- United States

- /

- Insurance

- /

- NYSE:OSCR

Oscar Health (OSCR) Reports Net Loss of US$228 Million in Q2 Earnings

Reviewed by Simply Wall St

Oscar Health (OSCR) recently announced a partnership with Hy-Vee, Inc to offer innovative healthcare benefits, despite reporting a net loss of $228 million in their second-quarter earnings. The company's stock experienced a 23% price increase in the last quarter, aligning largely with the 18% yearly rise of the broader market, suggesting broader market trends rather than specific company catalysts may have played a significant role. However, the strategic partnership and reaffirmed corporate guidance likely added positive undertones to the stock's performance, especially amid the healthcare sector's evolving landscape.

You should learn about the 1 possible red flag we've spotted with Oscar Health.

The partnership between Oscar Health and Hy-Vee, Inc. could play a key role in shaping the company's direction, potentially enhancing future revenue streams and earnings forecasts. With Oscar Health focusing on digital efficiencies amid higher claims costs and evolving policy risks, the collaboration may offer new avenues for exploiting technological advancements, possibly bolstering their strategy to mitigate rising expenses and regulatory challenges. The strategic alliance could support digital innovation, aiding profitability goals despite the existing vulnerabilities highlighted in the narrative.

Over a three-year period, Oscar Health’s total shareholder return was 178.56%. Although impressive, the stock underperformed the US market over the past year, which grew by 17.5%. Additionally, it lagged behind the US Insurance industry, which saw returns of 2.3% within the same period. These performance metrics underline the nuanced position Oscar Health holds amid industry peers and broader market movements.

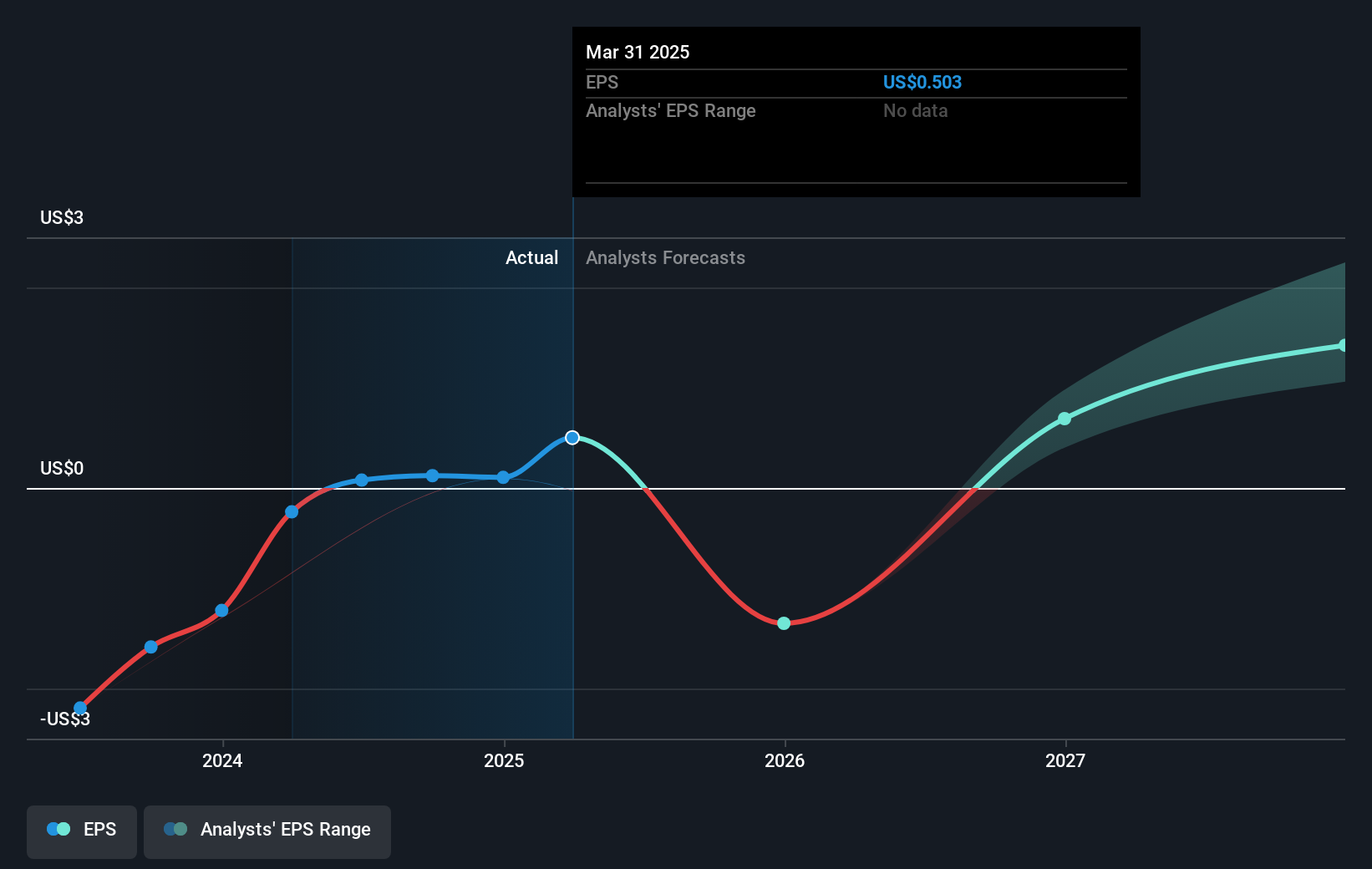

Despite recent positive news, the stock's current price of US$17.02 remains above analysts' consensus price target of US$11.14, suggesting the market might have higher expectations than analysts do. This implies the potential for reevaluation if projected improvements in revenue and profit margins, such as anticipated annual revenue growth to US$12.6 billion and earnings reaching US$239 million by 2028, do not materialize as expected. Investors may need to consider whether the forecasted financial improvements justify the current pricing. As Oscar Health navigates industry shifts and expanding partnerships, ongoing performance will be crucial for aligning market expectations with analyst predictions.

Review our growth performance report to gain insights into Oscar Health's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSCR

Oscar Health

Operates as a healthcare technology company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026