- United States

- /

- Insurance

- /

- NYSE:STC

Exploring Three Undiscovered Gems In The United States Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 3.9%, though it has risen by 17% over the past year, with earnings forecasted to grow by 14% annually. In this dynamic environment, identifying stocks that are not only resilient but also positioned for growth can be key to uncovering potential opportunities in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

American Coastal Insurance (NasdaqCM:ACIC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: American Coastal Insurance Corporation, through its subsidiaries, operates in the commercial and personal property and casualty insurance sectors in the United States with a market cap of $626.66 million.

Operations: ACIC generates revenue primarily from premiums in the commercial and personal property and casualty insurance sectors. The company's financial data does not provide detailed segment breakdowns or specific cost allocations.

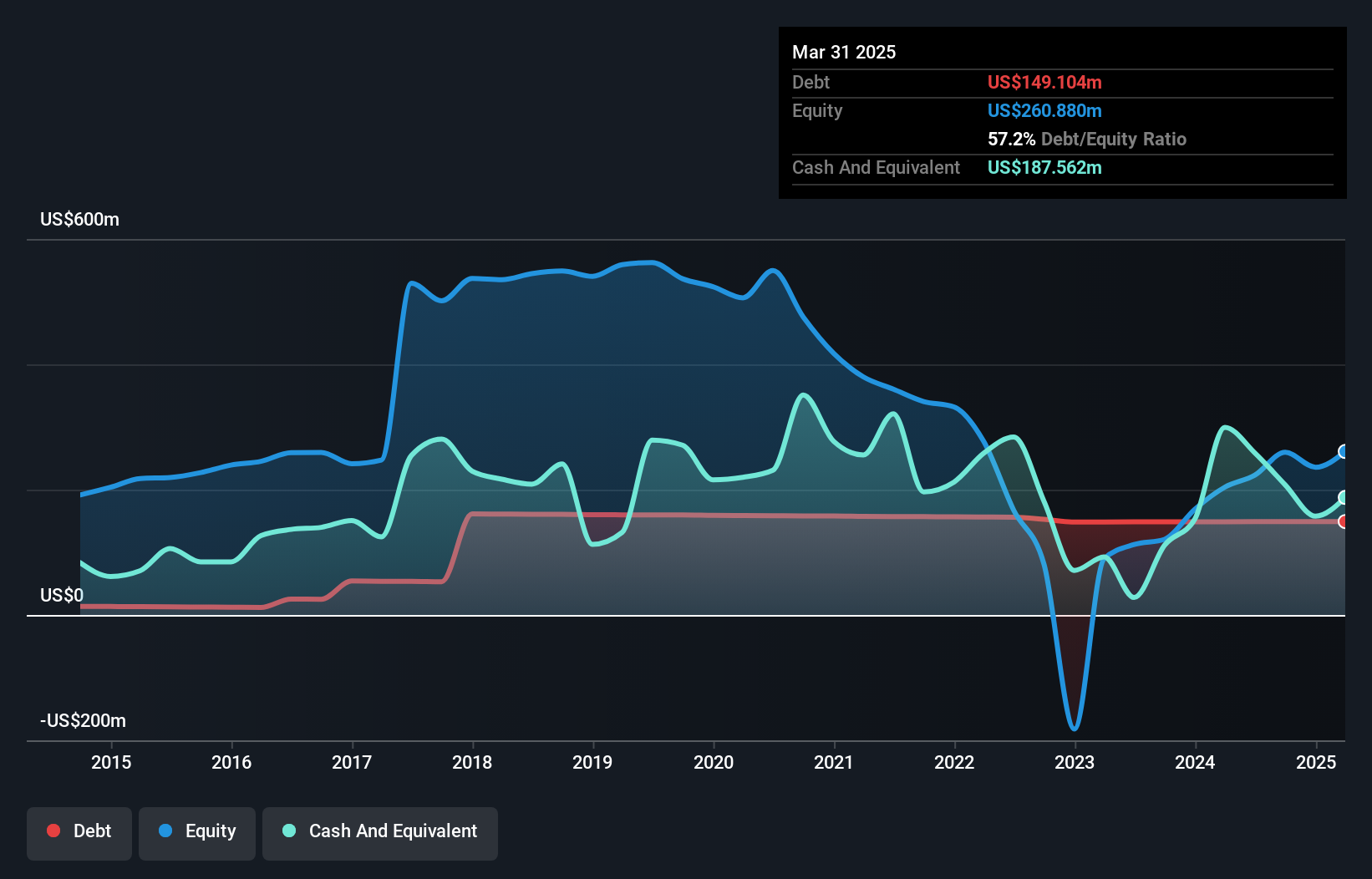

American Coastal Insurance, a smaller player in the insurance market, shows mixed performance with earnings growing 54% annually over the past five years. Despite this growth, its recent annual earnings increase of 23% lagged behind the industry's 32%. The company is trading at a favorable price-to-earnings ratio of 7.3x compared to the US market's average of 18x, suggesting potential value for investors. Debt management remains a concern as their debt-to-equity ratio has risen from 29.7% to 57.4% over five years, although interest payments are well covered by EBIT at nearly ten times coverage.

Douglas Dynamics (NYSE:PLOW)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Douglas Dynamics, Inc. is a North American manufacturer and upfitter of commercial work truck attachments and equipment, with a market cap of $586.59 million.

Operations: Douglas Dynamics generates revenue primarily through the sale of commercial work truck attachments and equipment. The company's financial performance is characterized by a net profit margin that has shown variability over recent periods.

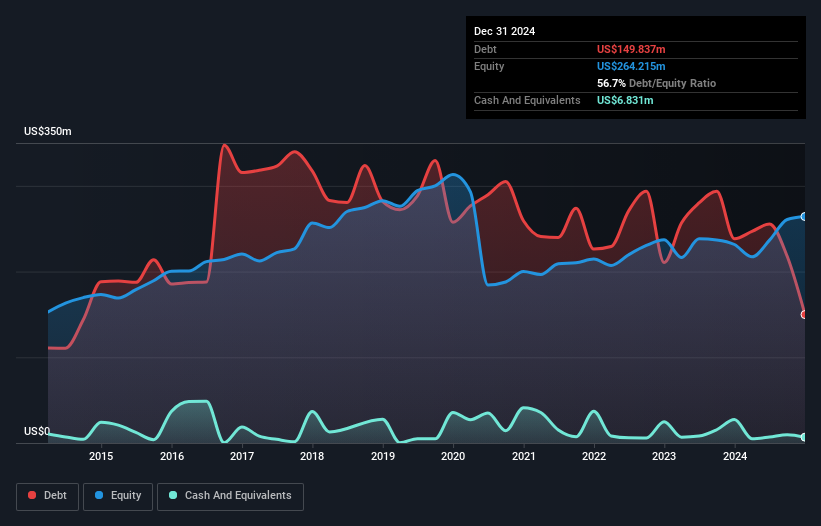

Douglas Dynamics, a key player in the commercial work truck attachments sector, has seen its earnings soar by 142.1% over the past year, outpacing the Machinery industry average of 14.7%. Despite this impressive growth, a significant one-off gain of $41 million impacted recent financials. The company is trading at 56.2% below estimated fair value and has reduced its debt to equity ratio from 82.2% to 56.5% over five years, though net debt remains high at 54.6%. While operational improvements promise annual savings up to $12 million, challenges like low snowfall and high interest rates may affect profitability in the near term.

Stewart Information Services (NYSE:STC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Stewart Information Services Corporation operates through its subsidiaries to provide title insurance and real estate transaction-related services both in the United States and internationally, with a market capitalization of approximately $1.93 billion.

Operations: Stewart Information Services generates revenue primarily from its Title segment, including mortgage services, which accounts for approximately $2.13 billion, and Real Estate Solutions contributing around $358.67 million. The company focuses on providing title insurance and related services across various markets.

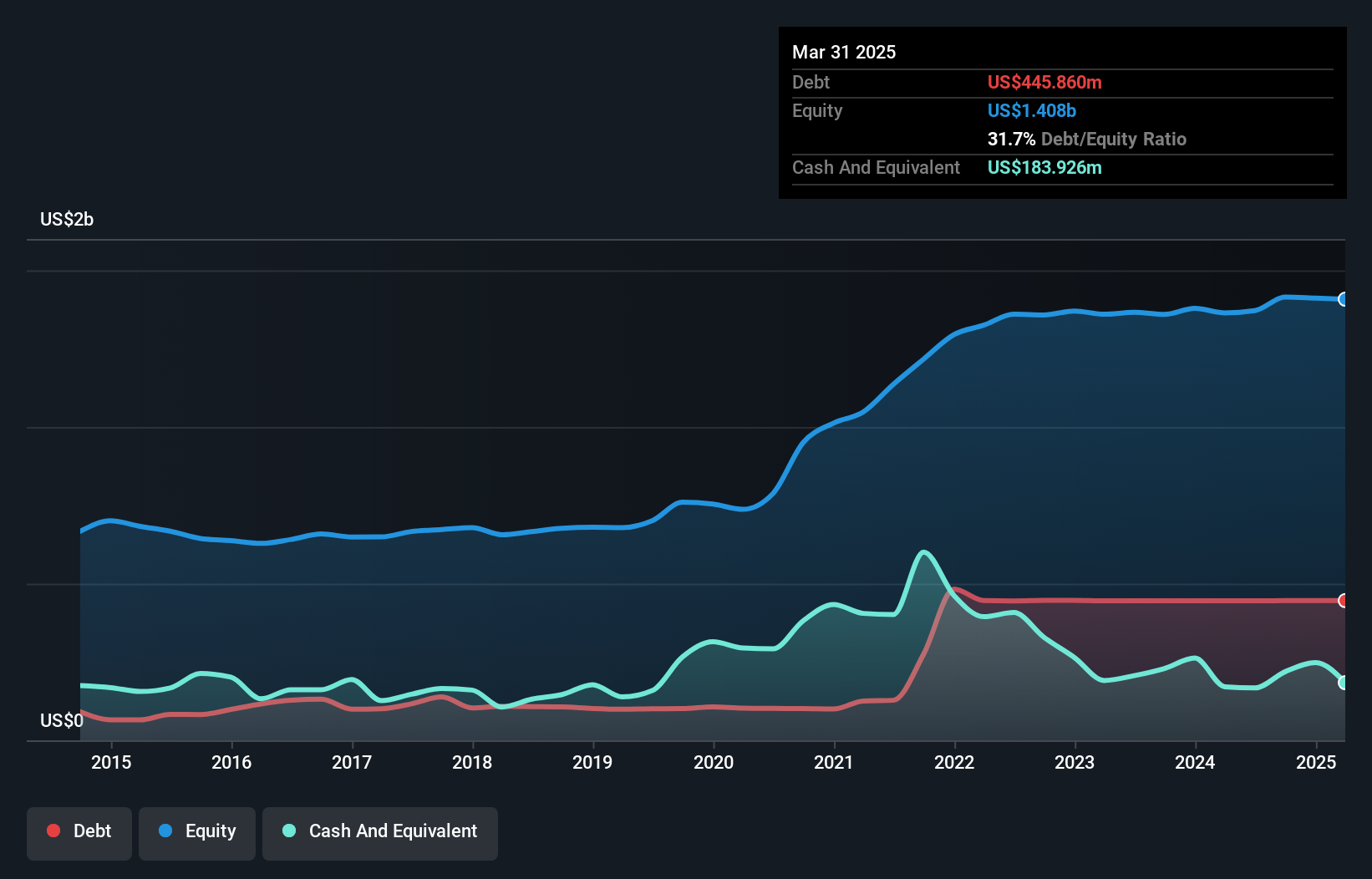

Stewart Information Services, a notable player in the title insurance sector, has been making strategic moves to bolster its market position. Over the past year, earnings surged by 140.8%, outpacing industry growth of 32.2%. The company's debt to equity ratio climbed from 14.2% to 31.6% over five years, yet it maintains a satisfactory net debt to equity ratio of 13.3%. Recent developments include the launch of Connect Close for attorney agents and plans for acquisitions despite challenging market conditions. With US$665 million in Q4 revenue and net income rising to US$22 million from US$9 million year-over-year, Stewart's financial health appears robust as it seeks further expansion opportunities.

Summing It All Up

- Embark on your investment journey to our 284 US Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STC

Stewart Information Services

Through its subsidiaries, provides title insurance and real estate transaction related services in the United States and internationally.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives