- United States

- /

- Insurance

- /

- NYSE:STC

Stewart Information Services (STC): Valuation Check After Discounted Equity Raise and Acquisition Push

Reviewed by Simply Wall St

Stewart Information Services (STC) just wrapped up a sizable equity raise, selling 1.9 million shares at a discount to bring in roughly $129 million, and potentially more if underwriters exercise their option.

See our latest analysis for Stewart Information Services.

The discounted raise comes after a busy stretch that includes a major acquisition of Mortgage Contracting Services and a conference appearance. The share price return has still climbed meaningfully this year, while multiyear total shareholder returns remain very strong, suggesting momentum is cooling a little rather than breaking.

If this kind of capital raise has you rethinking where the next opportunity might be, it could be worth exploring fast growing stocks with high insider ownership.

With the share price still up year to date and trading only modestly below analyst targets after a hefty equity raise, the key question now is whether Stewart is undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 7.3% Undervalued

With Stewart Information Services last closing at $74.19 against a narrative fair value near $80, the story leans toward modest upside rather than exuberance.

The analysts have a consensus price target of $78.5 for Stewart Information Services based on their expectations of its future earnings growth, profit margins and other risk factors. In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.4 billion, earnings will come to $214.5 million, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 6.2%.

Want to see what kind of earnings surge and margin reset would justify that calmer future multiple on much larger profits? The full narrative unpacks every assumption.

Result: Fair Value of $80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the housing slump, along with rising data and labor costs, could easily squeeze margins and test whether that projected earnings ramp really materializes.

Find out about the key risks to this Stewart Information Services narrative.

Another Angle on Valuation

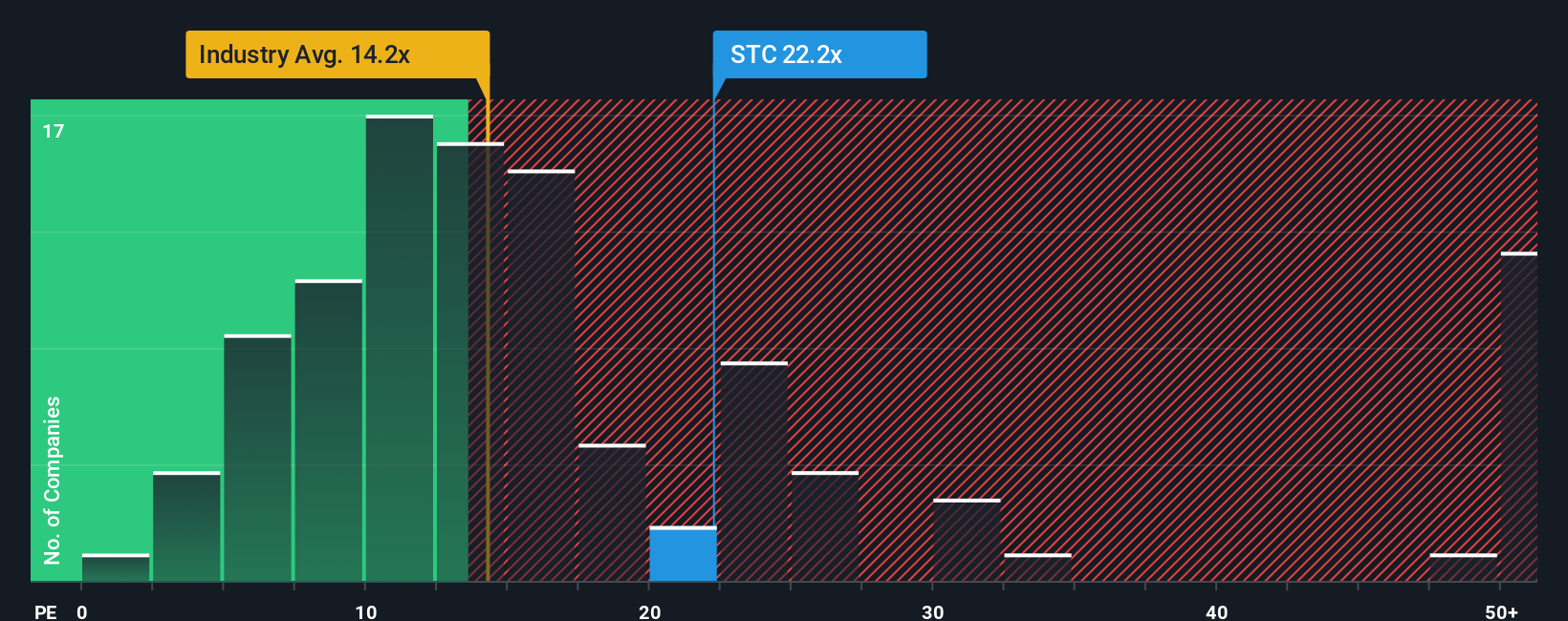

While the narrative fair value suggests modest upside, the earnings multiple tells a tougher story. Stewart trades on a 21.8x P/E versus an industry 13.6x, peers at 16.9x, and a fair ratio of 20.2x, pointing to a richer price and less room for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stewart Information Services Narrative

If you want to stress test these assumptions or prefer to rely on your own work, you can build a complete narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Stewart Information Services.

Ready for more investment ideas?

Before you move on, lock in your next set of opportunities with the Simply Wall Street Screener so you are not leaving potential returns on the table.

- Pinpoint quality income opportunities by reviewing these 13 dividend stocks with yields > 3% that could strengthen the yield of your portfolio.

- Ride powerful secular trends by evaluating these 26 AI penny stocks positioned to benefit from rapid advances in artificial intelligence.

- Target compelling value plays by scanning these 906 undervalued stocks based on cash flows that the market may be mispricing based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STC

Stewart Information Services

Through its subsidiaries, provides title insurance and real estate transaction related services in the United States and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)