- United States

- /

- Insurance

- /

- NYSE:MCY

Mercury General (MCY): Examining Valuation After a 21.9% Year-to-Date Share Price Gain

Reviewed by Kshitija Bhandaru

See our latest analysis for Mercury General.

Mercury General's share price has seen a strong run in 2024, logging a 21.9% gain so far this year and a recent 3% uptick over the past month, though it did take a breather this week. That momentum reflects optimism after a tough cycle for the insurance sector, and the company’s impressive 25.6% total shareholder return over the past year, as well as even more striking three- and five-year figures, shows that those who stuck with MCY have been well rewarded.

If you’re interested in seeing where momentum is building elsewhere, broaden your search and uncover new possibilities with our fast growing stocks with high insider ownership

But with shares now just under 25% below average analyst price targets, the key question for investors is whether Mercury General remains undervalued or if the company’s solid returns mean future growth is already factored in.

Most Popular Narrative: 19.9% Undervalued

Mercury General’s most closely followed valuation narrative sets its fair value at $100, notably above the last close price of $80.14. This is fueling interest, especially as the market tries to determine if these targets are achievable given the company’s recent run of returns.

The company's core underlying business, excluding catastrophe losses, is strong with favorable underlying combined ratios in their personal auto and homeowners business. This suggests potential for improvement in future earnings stability and net margins.

Want to know what’s driving this bullish target? The narrative banks on robust operational strength and a key assumption about a steadier profit engine. Find out which bullish projections could shake up expectations. There is a fascinating story behind these numbers.

Result: Fair Value of $100 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential setbacks from costly wildfire losses or rising reinsurance expenses could reduce optimism regarding Mercury General’s future earnings stability.

Find out about the key risks to this Mercury General narrative.

Another View: Based on Price-to-Earnings

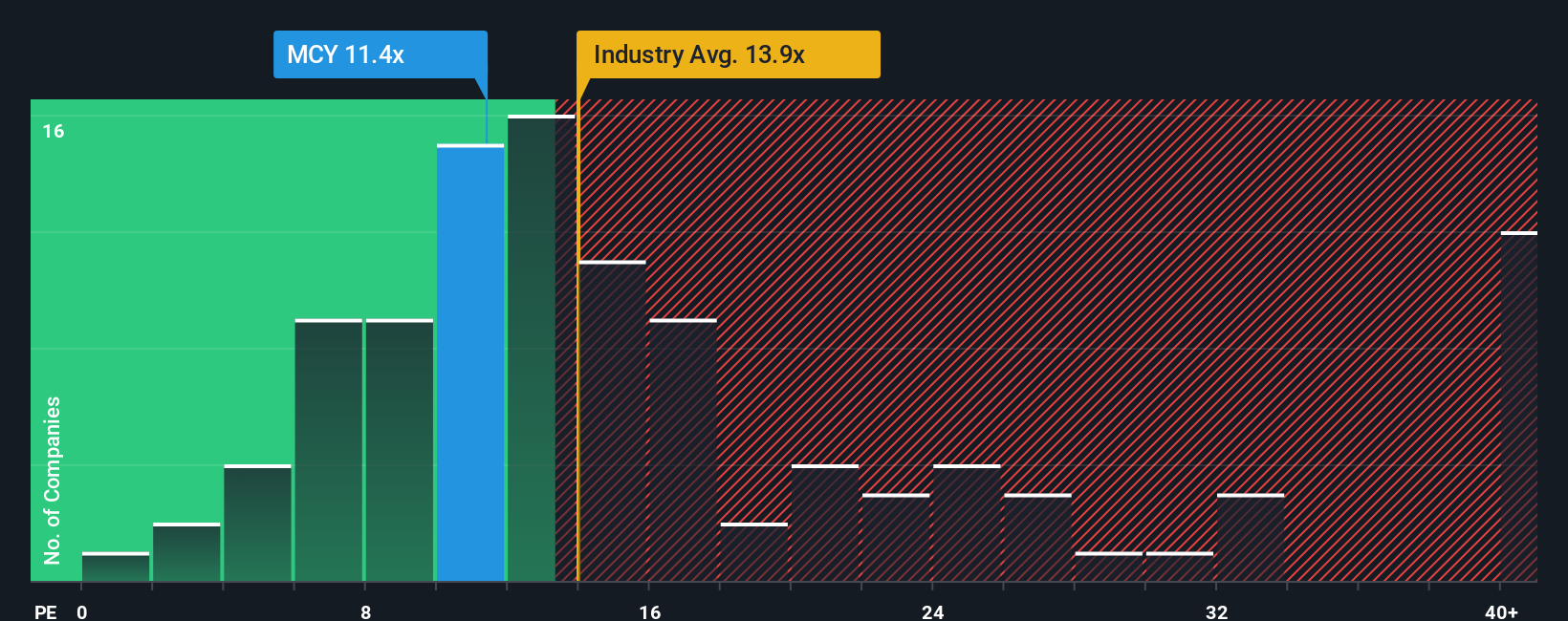

Looking from a price-to-earnings angle, Mercury General trades at 11.4x, which is much lower than peers at 15.8x, the US Insurance industry at 13.9x, and the fair ratio of 13.1x. This gap suggests the market sees extra risks or lacks confidence in the current outlook. Could sentiment shift or is caution justified?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mercury General for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mercury General Narrative

If you have a different perspective or want to dive deeper into the numbers, you can shape your own Mercury General narrative in just a few minutes. Do it your way

A great starting point for your Mercury General research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep ahead of the curve. Make sure you don’t miss out on tomorrow’s winners using the Simply Wall Street Screener, where opportunities are just a click away.

- Jump on fast cash flow opportunities and target tomorrow’s market movers with these 898 undervalued stocks based on cash flows.

- Tap into passive income potential by checking out these 19 dividend stocks with yields > 3%, which boasts yields higher than 3%.

- Ride the digital finance wave and access a world of disruption through these 79 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCY

Mercury General

Engages in writing personal automobile insurance in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives