- United States

- /

- Insurance

- /

- NYSE:UNM

Does Unum Stock Still Offer Value After Its Impressive 385% Five Year Run?

Reviewed by Bailey Pemberton

If you are wondering whether now is the right time to make a move on Unum Group stock, you are definitely not alone. Unum Group has been on quite a ride lately, with the stock closing at $75.85 most recently. Over the past year, it has shot up by 23.8%, and if you go back five years, the return is an eye-catching 385.4%. Even though the past week saw a drop of 4.5%, zooming out gives plenty of reasons for optimism, especially in light of the ongoing focus from big institutional investors who are drawn to the insurance sector’s defensive appeal as recession chatter ebbs and flows.

There’s more at play here than just broad market sentiment. The company’s strong three- and five-year gains speak to both steady execution and renewed interest every time the market pivots toward value stocks. That said, there are always questions about whether a run like this is deserved or just momentum at work. Is the stock still undervalued, or has it moved ahead of its fundamentals?

That’s where a sharper lens is useful. Unum Group currently earns a perfect valuation score of 6 out of 6, showing it appears undervalued across all six key valuation checks we track. But if you’re like me, you know that no single metric tells the whole story. So let’s break down the different valuation approaches. Later, I’ll introduce an even more nuanced way to gauge what Unum Group is truly worth.

Approach 1: Unum Group Excess Returns Analysis

The Excess Returns model is designed to measure how efficiently a company uses its shareholders’ capital to generate profit above its cost of equity. In Unum Group’s case, this approach focuses on the return on invested capital and how that surpasses the minimum return that investors demand for owning the stock.

For Unum Group, the key numbers tell a compelling story:

- Book Value: $65.76 per share

- Stable EPS: $8.47 per share

(Source: Weighted future Return on Equity estimates from 4 analysts.) - Cost of Equity: $5.09 per share

- Excess Return: $3.38 per share

- Average Return on Equity: 11.41%

- Stable Book Value: $74.24 per share

(Source: Weighted future Book Value estimates from 7 analysts.)

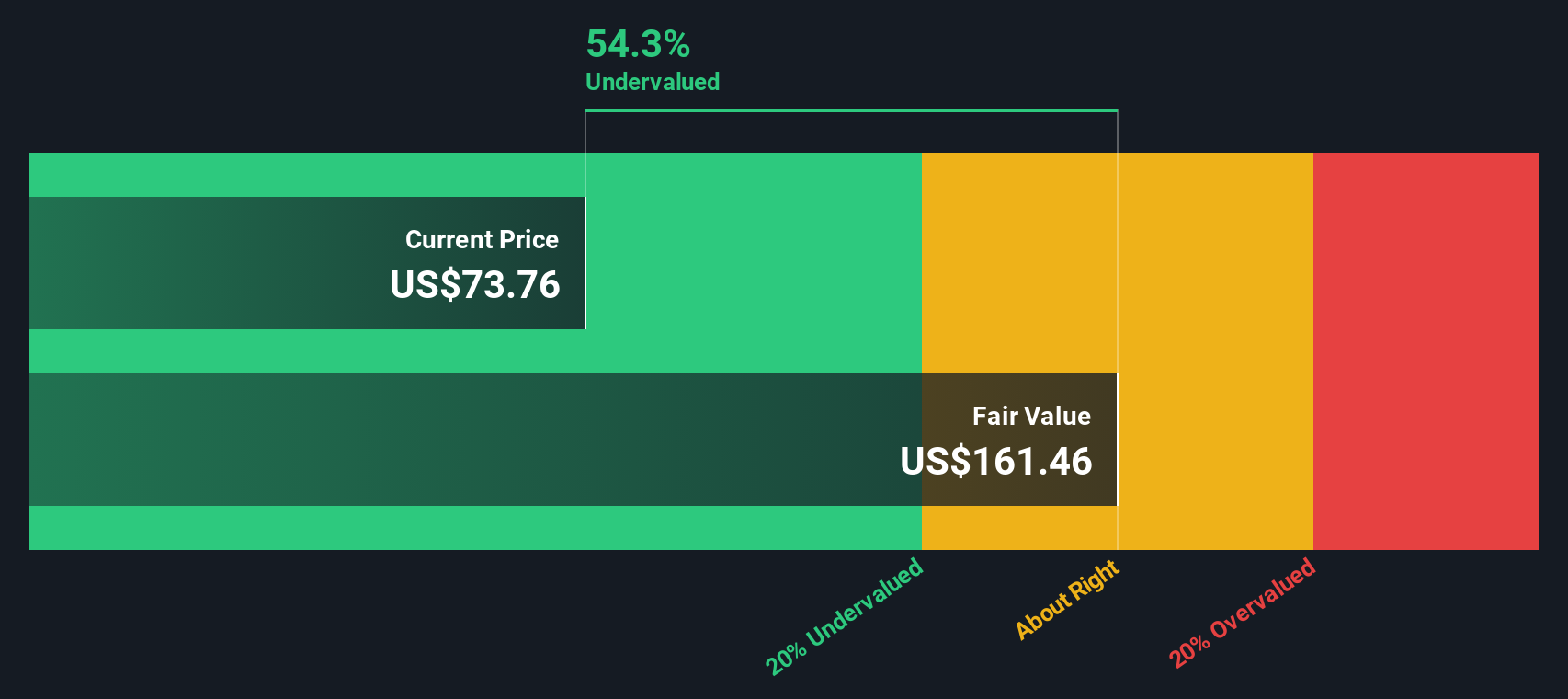

The Excess Returns model calculates an intrinsic value of $163.85, which is significantly higher than the most recent share price of $75.85. This means Unum Group stock stands out as highly undervalued, trading at a 53.7% discount to its estimated worth using this valuation approach. The model suggests that the company is generating well above-average returns on its shareholders’ investments, and the share price has not caught up yet.

Result: UNDERVALUED

Our Excess Returns analysis suggests Unum Group is undervalued by 53.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Unum Group Price vs Earnings

The Price-to-Earnings (PE) ratio is a useful way to value consistently profitable companies like Unum Group, as it reflects how much investors are willing to pay for each dollar of current earnings. This makes it well suited for an established insurance firm with a steady earnings track record.

It is important to remember that what constitutes a “fair” PE ratio depends not just on raw profitability, but also on factors like expected future growth rates and business risk. A higher PE might be justified for companies with greater growth prospects or lower risk, while slower-growing or riskier firms tend to have lower ratios.

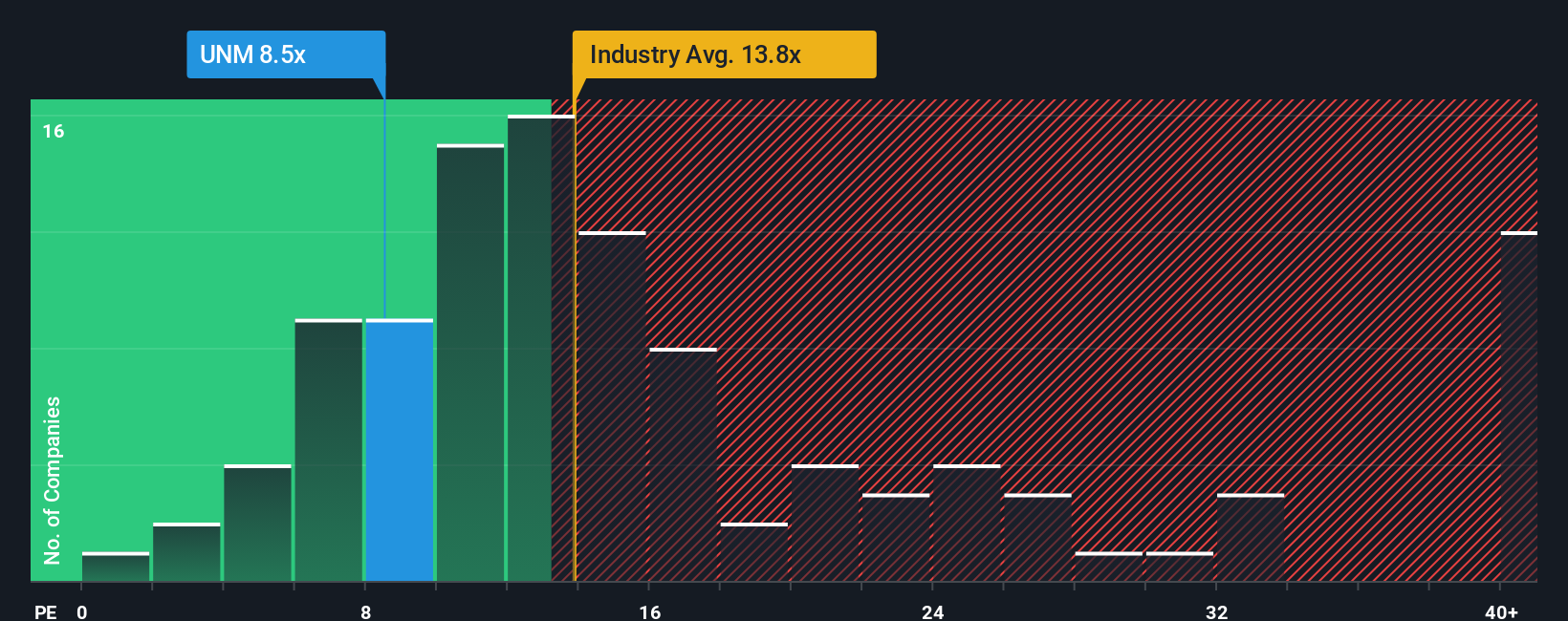

Unum Group’s current PE ratio sits at 8.5x, which is notably below the insurance industry average of 13.8x and the peer group average of 11.2x. This suggests the company is trading at a discount compared to its sector. However, benchmarks like the PE of the industry or peers do not always capture the nuances of a company’s specific profile.

This is where Simply Wall St’s proprietary Fair Ratio comes in. Based on key variables such as Unum Group’s growth rate, profit margin, risk factors, industry norms, and market cap, the Fair Ratio estimates a justified multiple of 12.3x for the stock. This model provides a much more tailored benchmark than a straight industry or peer comparison, as it factors in company-specific performance and outlook as well as risk characteristics.

Comparing the Fair Ratio (12.3x) with Unum Group’s actual PE (8.5x), Unum Group appears attractively below its fair multiple. This points to potential undervaluation on an earnings basis, suggesting the stock could have further room to run.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Unum Group Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your unique story about a company—how you see its future, including the fair value you estimate based on your own expectations for things like revenue, earnings, and profit margins. This approach links the company's story (what you believe is happening or will happen with the business) to a concrete financial forecast, and then connects all of that to a fair value you can act on.

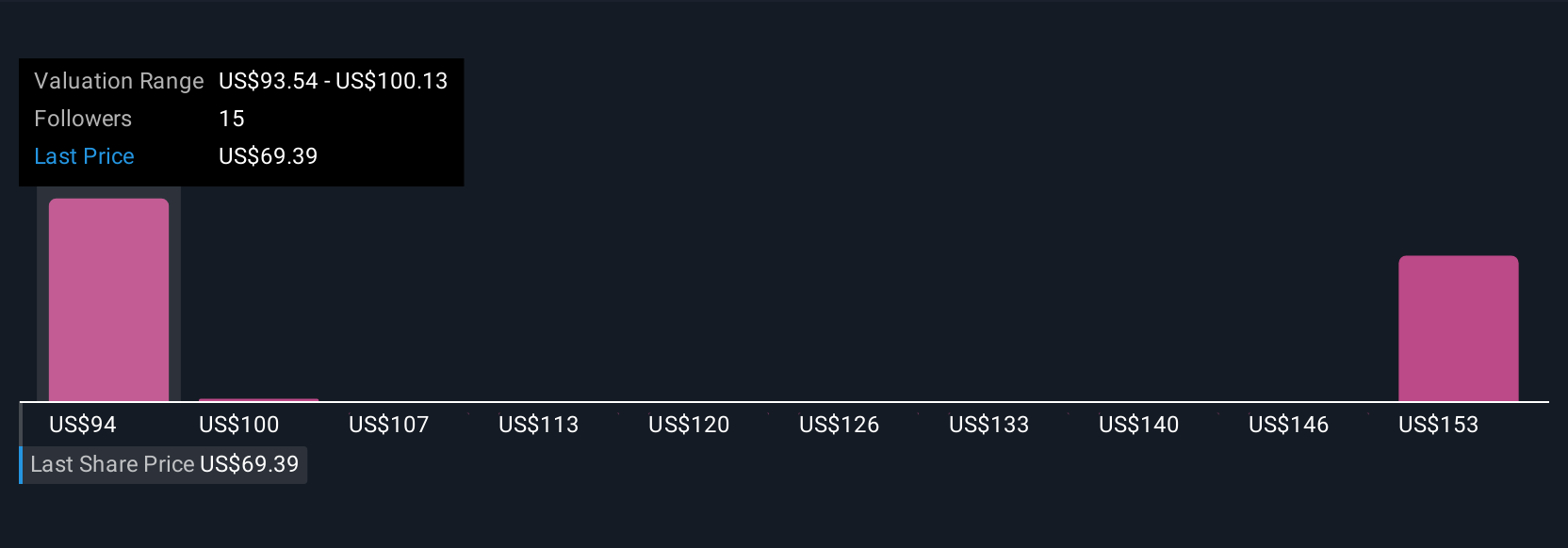

Unlike static ratios or analyst reports, Narratives are dynamic and personal. They are easy to create and update using the Community page on Simply Wall St, which is used by millions of investors. Narratives make it effortless to compare your Fair Value with the current Price to help you decide when it may be time to buy or sell, and they automatically update as new information such as earnings results or breaking news emerges. For example, some investors may forecast robust digital growth and price Unum Group above $108 per share, while others may be more cautious and set their Narrative closer to $79, based on differing views about risks and future opportunities.

Do you think there's more to the story for Unum Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNM

Unum Group

Provides financial protection benefit solutions in the United States, the United Kingdom, and Poland.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives