- United States

- /

- Insurance

- /

- NYSE:TRV

Travelers Companies (NYSE:TRV) Launches Synergy Product Liability Coverage for Life Sciences Sector

Reviewed by Simply Wall St

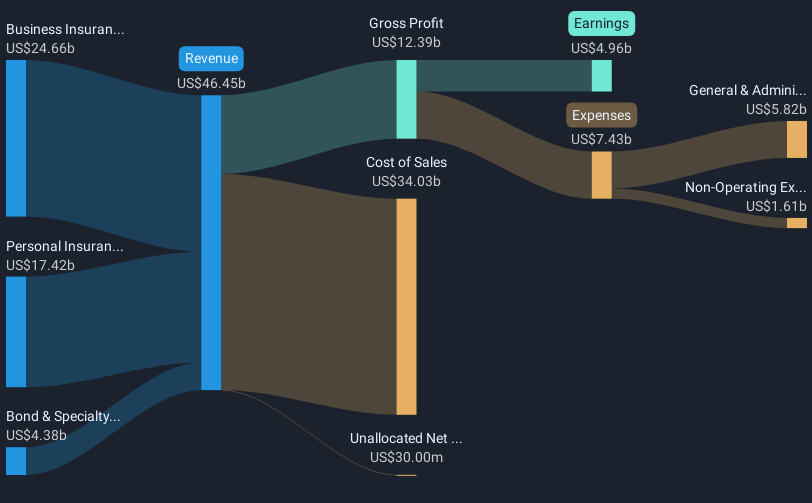

Travelers Companies (NYSE:TRV) recently unveiled Travelers Synergy, a new product liability coverage tailored for life sciences firms. This strategic enhancement, alongside the appointment of Mike Lawton as the new Chief Operating Officer of Travelers Europe, signifies the company's commitment to refining its market offerings and leadership team. Over the past month, Travelers' stock price rose 4.66%, despite a broader market decline with indexes like the Dow Jones and S&P 500 facing downward pressure due to intensified tariffs and economic uncertainty. While the overall market climate was challenging, marked by concerns over policy impacts from the Trump administration, Travelers' introduction of innovative services for the life sciences sector might have played a role in this positive price movement. The distinctiveness of Travelers Synergy, with its comprehensive coverage features, positions the company well in a competitive space, potentially reassuring investors amidst a fluctuating market landscape.

Click here to discover the nuances of Travelers Companies with our detailed analytical report.

Over the past five years, Travelers Companies has achieved a total return of 236.20%, including dividends. This impressive performance reflects a combination of strategic actions and favorable earnings growth that has contributed to the company’s market value. Notably, Travelers has succeeded in growing its earnings by a considerable 8.5% annually over this period, demonstrating robust management and strategic execution. Despite slower expected revenue growth compared to the broader US market, the company's strong net profit margins and earnings growth have set it apart from its peers in the insurance industry.

Travelers’ consistent quarterly dividend payments, the most recent being US$1.05 per share, have provided steady income for shareholders, enhancing total returns. Significant corporate actions such as share repurchases, amounting to substantial investments in the company’s own stock, have reduced share count and possibly supported earnings per share growth. Additionally, product launches like Quantum Boat 2.0 have expanded its market reach, while maintaining a clear focus on innovation and customer needs, such as the introduction of Travelers Synergy for life sciences firms.

- Analyze Travelers Companies' fair value against its market price in our detailed valuation report—access it here.

- Assess the downside scenarios for Travelers Companies with our risk evaluation.

- Is Travelers Companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travelers Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRV

Travelers Companies

Through its subsidiaries, provides a range of commercial and personal property, and casualty insurance products and services to businesses, government units, associations, and individuals in the United States and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives