- United States

- /

- Chemicals

- /

- NasdaqGS:LIN

Linde (LIN): Reassessing Valuation After Bullish Analyst Updates and Insider Buying Signals

Reviewed by Simply Wall St

Linde (LIN) just caught a bid after a wave of analyst commentary converged on the same theme: the growth story still looks intact thanks to a deep project backlog and disciplined capital allocation.

See our latest analysis for Linde.

The recent 3.21% one day share price gain to about $416 comes after a choppy few months, with a negative 90 day share price return but a still impressive 32.36% total shareholder return over three years. This suggests longer term momentum remains intact even as the market reassesses near term risks.

If Linde's story has you rethinking where growth and resilience can come from, it might be worth scanning other fast growing stocks with high insider ownership that have management teams backing their own thesis with real money.

With shares still trading at roughly a 21% discount to consensus targets and management signaling 8 to 12% EPS growth, is Linde quietly undervalued today, or is the market already baking in that next leg of expansion?

Most Popular Narrative: 17.2% Undervalued

With Linde closing at $416.24 versus a narrative fair value of about $502.88, the current setup implies a sizeable valuation gap driven by long duration growth assumptions and a relatively low discount rate of roughly 8.03%.

Strategic investments and customer commitments in rapidly expanding growth markets such as commercial space launches, electronics, and clean hydrogen (with almost $5 billion in new clean energy contracts) provide a runway for high margin revenue streams and new project conversion that will structurally lift blended margins and earnings.

Want to see how steady mid single digit revenue growth, rising margins, and shrinking share count can still justify a premium earnings multiple? The narrative lays out a detailed earnings path that leans on long term contracts and capital discipline. Curious which assumptions really carry that fair value sticker price? Dive in to unpack the full playbook behind this 17.2% upside case.

Result: Fair Value of $502.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained industrial weakness in Europe or prolonged oversupply and pricing pressure in key gases could easily derail that seemingly straightforward upside path.

Find out about the key risks to this Linde narrative.

Another View: What Do The Ratios Say?

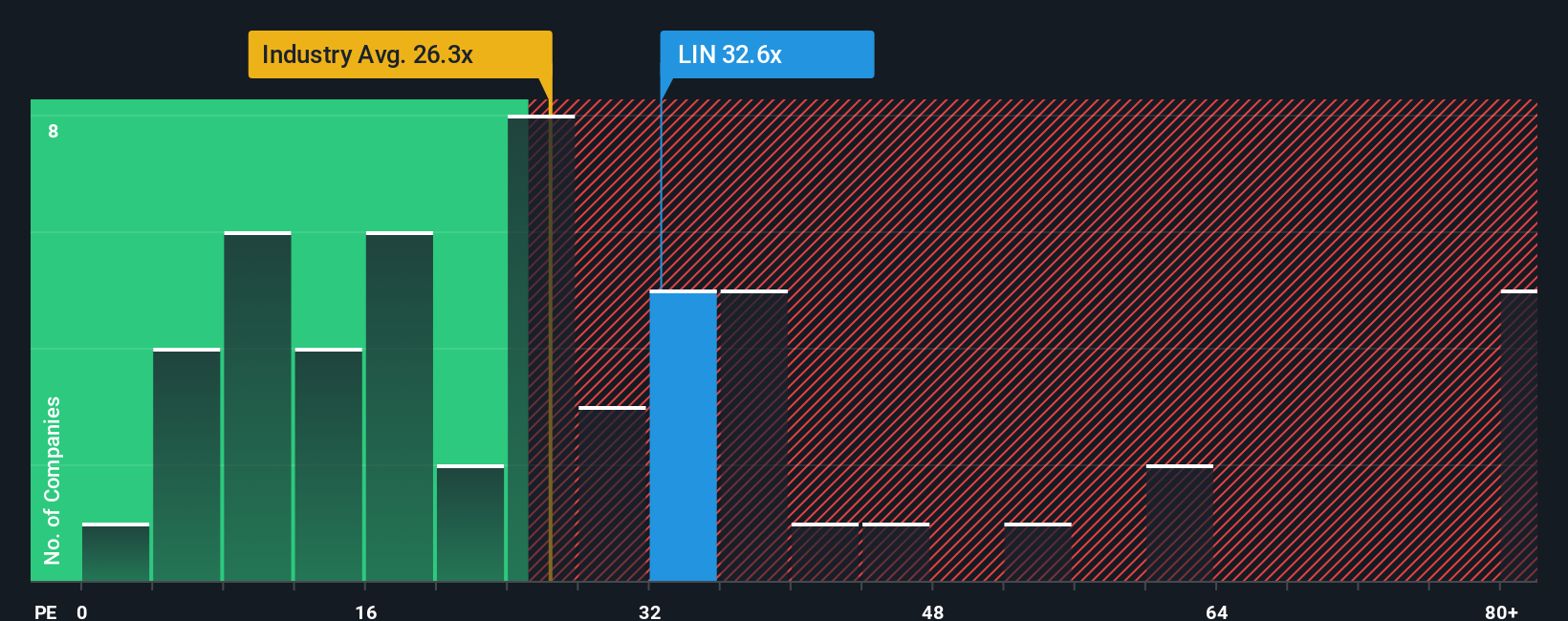

While the narrative fair value points to upside, today Linde trades on a 27.4x earnings multiple versus a 26.6x fair ratio and 24x for the US Chemicals industry, though still below a 31.6x peer average. That leaves a thin margin for error if growth disappoints, or a runway for catch up if peers rerate first?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Linde Narrative

If this perspective does not quite fit your view or you would rather dig into the numbers yourself, you can build a full narrative in minutes: Do it your way.

A great starting point for your Linde research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop with one compelling story; use the Simply Wall St Screener to uncover your next move before the crowd snaps up the best opportunities.

- Capture mispriced quality by scanning these 909 undervalued stocks based on cash flows that pair solid fundamentals with attractive discounts to intrinsic value.

- Ride structural growth trends by zeroing in on these 30 healthcare AI stocks transforming how medicine is discovered, diagnosed, and delivered.

- Position early in frontier innovation by tracking these 27 quantum computing stocks building real world applications in computing, security, and advanced materials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIN

Linde

Operates as an industrial gas company in the United States, China, Germany, the United Kingdom, Australia, Mexico, Brazil, and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)