- United States

- /

- Insurance

- /

- NYSE:PGR

Progressive (PGR) Dividend Boost: Assessing Whether Strong Payout Signals an Undervalued Stock

Reviewed by Simply Wall St

Progressive (PGR) just paired a hefty $13.50 annual dividend with its steady $0.10 quarterly payout, signaling clear confidence in its balance sheet and cash generation rather than a one off reward.

See our latest analysis for Progressive.

That confidence has been playing out in the market, too, with the latest $234.85 share price sitting on a 5.85% one month share price return even as the 1 year total shareholder return is modestly negative. This suggests long term momentum remains intact despite recent volatility.

If Progressive’s dividend strength has you rethinking your income strategy, it could be worth scanning pharma stocks with solid dividends for other stocks pairing resilient cash flows with generous payouts.

Yet with shares still below analyst targets despite years of outsized returns and profit growth, investors now face a key question: is Progressive quietly undervalued, or is the market already pricing in its next leg of expansion?

Most Popular Narrative Narrative: 8.8% Undervalued

With Progressive last closing at $234.85 against a narrative fair value near the mid $250s, the story leans toward underappreciated earnings power rather than peak pricing.

Continued investment in analytics, telematics, and product model enhancements further improves underwriting accuracy and expense leverage, leading to lower loss ratios and improved net margins over time.

Industry consolidation and regulatory reforms (e.g., in key markets like Florida), combined with Progressive's capacity for swift rate adjustments, enable above-industry growth and the ability to maintain or even widen operating margins in volatile or inflationary market cycles.

Want to see why slower earnings and only mid single digit revenue growth still justify a premium multiple and higher fair value? The narrative leans on margin durability, scale advantages, and a future valuation usually reserved for faster growing sectors. Curious which specific profit and discount rate assumptions hold this together? Read on to uncover the full blueprint behind this pricing call.

Result: Fair Value of $257.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and structurally higher claims costs could erode Progressive’s margin edge and challenge the premium valuation implied by today’s narrative.

Find out about the key risks to this Progressive narrative.

Another View: Market Multiples Send a Different Signal

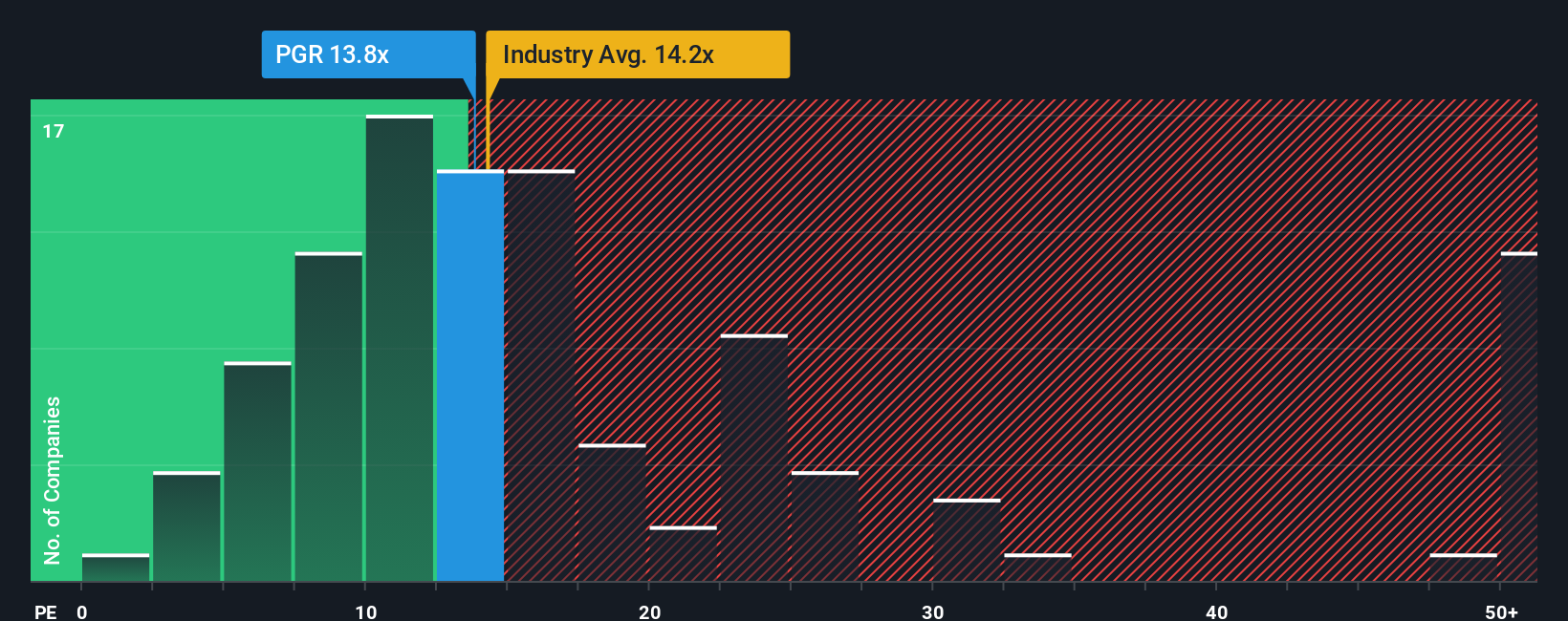

While the narrative fair value points to upside, the current price already bakes in a rich earnings tag. Progressive trades at about 12.9 times earnings versus an industry 13.5 times, but above a fair ratio of 12 times, which hints at less margin of safety if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Progressive Narrative

If you see the story differently or want to pressure test the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Progressive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you log off, give yourself an edge by using the Simply Wall St Screener to spot fresh opportunities that match your goals and risk style.

- Target dependable income streams by scanning these 13 dividend stocks with yields > 3% that can help anchor your portfolio with consistent cash returns.

- Capitalize on innovation by reviewing these 26 AI penny stocks positioned to benefit from advances in artificial intelligence and automation.

- Seize potential bargains by checking these 907 undervalued stocks based on cash flows where market pessimism may have opened the door to long term upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGR

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)