- United States

- /

- Insurance

- /

- NYSE:PRU

Prudential Financial (NYSE:PRU) Urges Shareholders To Reject Chairman-CEO Role Separation Proposal

Reviewed by Simply Wall St

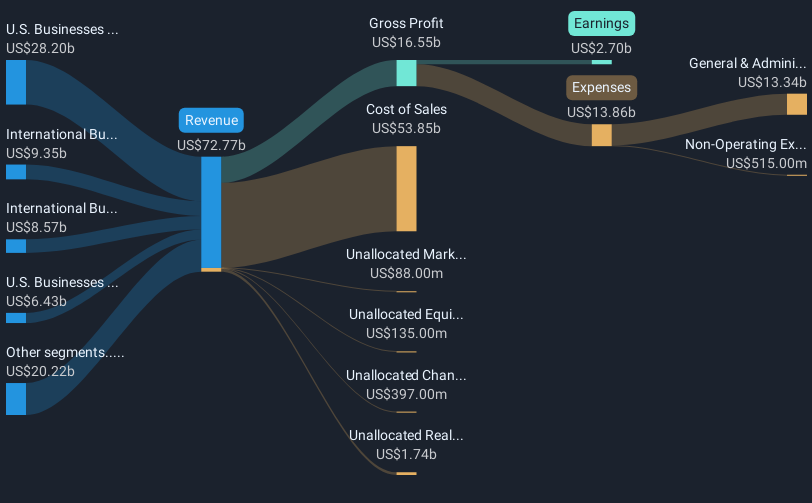

Recent developments at Prudential Financial (NYSE:PRU) involved the company filing a definitive proxy statement to urge shareholders against a proposal by investor John Chevedden to separate the roles of Chairman and CEO. This arises amidst fluctuations in their share price with a 3% movement last week, likely influenced by prevailing economic concerns, including high inflation and weak consumer sentiment that impacted the broader market, with key indexes like the Dow Jones experiencing near 2% declines. Prudential’s positioning against the shareholder proposal may communicate a commitment to its current leadership strategy amidst the volatile market conditions.

Over the last five years, Prudential Financial has delivered a total shareholder return of 216.06%, reflecting a robust combination of share price appreciation and consistent dividend payouts. While recent performance has trailed the broader market and the US Insurance industry over the past year, Prudential remains committed to rewarding shareholders through a combination of dividend increases and share buybacks. Notably, the company declared a quarterly dividend of US$1.35 per share as of February 2025, marking the 17th consecutive year of increases—a testament to its reliable shareholder return policy.

Prudential's expansion efforts and strategic partnerships have significantly shaped its performance over the years. The collaboration with Dai-ichi Life Holdings and Dimensional Fund Advisors are aimed at enhancing product distribution and income strategies. Additionally, leadership transitions, including Andrew Sullivan’s appointment as CEO, are poised to bring fresh perspectives and growth opportunities. While the company faces challenges such as foreign exchange impacts and underwriting volatility, its continued investments in diversified distribution and capital efficiency initiatives are set to influence potential future growth positively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRU

Prudential Financial

Provides insurance, investment management, and other financial products and services in the United States, Japan and internationally.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives