- United States

- /

- Metals and Mining

- /

- NasdaqGS:KALU

Kaiser Aluminum (KALU): Reassessing Valuation After a Strong 3‑Month Share Price Surge

Reviewed by Simply Wall St

Kaiser Aluminum (KALU) has quietly put together a strong run, with the stock up roughly 19% over the past month and about 40% in the past 3 months, drawing fresh valuation questions.

See our latest analysis for Kaiser Aluminum.

Zooming out, that recent surge sits on top of a solid year to date, with a share price return of roughly 55% and a three year total shareholder return above 60%. This suggests momentum is still building as investors reassess its recovery story and earnings power.

If Kaiser Aluminum’s rebound has you thinking more broadly about cyclical opportunities, it could be worth exploring aerospace and defense stocks for other names benefiting from long term demand in similar end markets.

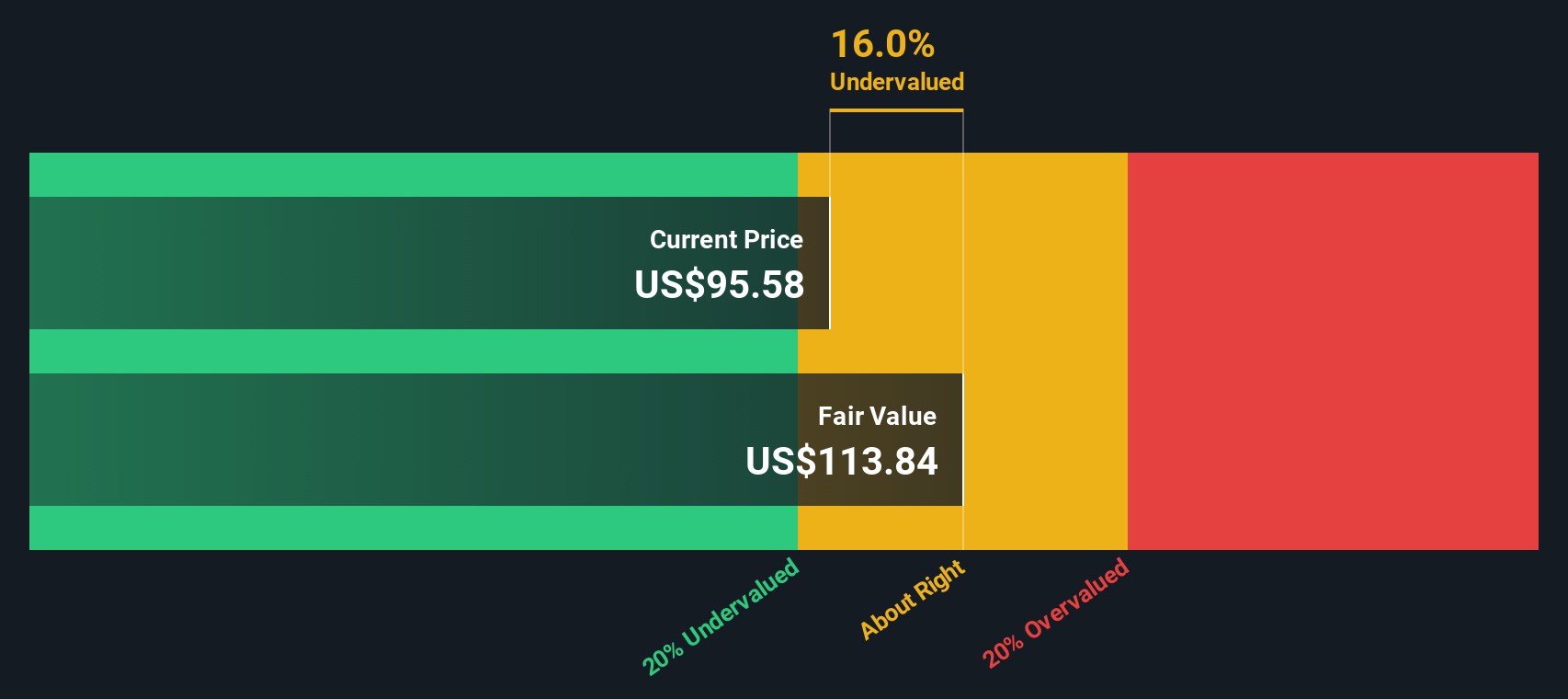

With the stock now trading slightly above the average analyst target but still at a notable discount to some intrinsic value estimates, investors face a key question: Is Kaiser Aluminum still a buy, or is future growth already priced in?

Price-to-Earnings of 20.5x: Is it justified?

Kaiser Aluminum looks modestly cheap against peers on earnings, with a 20.5x price to earnings multiple despite the strong recent share price run.

The price to earnings ratio compares what investors are paying today for each dollar of current earnings, a key yardstick for metals and mining companies with cyclical profits. For Kaiser Aluminum, the 20.5x multiple sits below both the US Metals and Mining industry average of 24.5x and a much higher peer group average of 45.8x, even as earnings are forecast to grow strongly.

This gap suggests the market is not fully pricing in Kaiser Aluminum’s profit trajectory, given earnings grew 59.6% over the past year and are projected to expand around 21% annually over the next three years. However, when stacked against an estimated fair price to earnings ratio of 20.2x, the stock screens only slightly expensive on this fair value benchmark. This implies limited room for multiple expansion from here if expectations do not keep rising.

Compared with the broader industry, Kaiser Aluminum trades at a clear discount to both the 24.5x sector average and the 45.8x peer average, while still broadly in line with the 20.2x fair price to earnings level that the market could ultimately gravitate towards if sentiment normalises.

Explore the SWS fair ratio for Kaiser Aluminum

Result: Price-to-earnings of 20.5x (UNDERVALUED)

However, investors should still weigh risks such as a cyclical demand slowdown or weaker aerospace and packaging volumes that could pressure margins and earnings expectations.

Find out about the key risks to this Kaiser Aluminum narrative.

Another View: Discounted Cash Flow Check

While the 20.5x earnings multiple presents Kaiser Aluminum as modestly cheap, our DCF model is more optimistic and suggests fair value near $130.91, about 17% above the current $108.79 price. If cash flows deliver, there may be additional potential beyond what simple multiples indicate.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kaiser Aluminum for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kaiser Aluminum Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Kaiser Aluminum research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next opportunities with targeted screeners that filter the noise and surface stocks aligned with your strategy in minutes.

- Target reliable income now by scanning for established payers with these 13 dividend stocks with yields > 3% that can support your portfolio through different market cycles.

- Capitalize on mispriced potential by zeroing in on these 908 undervalued stocks based on cash flows where the market might be overlooking strong cash flow stories.

- Position ahead of structural shifts by focusing on these 80 cryptocurrency and blockchain stocks at the intersection of digital assets, payments, and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kaiser Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KALU

Kaiser Aluminum

Manufactures and sells semi-fabricated specialty aluminum mill products.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)