- United States

- /

- Metals and Mining

- /

- NasdaqGM:CRML

Why Critical Metals (CRML) Surged After Landing a Decade-Long Rare Earth Supply Deal with REalloys

Reviewed by Sasha Jovanovic

- REalloys Inc. announced it has entered into a 10-year offtake agreement to purchase 15% of the projected rare earth concentrate from Critical Metals Corp.'s Tanbreez Project in Southern Greenland, supporting efforts to strengthen North America's critical minerals supply chain.

- This agreement coincides with major investment initiatives in the sector, along with increased U.S. government interest in securing domestic sources of rare earths amid heightened US-China trade tensions.

- We’ll explore how the REalloys deal enhances Critical Metals’ investment narrative against a backdrop of government action in critical minerals.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Critical Metals' Investment Narrative?

To be a shareholder in Critical Metals, you have to believe that surging government investment, direct supply agreements, and global efforts to secure rare earths will eventually create real, sustainable value for the company despite its current losses and cash flow uncertainties. The recent 10-year offtake deal with REalloys is a meaningful step, likely reducing commercial risk and increasing revenue visibility at the Tanbreez Project just as trade tensions continue to throw critical minerals into the policy spotlight. This progress could ease some near-term worries for investors, who previously faced ongoing auditor doubts about continuing operations and a reliance on external financing to fund ambitious development plans. Yet, the improved sentiment and rapid price move following the REalloys deal should not overshadow the reality that Critical Metals remains pre-revenue, with substantial unprofitability and a young management team still bedding in. But, investors should not ignore Critical Metals’ going concern warning and its heavy reliance on outside funding.

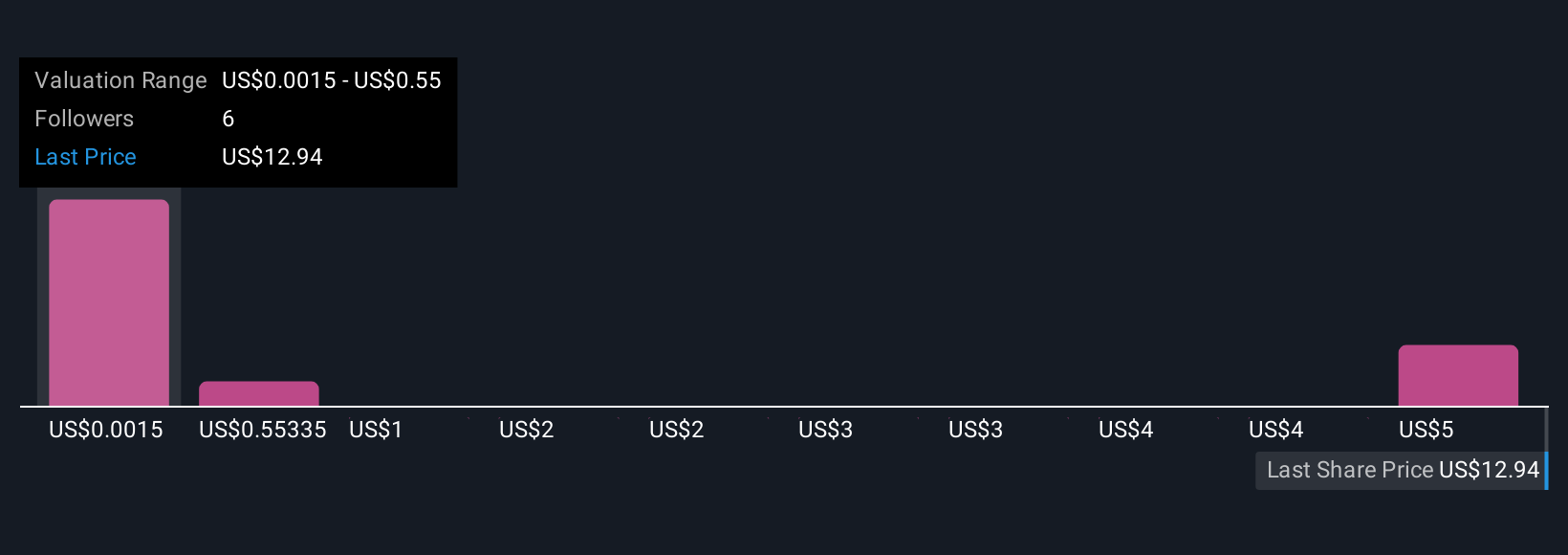

Upon reviewing our latest valuation report, Critical Metals' share price might be too optimistic.Exploring Other Perspectives

Explore 7 other fair value estimates on Critical Metals - why the stock might be worth as much as $5.52!

Build Your Own Critical Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Critical Metals research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Critical Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Critical Metals' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CRML

Critical Metals

Operates as a mining exploration and development company in Austria and Southern Greenland.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives