- United States

- /

- Insurance

- /

- NYSE:PRU

Prudential Financial (NYSE:PRU) Completes $250M Buyback As Q1 Net Income Declines

Reviewed by Simply Wall St

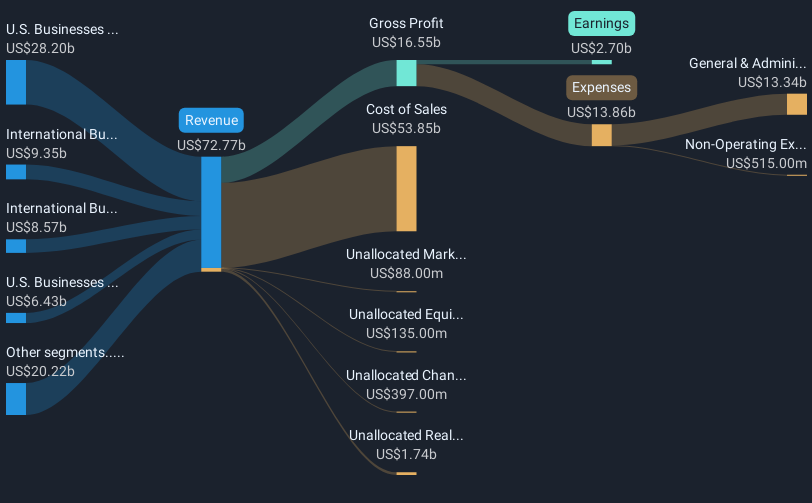

Prudential Financial (NYSE:PRU) announced its earnings for the first quarter of 2025, reporting a net income decrease to $707 million from $1,138 million the previous year, coupled with a share buyback of 2.2 million shares. This buyback could add weight to the market's overall 2.7% rise, despite a broader positive trend in technology stocks driving indices, reflecting a consistent market uptrend. Although Prudential's 1.1% price move last week aligns with the market's general performance, it highlights investors' mixed reactions to the earnings decrease amid strong broader market gains.

The recent net income decrease in Prudential Financial's first-quarter earnings, from US$1.14 billion to US$707 million, emphasizes a significant variance in earnings, which may challenge the company's expected revenue and earnings forecasts. The reported earnings contraction, despite the share buyback of 2.2 million shares, highlights mixed investor sentiment that might influence how the market views the company's growth trajectory and expansion plans. With revenue forecasted to decline by 3.8% annually over the next three years, this development could raise concerns about meeting analyst projections.

Over the past five years, Prudential Financial has delivered a total shareholder return of 144.47%, reflecting robust longer-term performance. This is an important context amid recent fluctuations and compares to its underperformance against the US market's 9.6% return and the US Insurance industry’s 17.7% return over the past year. The 1.1% share price movement, in proximity to the analyst price target of US$114.08 from the current price of US$104.03, suggests the stock may be fairly valued, given future forecasts.

Evaluate Prudential Financial's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRU

Prudential Financial

Provides insurance, investment management, and other financial products and services in the United States, Japan and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives