- United States

- /

- Metals and Mining

- /

- NasdaqGS:CENX

What Century Aluminum Company's (NASDAQ:CENX) 25% Share Price Gain Is Not Telling You

Century Aluminum Company (NASDAQ:CENX) shares have had a really impressive month, gaining 25% after a shaky period beforehand. The last month tops off a massive increase of 111% in the last year.

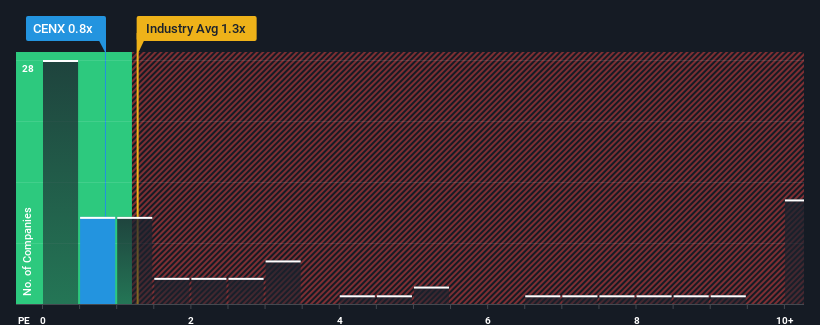

Although its price has surged higher, it's still not a stretch to say that Century Aluminum's price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Metals and Mining industry in the United States, where the median P/S ratio is around 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Century Aluminum

What Does Century Aluminum's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Century Aluminum's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Century Aluminum's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Century Aluminum's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 30% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 0.09% over the next year. That's shaping up to be materially lower than the 23% growth forecast for the broader industry.

With this in mind, we find it intriguing that Century Aluminum's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

Century Aluminum appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

When you consider that Century Aluminum's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Before you take the next step, you should know about the 4 warning signs for Century Aluminum (3 can't be ignored!) that we have uncovered.

If you're unsure about the strength of Century Aluminum's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CENX

Century Aluminum

Engages in the production of standard-grade and value-added primary aluminum products in the United States and Iceland.

Very undervalued slight.

Similar Companies

Market Insights

Community Narratives