- United States

- /

- Insurance

- /

- NYSE:RGA

RGA’s Private Credit Push: Could Its FoxPath Partnership Reshape Portfolio Strategy? (RGA)

Reviewed by Sasha Jovanovic

- FoxPath Capital Partners recently announced a long-term strategic partnership with Reinsurance Group of America (RGA), which includes RGA’s strategic investment and multi-fund anchor commitment to FoxPath’s specialist credit secondaries platform.

- This move expands RGA’s reach into private credit secondary markets and signals a commitment to innovative collaborations aimed at broadening portfolio flexibility and access to alternative assets.

- We’ll explore how RGA’s investment in FoxPath enhances its access to private credit markets and impacts the company's investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Reinsurance Group of America Investment Narrative Recap

Shareholders in Reinsurance Group of America (RGA) typically need confidence in the company’s ability to deliver resilient profit growth and manage risk amid evolving health trends and shifting insurance demand. While the FoxPath Capital Partners partnership broadens RGA’s access to private credit, this new step is unlikely to materially affect near-term results or the primary short-term catalyst: the company’s ability to stabilize earnings in light of recent claims variability. The largest risk remains earnings volatility driven by unpredictable claims and medical cost pressures. Of RGA’s recent announcements, the June 4 agreement with Tokio Marine & Nichido Life Insurance stands out. This deal expands RGA’s international reinsurance exposure through coinsurance of whole life policies, aligning with one of the main catalysts: growing demand in Asia and globally. It shows concrete action in building out geographic revenue diversification, one factor that could help offset earnings swings in core U.S. and North American markets moving forward. By contrast, investors should be aware of ongoing earnings variability from U.S. individual life claims and...

Read the full narrative on Reinsurance Group of America (it's free!)

Reinsurance Group of America's narrative projects $29.2 billion revenue and $1.9 billion earnings by 2028. This requires 10.3% yearly revenue growth and a $1.13 billion earnings increase from $770.0 million today.

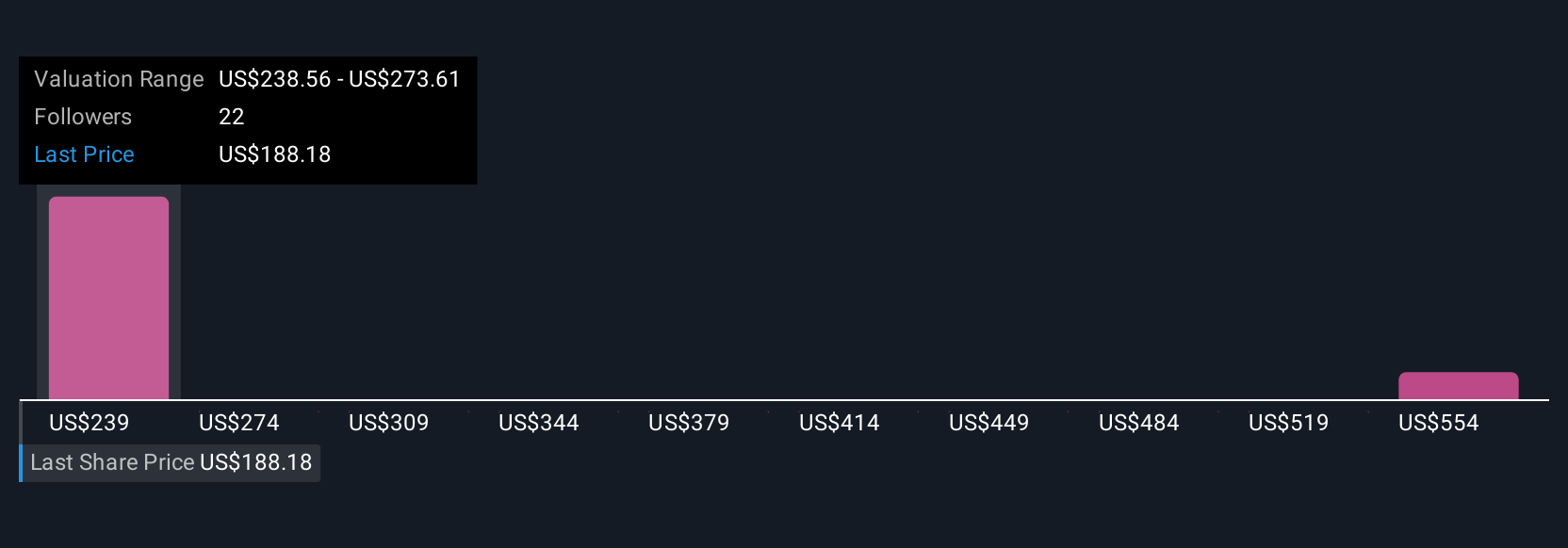

Uncover how Reinsurance Group of America's forecasts yield a $236.89 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range widely from US$236.89 to US$590.41 across two submissions. As investors debate RGA’s outlook, claims volatility and rising medical costs remain at the forefront and could significantly impact the company’s future earnings profile.

Explore 2 other fair value estimates on Reinsurance Group of America - why the stock might be worth over 3x more than the current price!

Build Your Own Reinsurance Group of America Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reinsurance Group of America research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Reinsurance Group of America research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reinsurance Group of America's overall financial health at a glance.

No Opportunity In Reinsurance Group of America?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RGA

Reinsurance Group of America

Provides reinsurance and financial solutions.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives