- United States

- /

- Insurance

- /

- NYSE:SPNT

Is SiriusPoint Still Attractive After Three-Year 259% Rally and Industry Tailwinds in 2025?

Reviewed by Bailey Pemberton

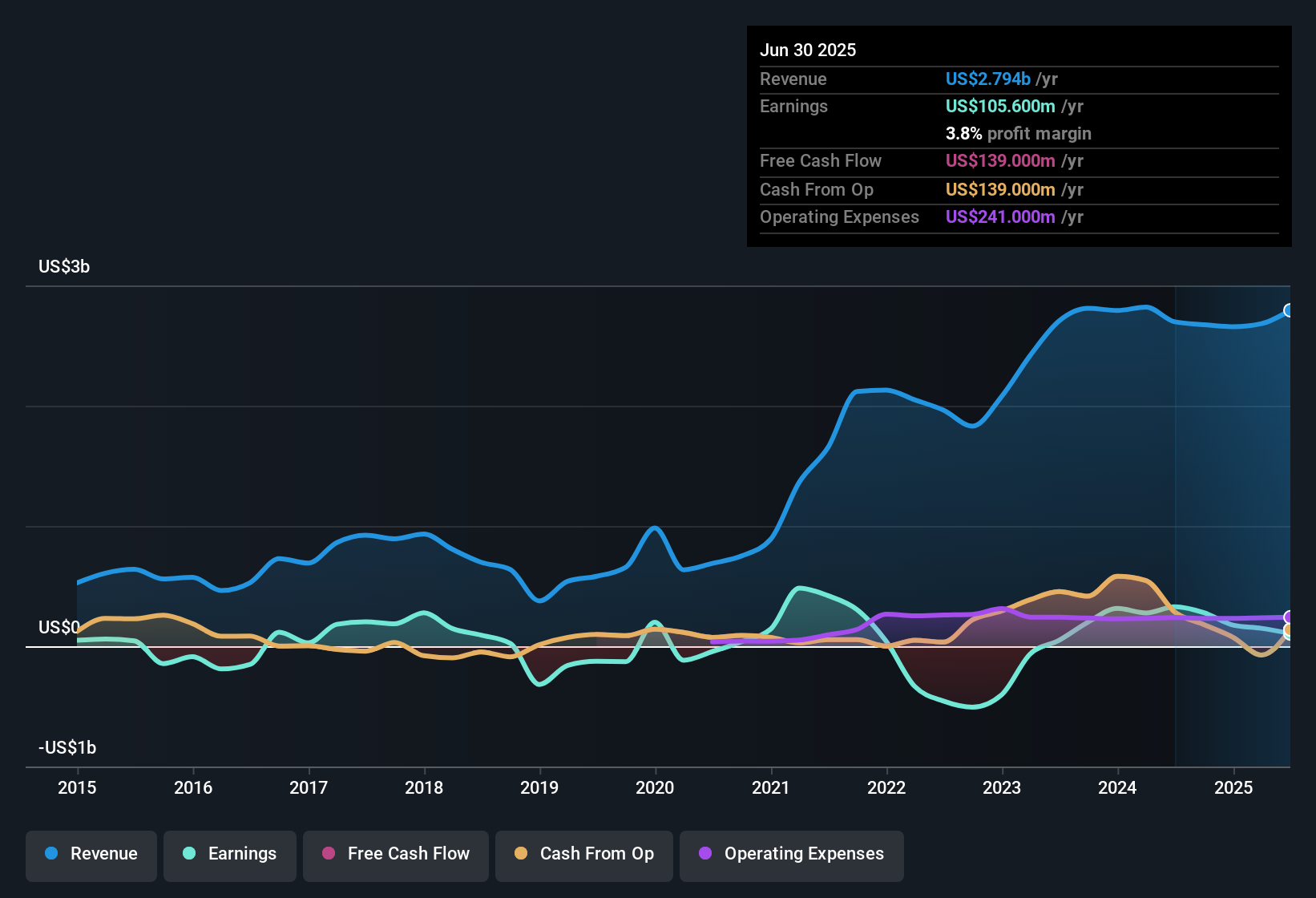

If you’ve been tracking SiriusPoint’s stock, you know this isn’t one of those sleepwalking tickers. Whether you’re eyeing that impressive 259.4% gain over the last three years or sizing up this year’s 15.8% return, SiriusPoint has certainly kept things interesting for shareholders. Even with a slight dip over the last month, it’s clear that investors are reassessing the company’s growth prospects and its risk, potentially setting up for the next big move.

Much of the recent momentum seems tied to broader shifts in the insurance and reinsurance sector, where SiriusPoint has been carving out a more confident position. The longer-term numbers, like a 132.7% gain over five years, suggest there may be more going on here than simple market noise. But of course, with a current value score of just 1 out of 6, the question is whether SiriusPoint is truly undervalued or you’re just seeing the market catching up with reality. Before you make your next move, let’s break down what those valuation checks really tell us, and why there may be an even smarter way to look at SiriusPoint’s true worth coming up later in the article.

SiriusPoint scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SiriusPoint Excess Returns Analysis

The Excess Returns model evaluates a company’s worth based on how much profit it generates over and above its cost of capital. This approach looks at whether management is efficiently turning shareholder money into consistent surplus returns. It offers a direct window into long-term business quality.

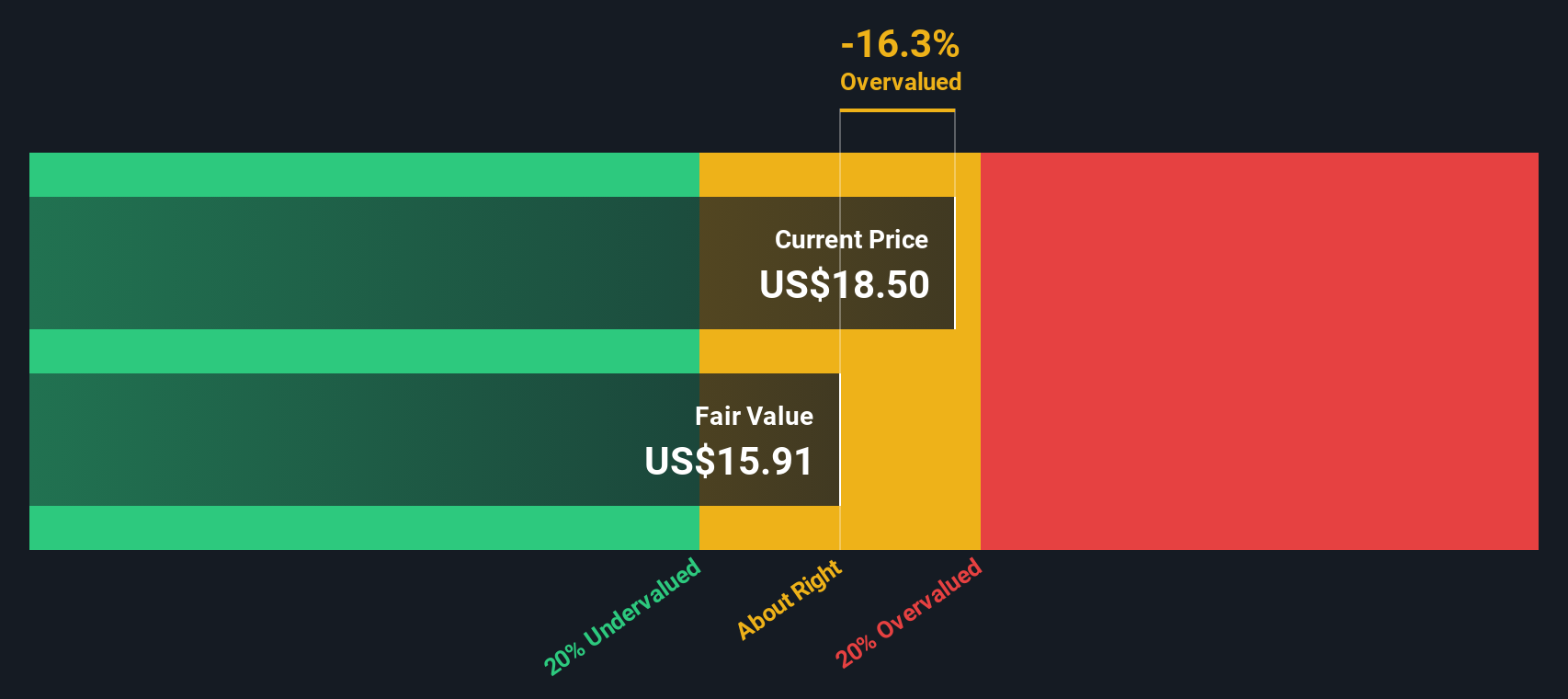

For SiriusPoint, the key figures highlight a steady but modest ability to generate value above its cost of equity. The company has a Book Value of $16.32 per share and a Stable EPS of $1.03 per share, reflecting its average performance based on the median Return on Equity from the past five years. The Cost of Equity stands at $0.95 per share, with the company producing an Excess Return of just $0.08 per share. Over time, SiriusPoint’s average Return on Equity sits at 7.50%, supported by a Stable Book Value of $13.76 per share.

Applying this methodology, the estimated intrinsic value under the Excess Returns model suggests that the stock is currently 14.4% overvalued compared to its fair value.

Result: OVERVALUED

Our Excess Returns analysis suggests SiriusPoint may be overvalued by 14.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: SiriusPoint Price vs Earnings

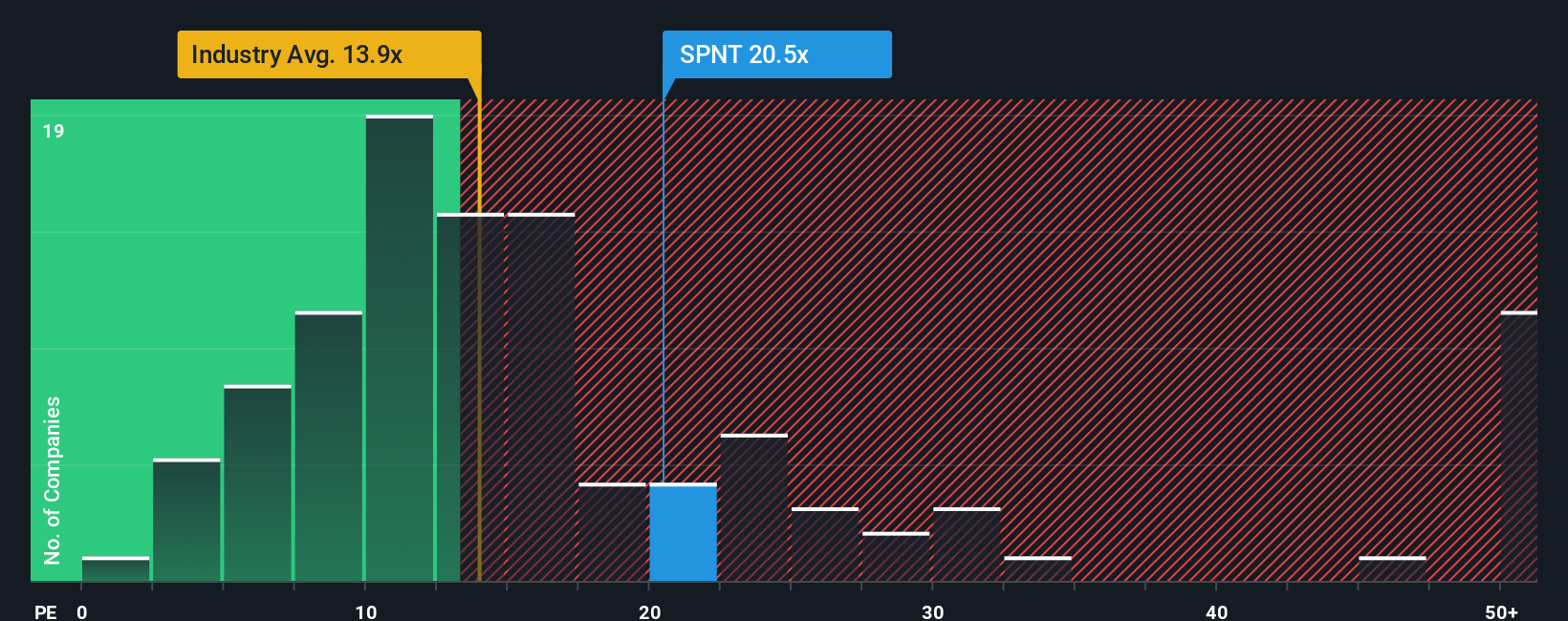

For consistently profitable companies like SiriusPoint, the Price-to-Earnings (PE) ratio is a reliable benchmark for valuation. It gives investors a quick sense of how much they are paying for each dollar of earnings, making it especially relevant for businesses with stable profits.

The “right” PE ratio is shaped by several factors. High-growth companies or those with lower risk profiles typically deserve a higher PE, while slower growth or riskier businesses command lower multiples. Comparing SiriusPoint’s current PE of 20.1x to the insurance industry average PE of 14.2x and its peer average of 13.5x, it is clear the market is assigning SiriusPoint a notable premium.

This is where Simply Wall St’s “Fair Ratio” comes in. This is a more sophisticated measure that accounts for SiriusPoint’s unique mix of growth expectations, risk profile, profit margin, and size. Unlike basic peer or industry comparisons, the Fair Ratio is tailored specifically to the company’s fundamentals. For SiriusPoint, the Fair Ratio stands at 34.3x, considerably above its latest PE ratio. This suggests that, relative to its earnings and outlook, the market is not fully pricing in the company’s potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SiriusPoint Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story you believe about a company, paired with your own assumptions for fair value and forecasts for future revenue, earnings, and margins. Narratives bridge the gap between what is happening in the business, your outlook, and what the stock might really be worth.

On Simply Wall St’s Community page, millions of investors use Narratives as a simple, accessible tool that helps them anchor their investment decisions in real analysis. Narratives connect your perspective on the business, such as its industry strengths or risks, to a set of forecasts and a fair value, so you can objectively compare that value to the current share price and decide whether to buy, hold, or sell.

Narratives update dynamically whenever new information arrives, like fresh news or earnings results, so your view is always current. For example, in SiriusPoint’s case, a bullish investor might focus on specialty market growth and assign a price target of $30. A more cautious view, perhaps emphasizing competitive or regulatory risks, lands at $21. Narratives make it easy to see both sides, test your own assumptions, and invest with clarity.

Do you think there's more to the story for SiriusPoint? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPNT

SiriusPoint

Provides multi-line reinsurance and insurance products and services worldwide.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)