- United States

- /

- Insurance

- /

- NYSE:PRU

Prudential Financial (NYSE:PRU) Announces Board Changes and Appoints New SVP Controller

Reviewed by Simply Wall St

Prudential Financial (NYSE:PRU) recently announced significant executive and board changes, including the planned departure of Douglas A. Scovanner and the appointment of Robert Boyle to a key financial position. These developments came amid a 1.85% decline in Prudential Financial's share price over the last week. The company's launch of "One leave," aimed at enhancing absence and disability management, coincided with broader market pressures. During this period, markets overall experienced a downturn, with the Dow and S&P 500 each declining by 1.7%, marking the Dow's worst week since October. This recent market volatility, influenced by disappointing economic data and significant declines in key sectors such as health and technology, could have contributed to Prudential's share price movement. As stocks, including major insurers, grappled with negative pressures, Prudential's performance aligned with broader market trends.

Navigate through the intricacies of Prudential Financial with our comprehensive report here.

Over the past five years, Prudential Financial (NYSE:PRU) has provided a significant total shareholder return of 86.95%. During this time, it has ensured a steady dividend growth, increasing its quarterly dividends for 17 consecutive years—a testament to its commitment to returning value to shareholders. This consistent dividend policy, including the recent 4% dividend increase, has likely contributed to the total return.

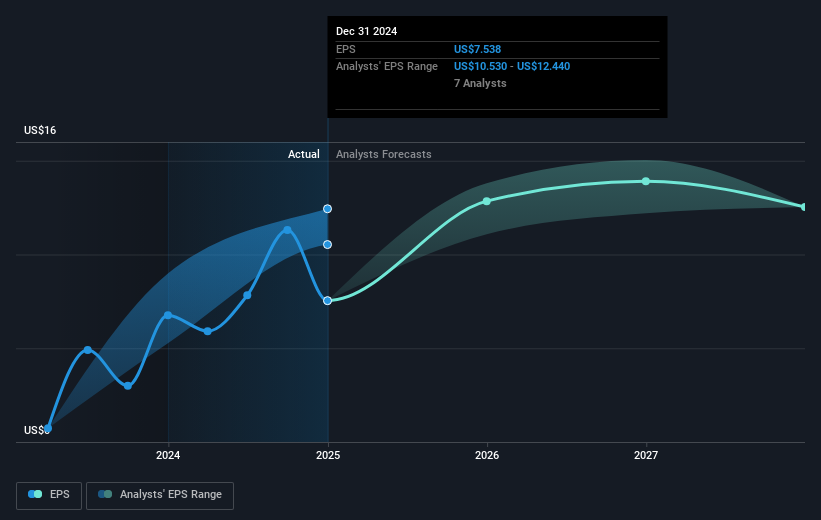

Strategic collaborations, such as with Dai-ichi Life Holdings, have enabled Prudential to enhance product distribution in international markets. While the company faced a net loss in Q4 2024, this was balanced by positive full-year net income growth. Prudential's share buyback program also played a role, returning capital to shareholders through repurchasing 8.59 million shares valued at US$250.05 million. Nevertheless, over the last year, Prudential has underperformed compared to the broader US market and the insurance industry, highlighting challenges despite its longer-term achievements.

- Understand the fair market value of Prudential Financial with insights from our valuation analysis—click here to learn more.

- Assess the potential risks impacting Prudential Financial's growth trajectory—explore our risk evaluation report.

- Have a stake in Prudential Financial? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRU

Prudential Financial

Provides insurance, investment management, and other financial products and services in the United States, Japan and internationally.

6 star dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives