- United States

- /

- Insurance

- /

- NYSE:PRI

How Rising Analyst Optimism on Earnings Potential Could Shape Primerica (PRI)'s Investment Story

Reviewed by Sasha Jovanovic

- Primerica recently attracted increased analyst attention after topping earnings estimates in its last two reports and achieving a +3.21% Earnings ESP, with the next earnings release expected on November 5, 2025.

- This optimism is supported by significant improvements in profit margins, ongoing share repurchases, and robust return on equity, underscoring healthy fundamentals and growing confidence ahead of earnings.

- We'll explore how rising analyst confidence in Primerica's near-term earnings potential could impact its investment narrative and future growth outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Primerica Investment Narrative Recap

To be a Primerica shareholder, you need to believe in the company's ability to harness demographic demand for retirement planning, maintain a productive sales force, and achieve steady earnings growth amid a challenging insurance market. While recent earnings beats and rising analyst optimism have buoyed sentiment, these successes are yet to materially offset ongoing risks tied to Term Life policy sales declines and agent productivity, short-term catalysts could still be overshadowed by pressure on topline revenue if these trends persist.

Among recent company developments, Primerica's ongoing share repurchase program stands out, with the company having repurchased nearly 2.72% of shares for US$247.1 million so far this year. Share buybacks can support earnings per share metrics and signal management's confidence, but their impact must be weighed against the underlying headwinds facing policy growth and agent recruitment.

However, against this positive momentum, investors should keep in mind the potential impact if agent productivity fails to...

Read the full narrative on Primerica (it's free!)

Primerica's outlook anticipates $3.7 billion in revenue and $775.3 million in earnings by 2028. This requires 4.4% annual revenue growth and a $67.8 million increase in earnings from the current $707.5 million.

Uncover how Primerica's forecasts yield a $312.43 fair value, a 18% upside to its current price.

Exploring Other Perspectives

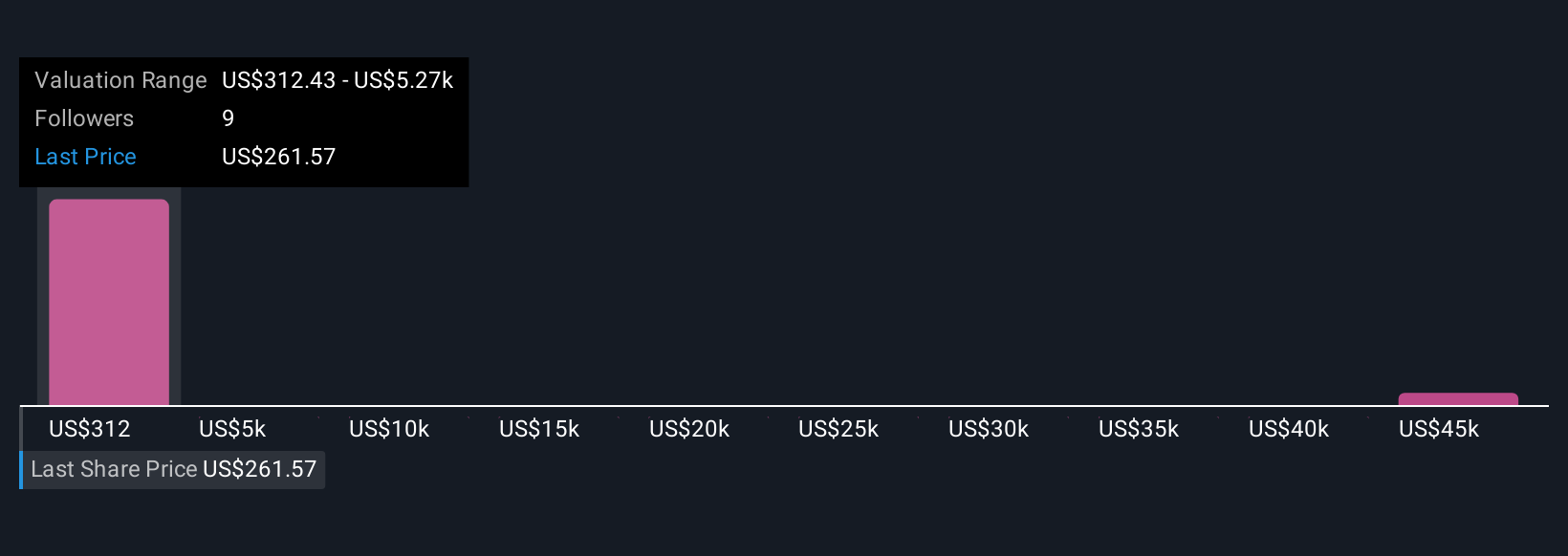

Simply Wall St Community members place Primerica's fair value between US$312 and an outlier high above US$49,000 across three individual estimates. In the context of enhanced analyst optimism but ongoing risks to policy sales, these views stress how opinions on future performance can differ, take time to explore the breadth of perspectives for yourself.

Explore 3 other fair value estimates on Primerica - why the stock might be worth just $312.43!

Build Your Own Primerica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Primerica research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Primerica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Primerica's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRI

Primerica

Provides financial products and services to middle-income households in the United States and Canada.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)