- United States

- /

- Banks

- /

- NasdaqGS:HBAN

Top US Dividend Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed performances, with major indices fluctuating amid anticipation of key economic data and interest rate decisions, investors are keeping a close eye on dividend stocks for potential stability and income. In such a dynamic environment, strong dividend-paying companies can offer attractive opportunities by providing consistent returns through dividends even when market volatility is high.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.70% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.30% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.79% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.57% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.78% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.90% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.02% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.01% | ★★★★★★ |

Click here to see the full list of 156 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

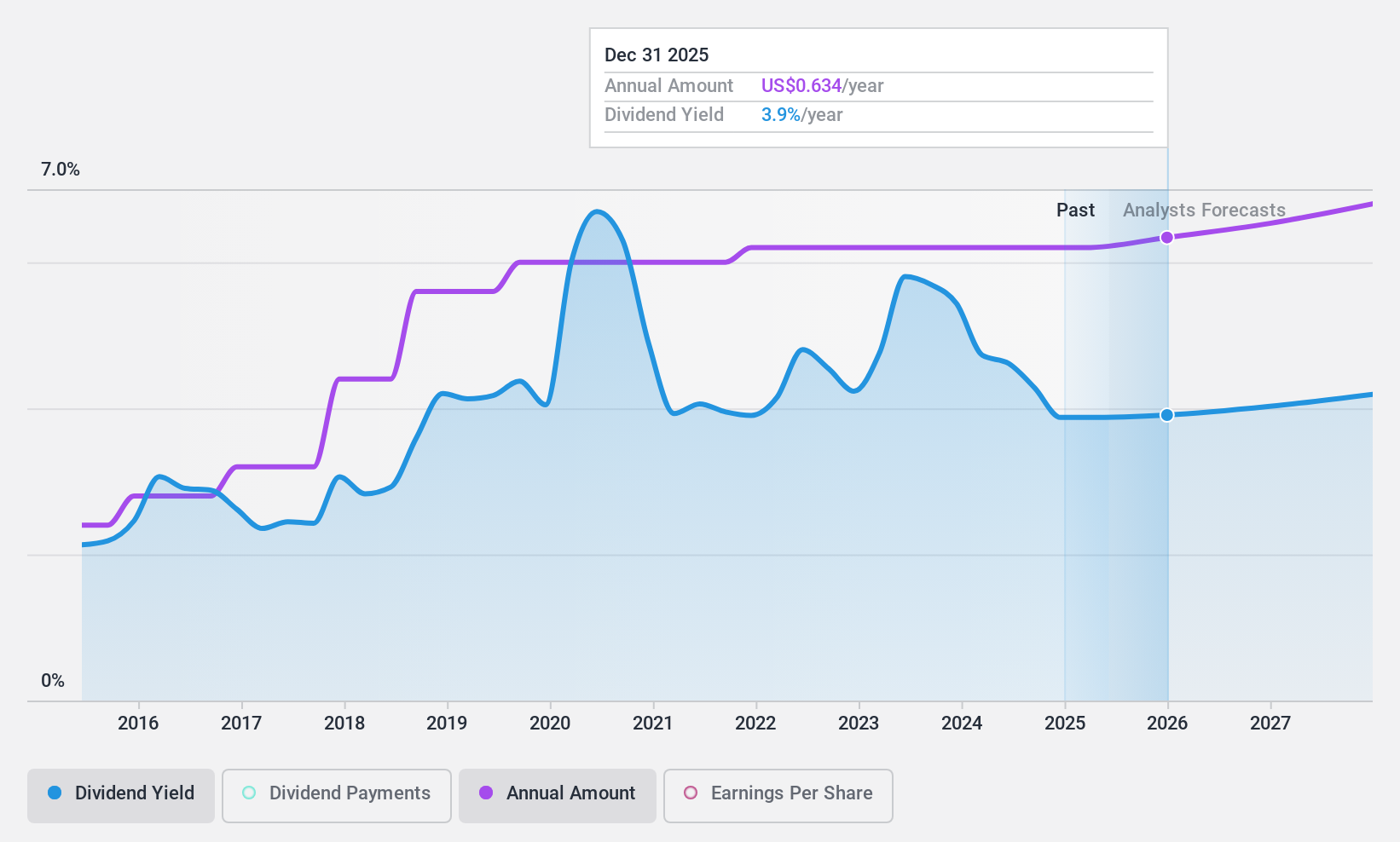

Huntington Bancshares (NasdaqGS:HBAN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Huntington Bancshares Incorporated is a bank holding company for The Huntington National Bank, offering commercial, consumer, and mortgage banking services in the United States with a market cap of approximately $23.87 billion.

Operations: Huntington Bancshares generates revenue primarily through its Consumer & Regional Banking segment, which accounts for $4.98 billion, followed by the Commercial Banking segment at $2.60 billion.

Dividend Yield: 3.8%

Huntington Bancshares maintains a stable dividend history with consistent growth over the past decade. Its current dividend yield of 3.77% is reliable, though not among the highest in the U.S. market. The company's payout ratio of 59.2% suggests dividends are well-covered by earnings, with future coverage expected to improve to 48.4%. Recent financial activities include preferred stock dividends and fixed-income offerings totaling US$1.75 billion, indicating ongoing capital management strategies.

- Unlock comprehensive insights into our analysis of Huntington Bancshares stock in this dividend report.

- Our valuation report unveils the possibility Huntington Bancshares' shares may be trading at a discount.

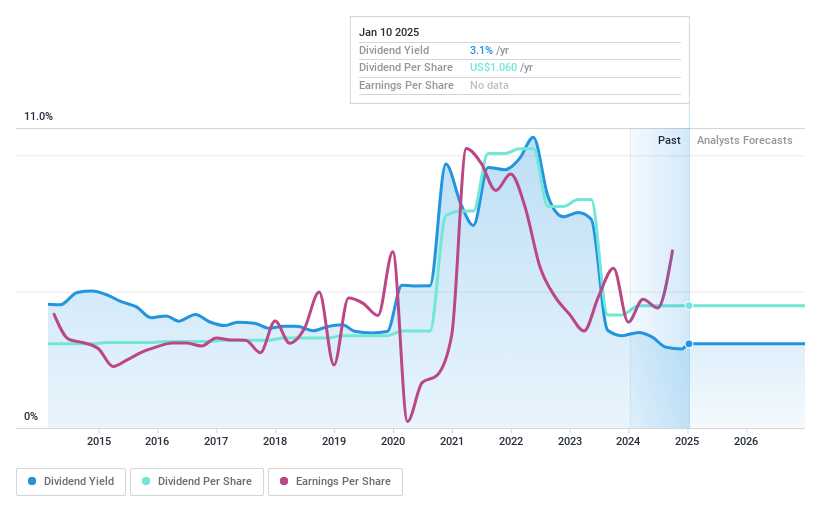

Old Republic International (NYSE:ORI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Old Republic International Corporation operates in the insurance underwriting and related services sector, primarily in the United States and Canada, with a market cap of approximately $8.65 billion.

Operations: Old Republic International Corporation generates revenue through its Title Insurance segment, contributing $2.63 billion, and its General Insurance segment, which accounts for $5.23 billion.

Dividend Yield: 3.1%

Old Republic International recently declared a special cash dividend of US$2.00 per share, enhancing its appeal to income-focused investors. Despite a historically volatile dividend record, the company has increased its total annual dividend by 8.2% to US$1.06 per share in 2024, with dividends well-covered by earnings and cash flows given payout ratios of 29.4% and 23.1%, respectively. The formation of Old Republic Cyber Inc., aimed at diversifying revenue streams, underscores strategic growth efforts amidst competitive market valuations.

- Get an in-depth perspective on Old Republic International's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Old Republic International shares in the market.

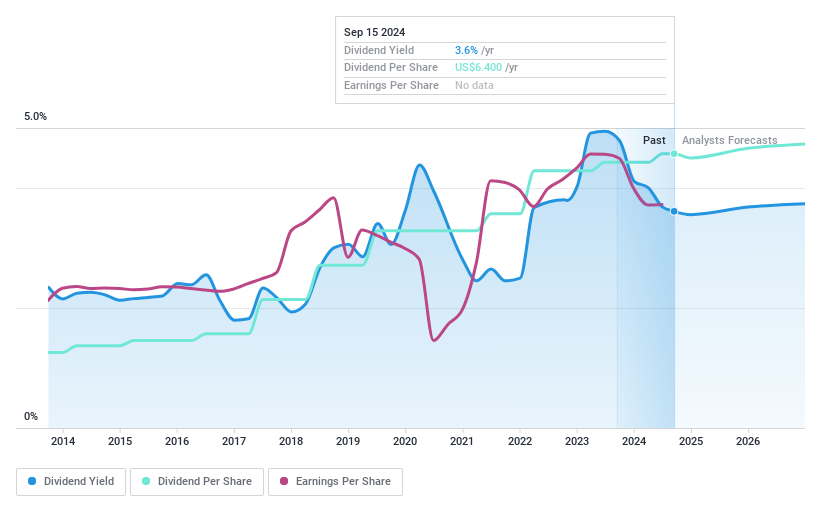

PNC Financial Services Group (NYSE:PNC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The PNC Financial Services Group, Inc. is a diversified financial services company operating in the United States with a market capitalization of approximately $77.25 billion.

Operations: PNC Financial Services Group generates revenue through its Asset Management Group ($1.57 billion), Corporate & Institutional Banking ($9.58 billion), and Retail Banking including Residential Mortgage ($13.99 billion) segments.

Dividend Yield: 3.3%

PNC Financial Services Group has consistently delivered reliable dividends over the past decade, with a current payout ratio of 52.9% and future coverage expected to improve to 38.8%. Despite trading below its estimated fair value, its dividend yield of 3.29% is modest compared to top US payers. Recent announcements include a quarterly common stock dividend of $1.60 per share and preferred stock dividends across various series, reflecting stable income generation for investors amidst ongoing financial activities like shelf registrations and fixed-income offerings.

- Click here to discover the nuances of PNC Financial Services Group with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that PNC Financial Services Group is priced lower than what may be justified by its financials.

Taking Advantage

- Investigate our full lineup of 156 Top US Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntington Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HBAN

Huntington Bancshares

Operates as the bank holding company for The Huntington National Bank that provides commercial, consumer, and mortgage banking services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives