- United States

- /

- Insurance

- /

- NYSE:ORI

Old Republic International (ORI): Assessing Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Old Republic International (ORI) continues to draw interest after its recent strong run, with the stock gaining 19% in the past 3 months. Investors are now weighing whether this insurance giant's momentum can hold steady.

See our latest analysis for Old Republic International.

ORI’s share price momentum has gathered pace this year, with its recent 7% lift over the past month fueling optimism. The stock’s performance is more than just a short-term surge. After several steady quarters and positive insurance sector sentiment, Old Republic boasts a one-year total shareholder return of 32% and an impressive 313% over the past five years, hinting at both durability and renewed interest.

If you’re thinking about what else is moving lately, this could be the perfect moment to broaden your investing radar and discover fast growing stocks with high insider ownership

With so much momentum behind Old Republic International, investors face a crucial question: is the stock still undervalued based on its fundamentals, or is the market already pricing in all its future growth potential?

Most Popular Narrative: 8.1% Undervalued

Compared to its last close price of $43.19, the narrative-driven fair value estimate of $47 points to more upside for Old Republic International. Analysts’ consensus underscores the company's forward momentum, setting the scene for key assumptions that fuel this valuation case.

Active capital management, including prudent reserving, special dividends, and opportunistic share repurchases, along with ongoing investments in new specialty underwriting subsidiaries, positions the company to enhance earnings per share and drive long-term growth in book value.

Want to know how analysts justify this premium? Key financial projections, shifting capital strategies, and ambitious specialty insurance expansion form the hidden engine of this valuation. Intrigued by what metrics are powering the story? Dive into the narrative to see the bold assumptions behind the headline target price.

Result: Fair Value of $47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in real estate markets and rising expense ratios could quickly challenge the bullish outlook if these trends continue without interruption.

Find out about the key risks to this Old Republic International narrative.

Another View: Market Ratios Send Mixed Signals

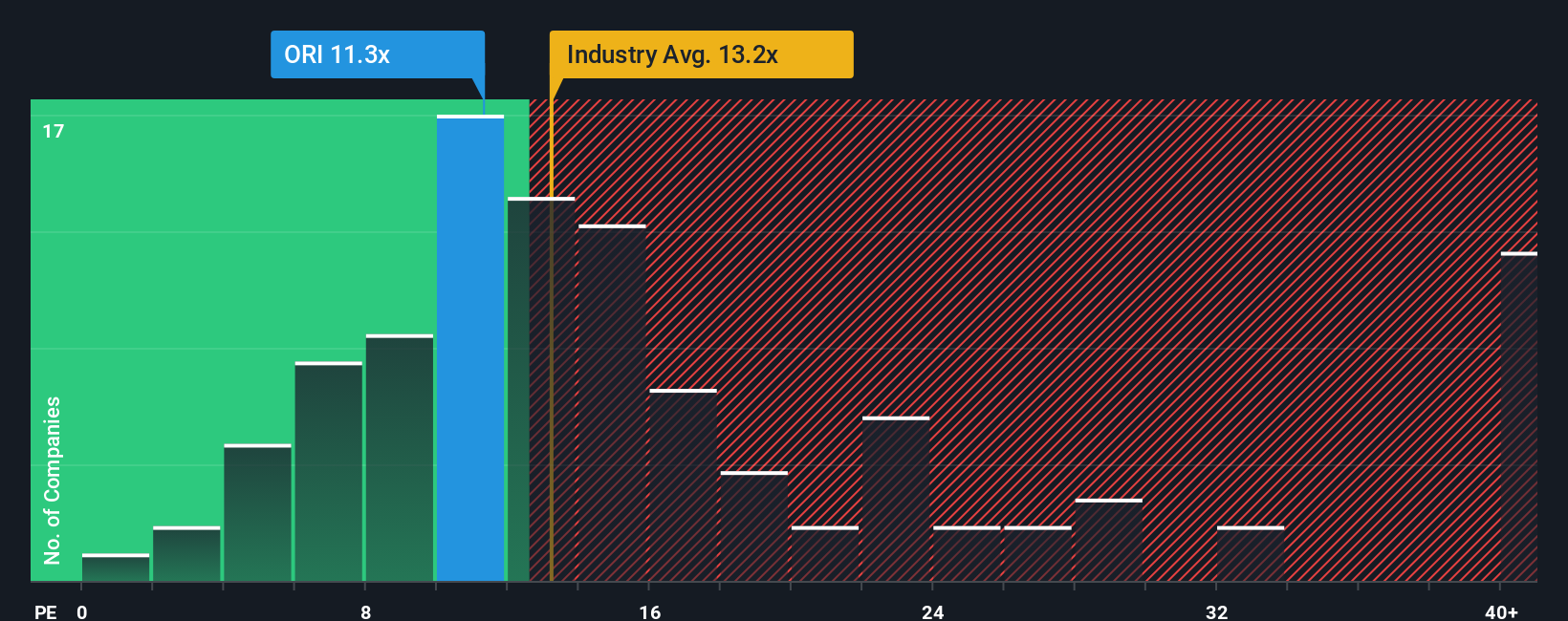

While fair value estimates suggest Old Republic International is undervalued, looking at its price-to-earnings ratio paints a more complicated picture. The company trades at 11.8 times earnings, which is higher than its fair ratio of 11.2 times, but lower than both industry and peer averages. Does this gap offer protection or expose investors to valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Old Republic International Narrative

If you see the story differently or want to dig into the numbers on your own terms, you can build a custom valuation and narrative for Old Republic International in just a couple of minutes. Do it your way

A great starting point for your Old Republic International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors look beyond a single opportunity. Broaden your perspectives and spot your next winning stock with these hand-picked possibilities from Simply Wall Street’s powerful screeners.

- Unlock the potential of robust long-term returns by examining these 19 dividend stocks with yields > 3%, packed with businesses offering solid yields above 3%.

- Catch the surge in cutting-edge innovation with these 25 AI penny stocks, uncovering companies at the forefront of artificial intelligence breakthroughs.

- Capitalize on value by targeting these 897 undervalued stocks based on cash flows, where market prices may not fully reflect underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORI

Old Republic International

Through its subsidiaries, provides insurance underwriting and related services primarily in the United States and Canada.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives