- United States

- /

- Metals and Mining

- /

- NYSEAM:VGZ

Promising US Penny Stocks To Consider In January 2025

Reviewed by Simply Wall St

As the U.S. equities market takes a breather from its recent rally, major indexes have slipped slightly after reaching record high levels. In this context, penny stocks—often associated with smaller or newer companies—continue to offer intriguing growth opportunities at lower price points. Despite being considered a somewhat outdated term, these stocks can still provide significant potential when backed by strong financials and fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $111.94M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.93 | $6.36M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.80 | $11.61M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.94 | $2.18B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2899 | $10.66M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.90 | $88.72M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.38 | $54.13M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.26 | $22.7M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.92 | $83.39M | ★★★★★☆ |

Click here to see the full list of 706 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Acumen Pharmaceuticals (NasdaqGS:ABOS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Acumen Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company focused on developing targeted therapies for Alzheimer's disease, with a market cap of approximately $105.14 million.

Operations: Acumen Pharmaceuticals, Inc. does not report any revenue segments as it is a clinical-stage biopharmaceutical company focused on developing therapies for Alzheimer's disease.

Market Cap: $105.14M

Acumen Pharmaceuticals, Inc., with a market cap of approximately US$105.14 million, is a pre-revenue clinical-stage biopharmaceutical company focused on Alzheimer's therapies. The recent Phase 1 trial results for its antibody treatment sabirnetug showed promising safety and efficacy in targeting amyloid plaques, crucial for early Alzheimer's intervention. Despite being unprofitable and experiencing increasing losses, the company benefits from an experienced board and management team. It maintains more cash than debt and has short-term assets significantly exceeding liabilities, providing some financial stability as it progresses with its Phase 2 trials across multiple sites internationally.

- Jump into the full analysis health report here for a deeper understanding of Acumen Pharmaceuticals.

- Gain insights into Acumen Pharmaceuticals' future direction by reviewing our growth report.

Sight Sciences (NasdaqGS:SGHT)

Simply Wall St Financial Health Rating: ★★★★★★

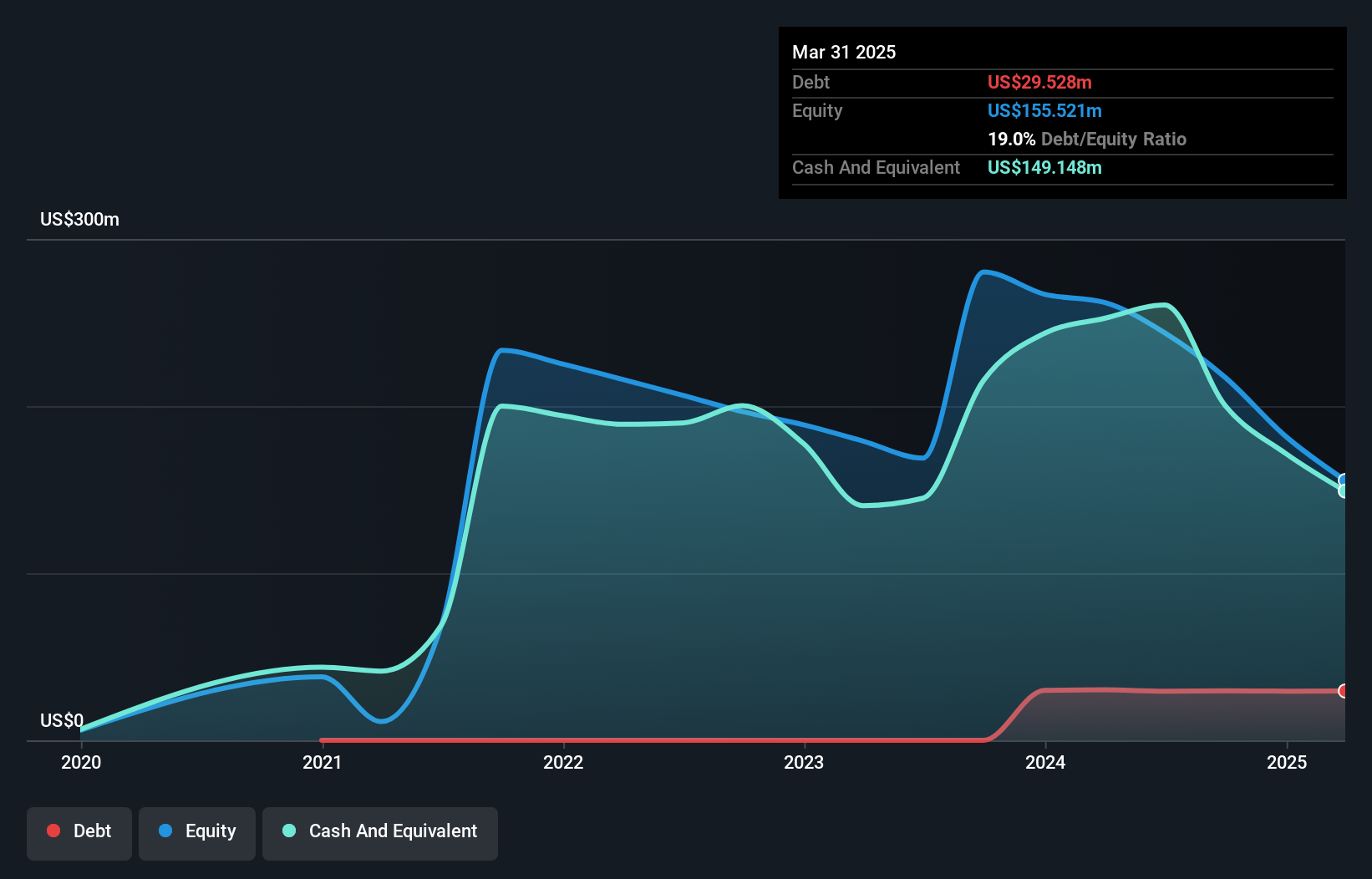

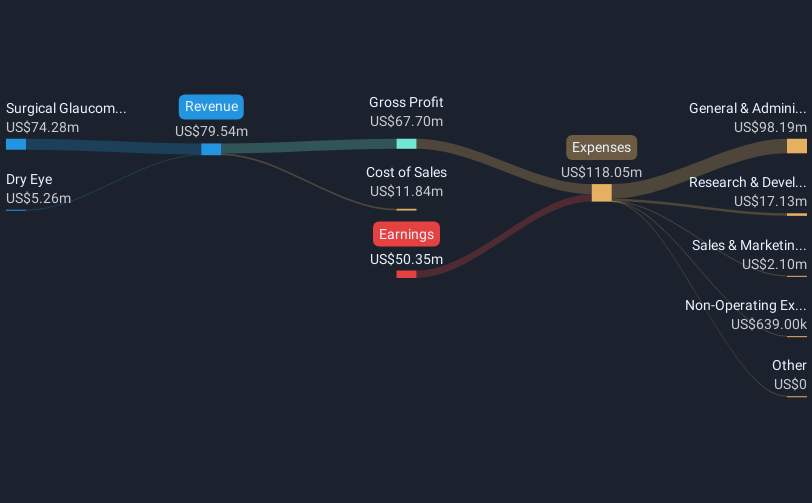

Overview: Sight Sciences, Inc. is an ophthalmic medical device company focused on developing and commercializing surgical and nonsurgical technologies for treating eye diseases, with a market cap of approximately $146.17 million.

Operations: The company generates revenue through two main segments: Dry Eye, contributing $5.26 million, and Surgical Glaucoma, accounting for $74.28 million.

Market Cap: $146.17M

Sight Sciences, Inc., with a market cap of approximately US$146.17 million, focuses on ophthalmic medical devices and generates revenue primarily from its Surgical Glaucoma segment. Despite being unprofitable with a negative return on equity of -53.03%, the company has more cash than debt and sufficient short-term assets to cover liabilities, ensuring some financial stability. Recent studies highlight the long-term effectiveness of its OMNI Surgical System for glaucoma treatment, potentially reinforcing its market position. However, significant insider selling and management changes may raise concerns about internal confidence and strategic direction as it navigates profitability challenges.

- Click here to discover the nuances of Sight Sciences with our detailed analytical financial health report.

- Assess Sight Sciences' future earnings estimates with our detailed growth reports.

Vista Gold (NYSEAM:VGZ)

Simply Wall St Financial Health Rating: ★★★★★★

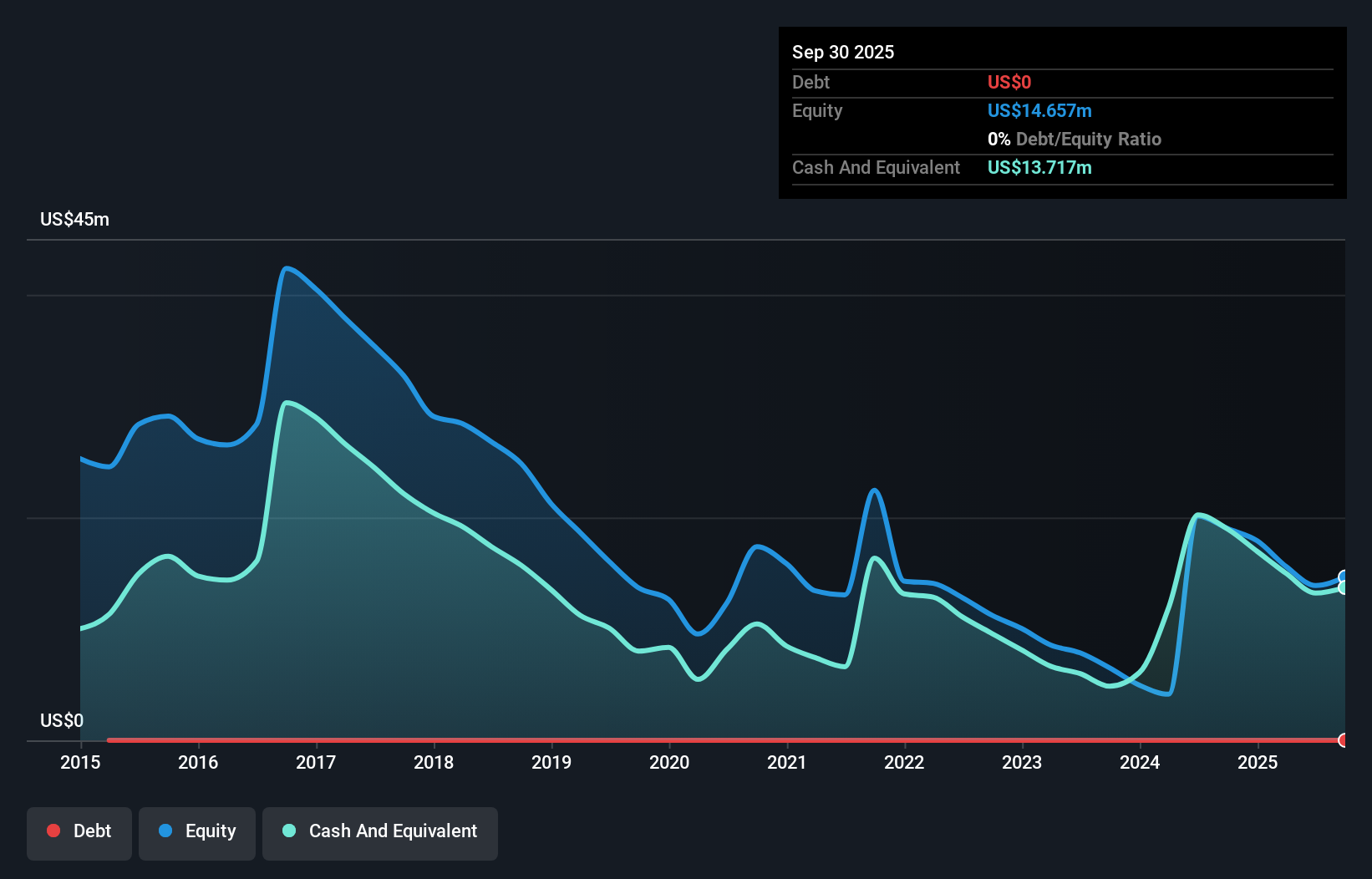

Overview: Vista Gold Corp. is engaged in acquiring, exploring, evaluating, and advancing gold exploration and development projects in Australia, with a market cap of $73.75 million.

Operations: Vista Gold Corp. does not report any revenue segments, as it focuses on the acquisition and development of gold projects in Australia.

Market Cap: $73.75M

Vista Gold Corp., with a market cap of US$73.75 million, is pre-revenue and focuses on gold exploration in Australia. The company recently became profitable, boasting an outstanding return on equity of 59.3% and no debt, enhancing its financial stability. Vista's short-term assets significantly exceed both its short-term and long-term liabilities, indicating a strong balance sheet position. Recent drilling results at the Mt Todd project reveal promising high-grade gold intercepts, suggesting potential resource expansion. The ongoing feasibility study aims to optimize production costs and increase reserve grades, with completion expected by mid-2025, potentially enhancing future profitability prospects.

- Click to explore a detailed breakdown of our findings in Vista Gold's financial health report.

- Understand Vista Gold's track record by examining our performance history report.

Summing It All Up

- Unlock more gems! Our US Penny Stocks screener has unearthed 703 more companies for you to explore.Click here to unveil our expertly curated list of 706 US Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:VGZ

Vista Gold

Vista Gold Corp., together with its subsidiaries, operate as a development-stage company in the gold mining industry in Australia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives