of approximately $42.41 billion.

Operations: The company's revenue segments include Banking Solutions at $6.86 billion and Capital Market Solutions at $2.91 billion.

Estimated Discount To Fair Value: 33.7%

Fidelity National Information Services, trading at US$78.91, is significantly below its estimated fair value of US$119, highlighting potential undervaluation based on cash flows. Despite a slower revenue growth forecast of 4.2%, earnings are projected to grow robustly at 22.8% annually, surpassing the broader market's rate. However, high debt levels and a dividend not fully covered by earnings present challenges. Recent strategic initiatives and leadership changes aim to bolster its financial technology offerings globally.

- Insights from our recent growth report point to a promising forecast for Fidelity National Information Services' business outlook.

- Delve into the full analysis health report here for a deeper understanding of Fidelity National Information Services.

Key Takeaways

- Delve into our full catalog of 168 Undervalued US Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGLD

Royal Gold

Acquires and manages precious metal streams, royalties, and related interests.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives