- United States

- /

- Insurance

- /

- NYSE:ORI

What Old Republic International (ORI)'s Leadership Changes Mean For Shareholders

Reviewed by Simply Wall St

- On July 16, 2025, Old Republic Surety Company appointed Alan Pavlic as CEO and Steve Denault as President, both effective immediately, marking a significant shift in leadership.

- This leadership transition introduces a blend of long-standing company experience and fresh industry insight, which could influence future decision-making and direction for Old Republic Surety.

- We'll examine how the appointment of Alan Pavlic as CEO could shape Old Republic International's investment narrative and future strategy.

Old Republic International Investment Narrative Recap

To be a shareholder in Old Republic International, you need to believe in the company’s mix of diverse insurance offerings and its ability to capitalize on growth in specialty lines, while managing margin pressures in title insurance. The recent leadership changes at Old Republic Surety Company are unlikely to have a material impact on short-term catalysts such as continued specialty insurance growth, but may provide added depth in managing risks tied to emerging underwriting divisions.

Of the company’s recent announcements, the formation of Old Republic Cyber Inc. stands out for its direct alignment with growth catalysts. Expanding into cyber and technology errors and omissions insurance may support earnings diversification, further reinforcing Old Republic’s focus on specialty segment expansion.

Conversely, investors should keep in mind the persistent risk of elevated combined ratios in Title Insurance if market headwinds endure, as...

Read the full narrative on Old Republic International (it's free!)

Old Republic International's outlook anticipates $10.2 billion in revenue and $855.7 million in earnings by 2028. This scenario is based on a 6.8% annual revenue growth rate and a $74.7 million increase in earnings from the current level of $781.0 million.

Exploring Other Perspectives

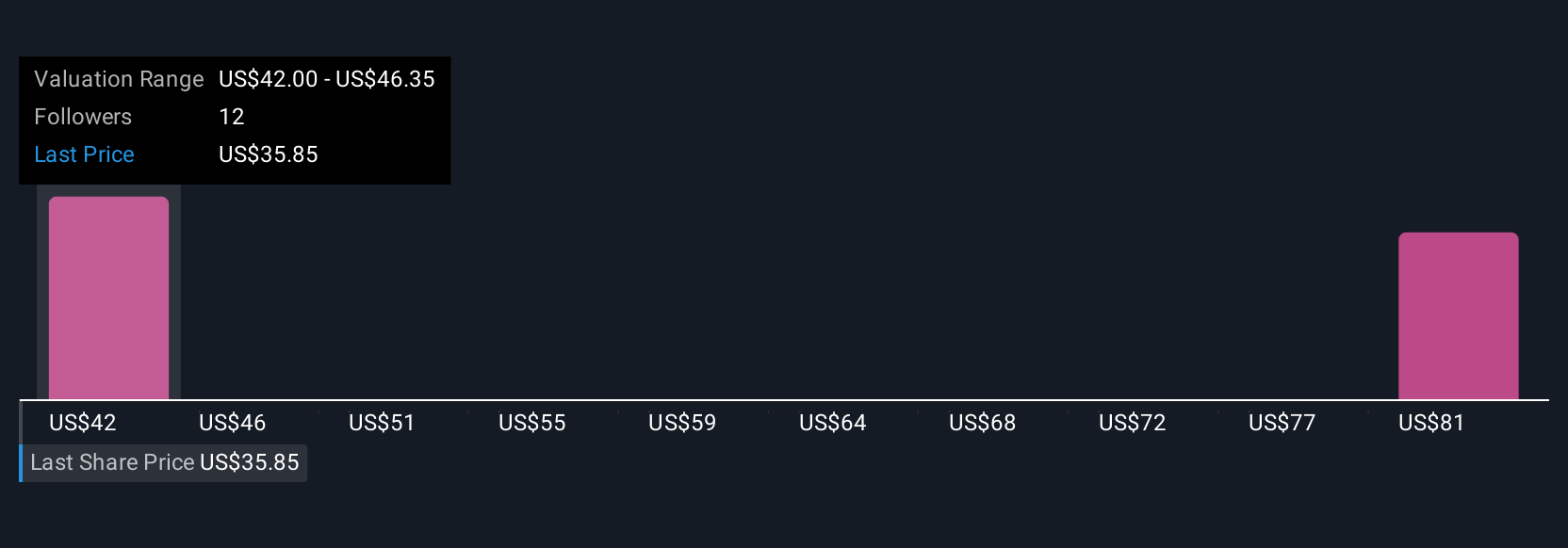

Three Simply Wall St Community members have offered fair value estimates ranging from US$42 to US$84.32 per share. While many anticipate gains from specialty insurance growth, headwinds in Title Insurance remain front of mind for future performance. Explore how your view compares to others in our community.

Build Your Own Old Republic International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Old Republic International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Old Republic International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Old Republic International's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORI

Old Republic International

Through its subsidiaries, provides insurance underwriting and related services primarily in the United States and Canada.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives