- United States

- /

- Metals and Mining

- /

- NasdaqGS:HAYN

Haynes International (NASDAQ:HAYN) Has Re-Affirmed Its Dividend Of US$0.22

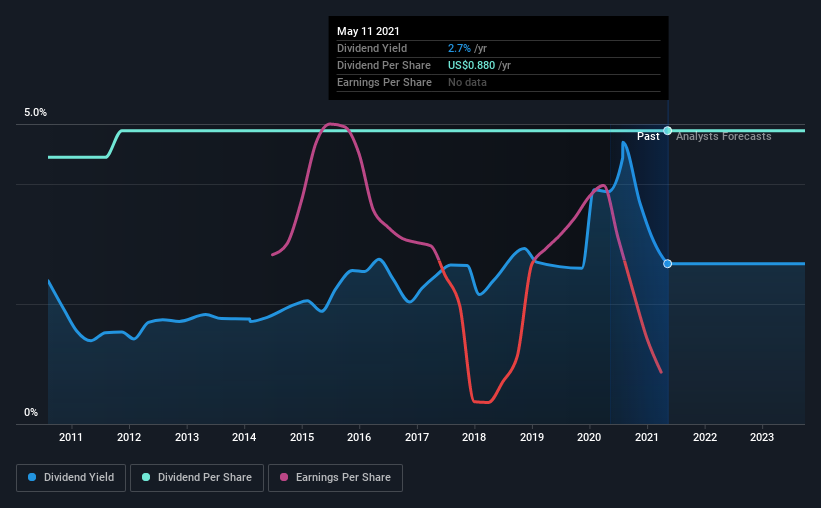

The board of Haynes International, Inc. (NASDAQ:HAYN) has announced that it will pay a dividend of US$0.22 per share on the 15th of June. The dividend yield will be 2.7% based on this payment which is still above the industry average.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Haynes International's stock price has increased by 35% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Haynes International

Haynes International Might Find It Hard To Continue The Dividend

If the payments aren't sustainable, a high yield for a few years won't matter that much. Haynes International is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Looking forward, earnings per share is forecast to expand by 88.5% over the next year. It's encouraging to see things moving in the right direction, but this probably won't be enough for the company to turn a profit. The healthy cash flows are definitely a good sign though, so we wouldn't panic just yet, especially with the earnings growing.

Haynes International Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2011, the dividend has gone from US$0.80 to US$0.88. Dividend payments have been growing, but very slowly over the period. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

Dividend Growth Is Doubtful

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, things aren't all that rosy. Haynes International has seen earnings per share falling at 9.0% per year over the last five years. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

Our Thoughts On Haynes International's Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We don't think Haynes International is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 2 warning signs for Haynes International that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you decide to trade Haynes International, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Haynes International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:HAYN

Haynes International

Develops, manufactures, markets, and distributes nickel and cobalt-based alloys in sheet, coil, and plate forms in the United States, Europe, China, and internationally.

Excellent balance sheet average dividend payer.