- United States

- /

- Insurance

- /

- NYSE:RYAN

Ryan Specialty Holdings (NYSE:RYAN) Reports Strong Revenue Growth and Dividend Increase to $0.12 per Share

Reviewed by Simply Wall St

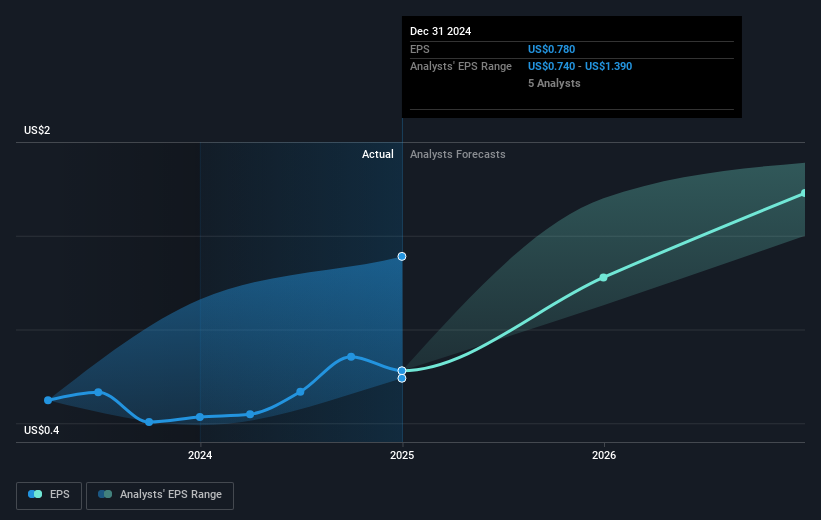

Ryan Specialty Holdings (NYSE:RYAN) recently announced its fourth-quarter earnings, reporting increased revenue but a decline in net income. Concurrently, the company declared a 9% dividend increase to USD 0.12 per share and provided positive earnings guidance for 2025, projecting 11% to 13% organic revenue growth. These initiatives, coupled with the bullish future outlook, may have supported the stock’s 2.8% price increase over the past month. However, this occurred amidst broader market headwinds driven by a downturn in major indexes. During the same period, the Dow Jones and other key indices registered overall weekly losses amid concerns around companies like UnitedHealth. Despite overall market volatility, such a performance by Ryan Specialty Holdings illustrates investor confidence possibly buoyed by its positive revenue guidance and dividend increase, affirming its resilience in a challenging environment. This alignment with broader market trends highlights the company's distinct positioning.

Get an in-depth perspective on Ryan Specialty Holdings's performance by reading our analysis here.

Over the past three years, Ryan Specialty Holdings delivered a robust total shareholder return of 76.99%. This performance reflects investor confidence, as the company's earnings growth outpaced industry benchmarks. Notably, the firm's earnings rose by 78.5% in the past year, significantly exceeding the Insurance industry's 29.3% growth. During this period, Ryan Specialty Holdings also announced several dividend increases, contributing to shareholder value.

Key developments have bolstered the company's long-term prospects, such as the finalization of discussions to acquire Innovisk Capital Partners, which positioned the firm for further growth. Leadership transition also marked a significant phase in 2024, with Patrick G. Ryan moving to Executive Chairman and Timothy W. Turner becoming CEO. Additionally, the company’s inclusion in the S&P 400 Financials and S&P Composite 1500 indexes in mid-2024 likely enhanced its visibility and attractiveness to investors.

- See whether Ryan Specialty Holdings' current market price aligns with its intrinsic value in our detailed report

- Analyze the downside risks for Ryan Specialty Holdings and understand their potential impact—click to learn more.

- Is Ryan Specialty Holdings part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RYAN

Ryan Specialty Holdings

Operates as a service provider of specialty products and solutions for insurance brokers, agents, and carriers in the United States, Canada, the United Kingdom, Europe, and Singapore.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives