- United States

- /

- Metals and Mining

- /

- NasdaqCM:GSM

Does Ferroglobe’s (GSM) Completed Share Buyback Reveal a Shift in Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- Between July 1 and September 30, 2025, Ferroglobe repurchased 3,710,111 shares for US$15.87 million, bringing its total buyback under the program announced May 14, 2024, to 13,465,973 shares or 7.19% of shares outstanding at a cost of US$52 million.

- This completed buyback significantly reduced Ferroglobe’s outstanding share count, underscoring management’s capital allocation priorities and their confidence in the company’s future prospects.

- We'll examine how Ferroglobe’s recently completed share buyback shapes its investment outlook and potential for future earnings growth.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ferroglobe Investment Narrative Recap

To invest in Ferroglobe, you need conviction in a recovery for silicon metal prices sparked by new trade protections and improved demand from next-generation industries such as solar and electric vehicles. The just-completed share buyback reflects management’s emphasis on shareholder value but does not materially impact what remains the short-term catalyst, EU safeguard measures on silicon metal, or the biggest risk, namely prolonged oversupply and pricing pressure from Chinese imports.

Among recent announcements, Ferroglobe's Q2 2025 results, which revealed a net loss amid falling sales, provide essential backdrop. Share buybacks may boost per-share metrics, but, without a turnaround in margins or demand visibility, future earnings remain vulnerable until the industry’s supply-demand imbalance shifts.

By contrast, investors should keep a close eye on any further escalation in low-priced Chinese silicon imports because...

Read the full narrative on Ferroglobe (it's free!)

Ferroglobe's narrative projects $2.0 billion revenue and $222.1 million earnings by 2028. This requires 9.3% yearly revenue growth and a $308.4 million increase in earnings from the current level of -$86.3 million.

Uncover how Ferroglobe's forecasts yield a $8.00 fair value, a 46% upside to its current price.

Exploring Other Perspectives

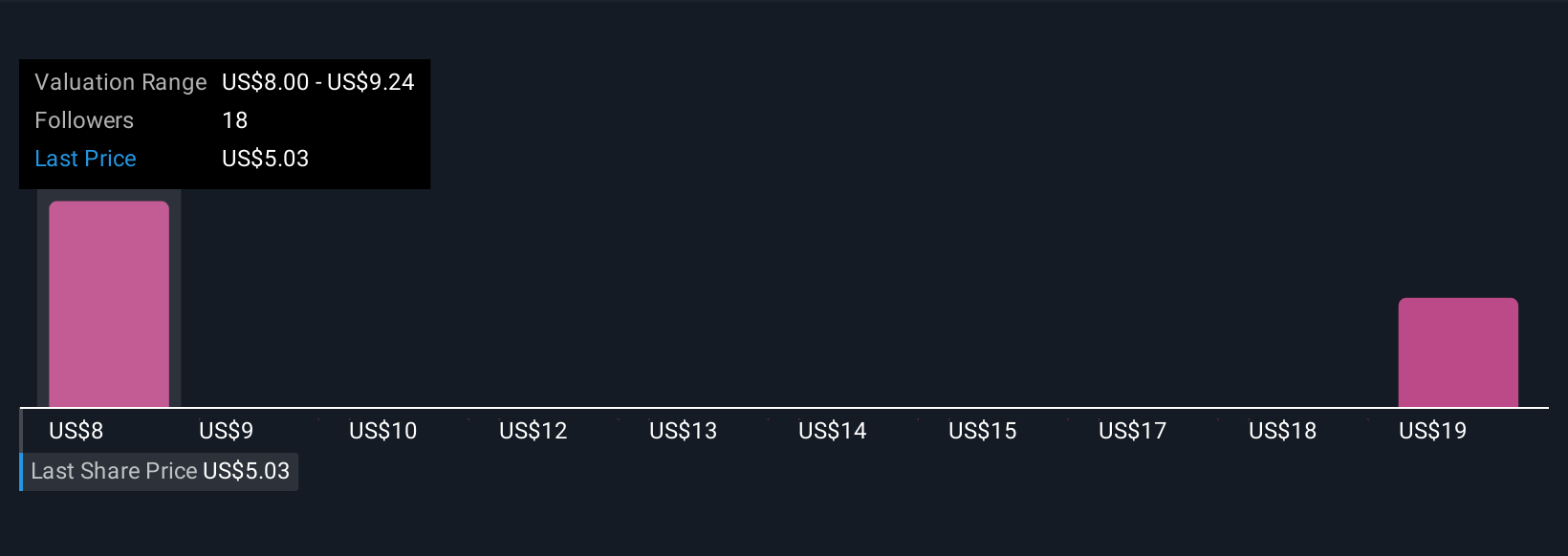

Simply Wall St Community fair value estimates for Ferroglobe span US$8 to US$20.54, based on two contrasting outlooks. While some foresee upside, ongoing margin pressure from oversupply could temper expectations so consider several viewpoints before reaching any conclusions.

Explore 2 other fair value estimates on Ferroglobe - why the stock might be worth just $8.00!

Build Your Own Ferroglobe Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ferroglobe research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Ferroglobe research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ferroglobe's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GSM

Ferroglobe

Produces and sells silicon metal, and silicon and manganese-based ferroalloys in the United States, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives