- United States

- /

- Insurance

- /

- NYSE:UVE

US Undiscovered Gems Promising Stocks In October 2025

Reviewed by Simply Wall St

As the U.S. stock market reaches record highs, buoyed by a tame inflation reading and expectations of an interest rate cut by the Federal Reserve, investors are increasingly turning their attention to small-cap stocks as potential opportunities for growth. In this vibrant landscape, identifying promising stocks involves looking for companies that demonstrate resilience and adaptability in navigating economic shifts and leveraging emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Business First Bancshares (BFST)

Simply Wall St Value Rating: ★★★★★★

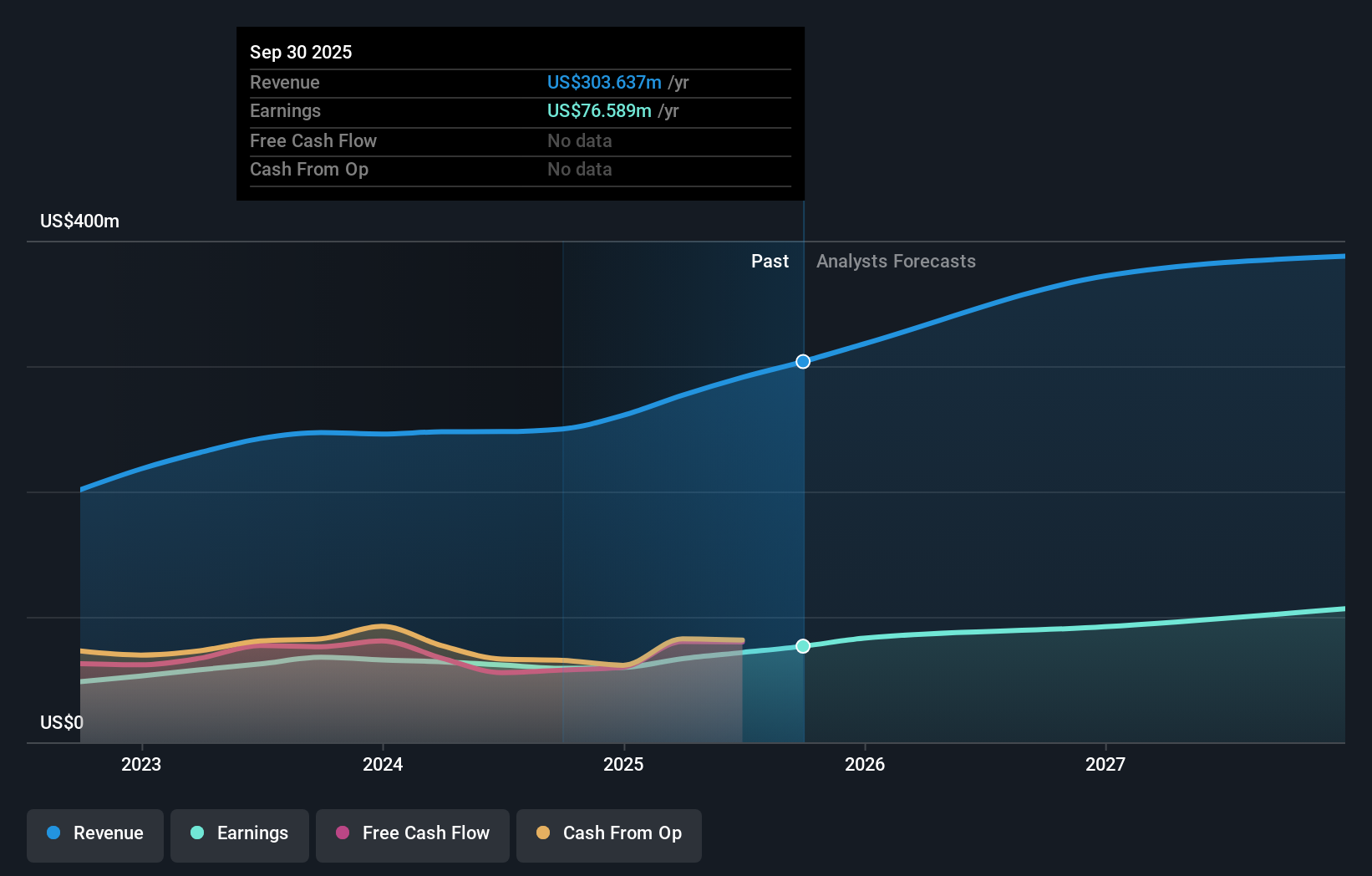

Overview: Business First Bancshares, Inc. is the bank holding company for b1BANK, offering a range of banking products and services in Louisiana and Texas, with a market cap of $740.68 million.

Operations: The company generates revenue primarily from its community banking segment, which reported $303.64 million.

Business First Bancshares, with assets totaling US$8 billion and equity of US$878.4 million, is carving a niche in the banking sector. It boasts total deposits of US$6.5 billion against loans of US$6 billion, supported by a net interest margin of 3.5%. The bank's earnings growth over the past year at 29.7% outpaced the industry average of 16.2%, reflecting its strong performance and strategic positioning in regional markets through acquisitions and digital initiatives. With bad loans at just 0.8%, it maintains high-quality earnings while trading at an attractive value compared to peers, suggesting potential for future growth.

China Yuchai International (CYD)

Simply Wall St Value Rating: ★★★★★☆

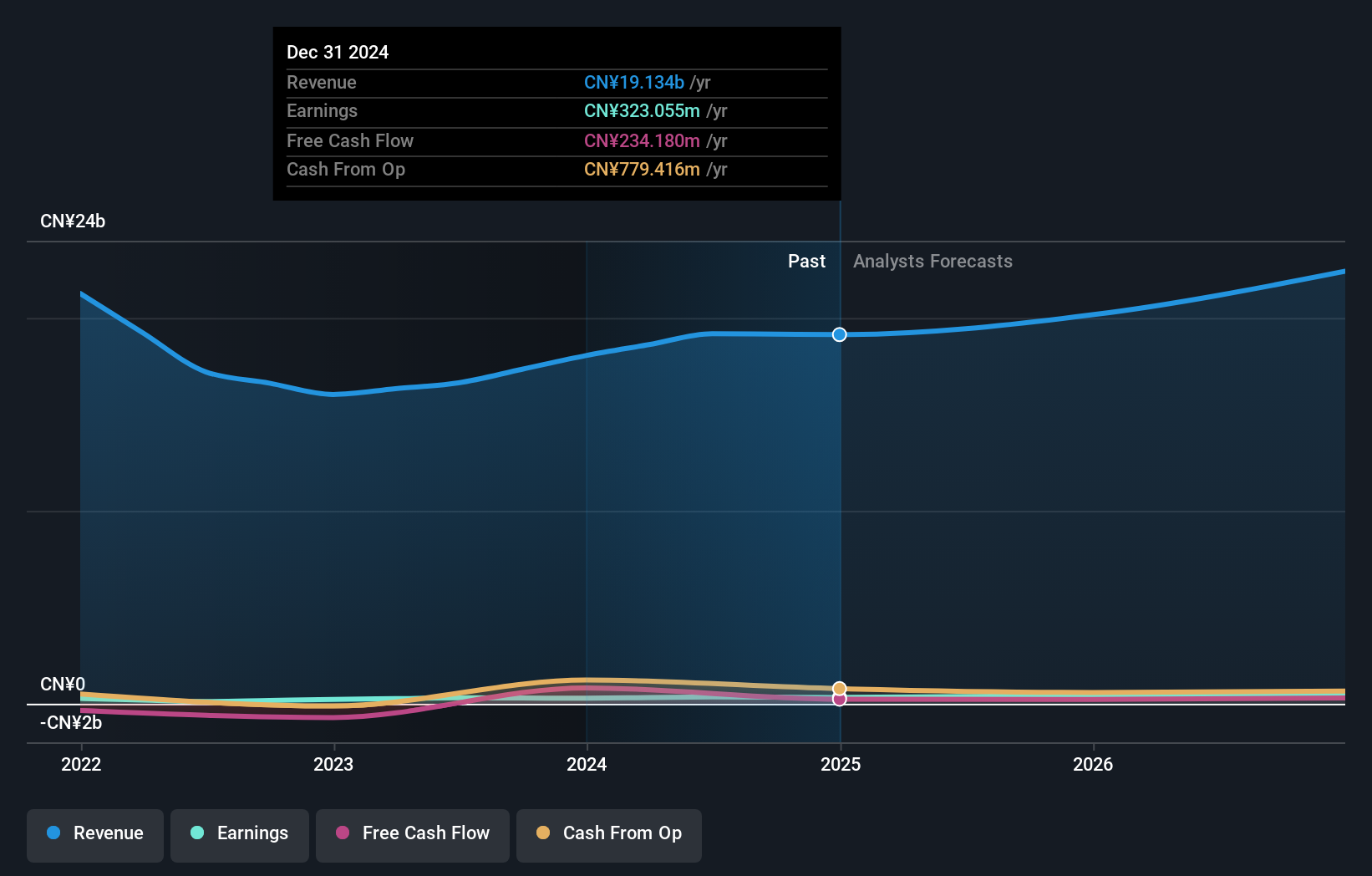

Overview: China Yuchai International Limited manufactures, assembles, and sells diesel and natural gas engines for various applications including trucks, buses, construction equipment, and marine use with a market cap of $1.39 billion.

Operations: China Yuchai International generates revenue primarily through the sale of diesel and natural gas engines for diverse applications. The company's financial performance includes a net profit margin that has shown variability over recent periods.

China Yuchai International, a player in the engine manufacturing sector, has seen its earnings grow by 29% over the past year, outpacing the Machinery industry's -4% performance. The company reported half-year sales of CNY 13.81 billion and net income of CNY 365.79 million. Its price-to-earnings ratio stands at 22x, below the industry average of 25x, indicating potential value for investors. Despite having more cash than total debt and strong interest coverage, its debt-to-equity ratio has increased to 21% from 18% over five years. Recently added to the S&P Global BMI Index, China Yuchai is navigating challenges with diesel demand falling as electrification expands but is investing in alternative fuels and OEM partnerships for future growth prospects.

Universal Insurance Holdings (UVE)

Simply Wall St Value Rating: ★★★★☆☆

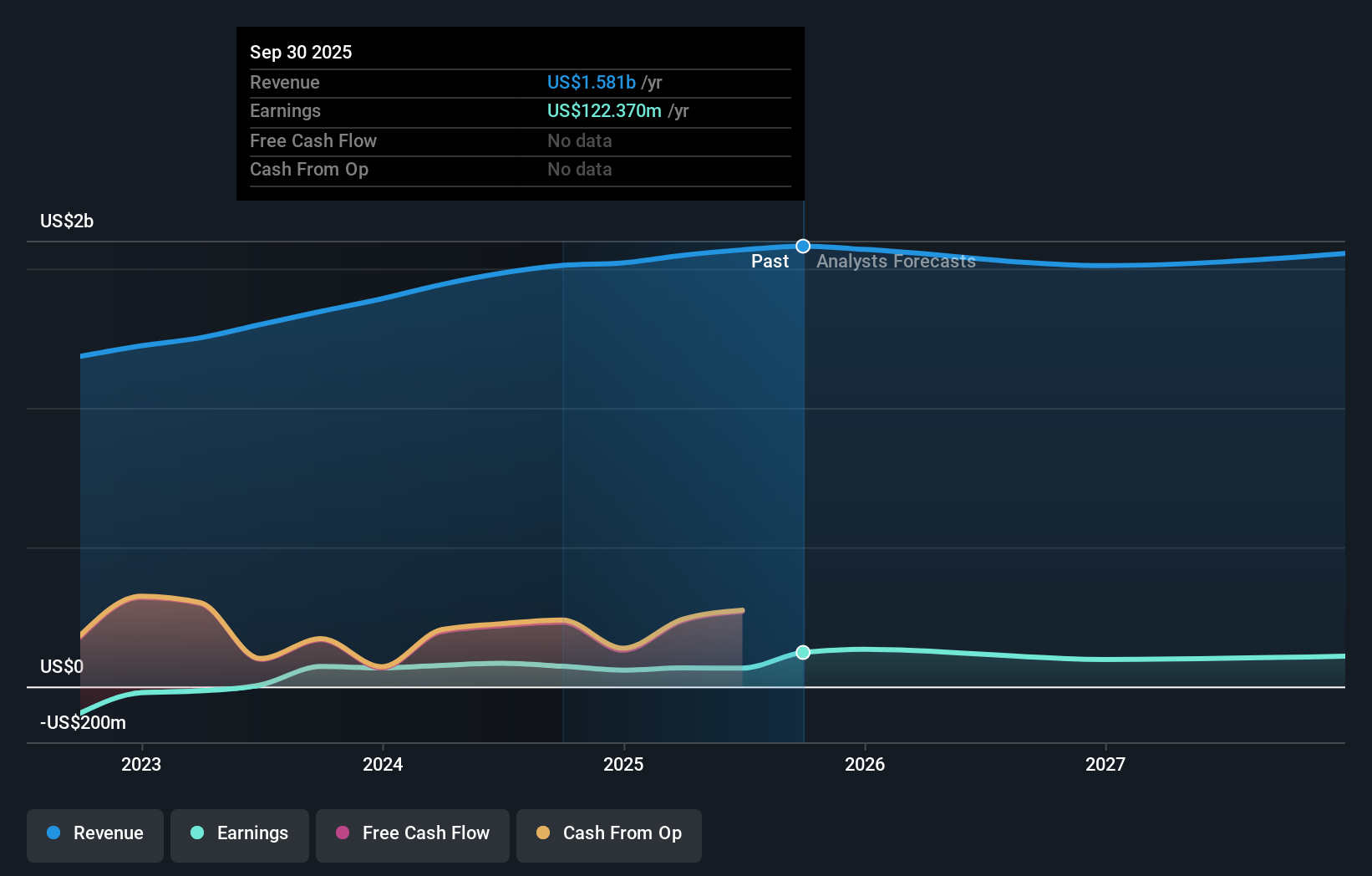

Overview: Universal Insurance Holdings, Inc. operates as an integrated insurance holding company in the United States with a market capitalization of approximately $898.94 million.

Operations: UVE generates revenue primarily from its Property & Casualty insurance segment, which amounted to approximately $1.58 billion. The company's financial performance is characterized by a focus on this core segment.

Universal Insurance Holdings, a small cap player in the insurance sector, has demonstrated robust financial performance with net income reaching US$39.83 million in Q3 2025, a significant turnaround from a net loss of US$16.16 million the previous year. The company is trading at 38.6% below its estimated fair value and boasts high-quality earnings with EBIT covering interest payments 26 times over. While earnings grew by an impressive 67.9% last year, challenges such as competition and geographic concentration remain concerns. Recent share repurchases totaling US$12.91 million reflect confidence in its market positioning amidst these dynamics.

Where To Now?

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 294 more companies for you to explore.Click here to unveil our expertly curated list of 297 US Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UVE

Universal Insurance Holdings

Operates as an integrated insurance holding company in the United States.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives