- United States

- /

- Insurance

- /

- NYSE:MCY

Mercury General (MCY): Evaluating Valuation After Recent 13% Share Price Rally

Reviewed by Kshitija Bhandaru

See our latest analysis for Mercury General.

Mercury General’s recent momentum is more than just a short-term upswing. The stock’s 1-month share price return stands at an impressive 12.9%, contributing to a 1-year total shareholder return of 36.1%. After a period of modest performance, this surge signals a shift in sentiment as investors reassess growth potential and risk outlook for the insurer in the wake of sector-wide moves and a stabilizing rate environment.

If this renewed interest in Mercury General has you curious about where else momentum may be building, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading below analyst targets but following a major rally, the crucial question is whether Mercury General is still undervalued or if the current price fully reflects its growth prospects. Is there a buying opportunity, or has the market already priced in future gains?

Most Popular Narrative: 13.1% Undervalued

With Mercury General’s latest close at $86.93 and the narrative’s fair value rising to $100, expectations are running higher than current market pricing. The stage is set for a possible catch-up if these valuation drivers play out.

The company's core underlying business, excluding catastrophe losses, is strong with favorable underlying combined ratios in their personal auto and homeowners business. This suggests potential for improvement in future earnings stability and net margins.

Want to know what’s fueling this bullish view? The narrative is based on projections that target consistent margin strength and accelerated capital recovery. What is the linchpin number that secures this value? Is it future profits, powerful revenue momentum, or a surging earnings multiple? Unlock the narrative’s full recipe and see which assumption might flip the whole story.

Result: Fair Value of $100 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant wildfire-related losses and rising reinsurance costs could quickly undermine this optimistic outlook for Mercury General’s future earnings stability.

Find out about the key risks to this Mercury General narrative.

Another View: DCF Model Weighs In

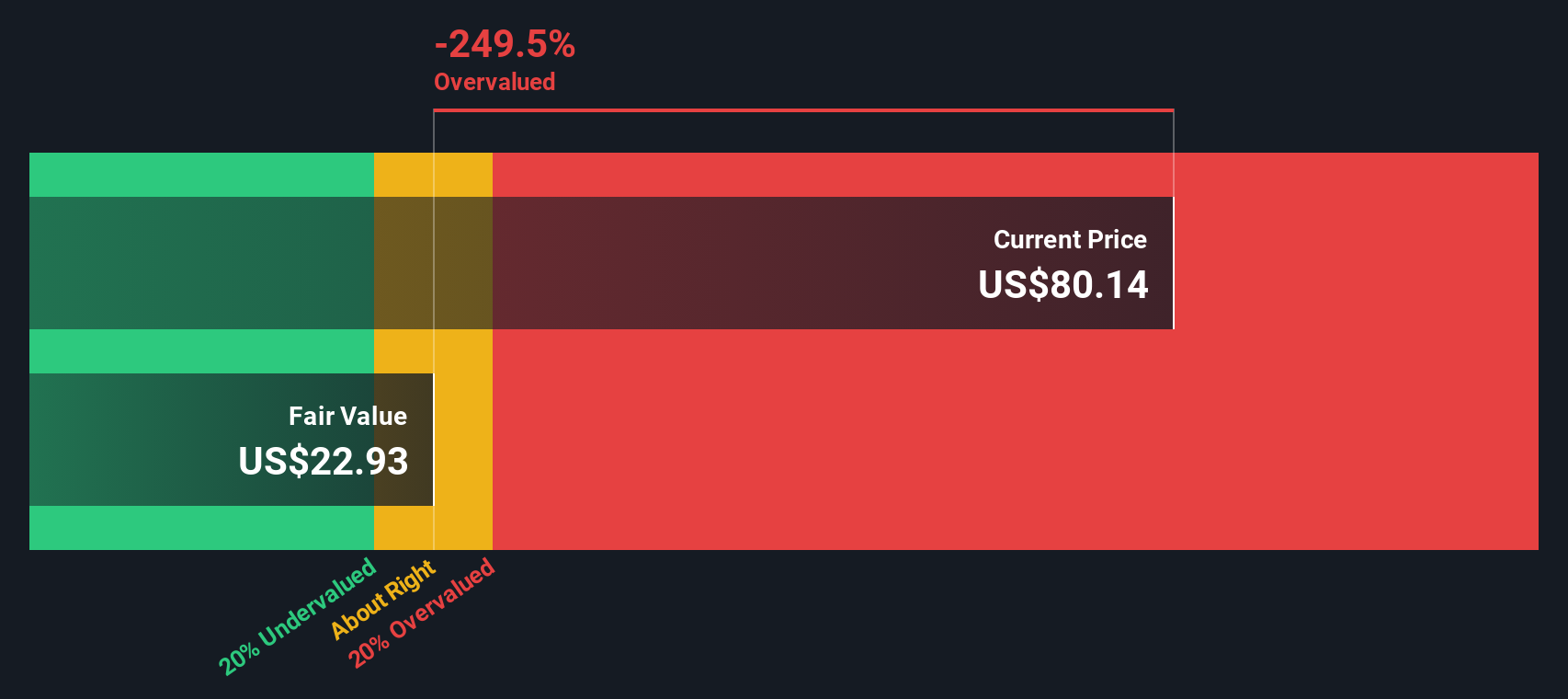

While many see Mercury General as undervalued based on future earnings and price targets, the Simply Wall St DCF model presents a much more cautious picture. According to this approach, the current price is well above the DCF model’s estimate of fair value. Does this gap suggest the market is too optimistic, or does it highlight the limits of DCF for insurers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mercury General for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mercury General Narrative

Keep in mind, if these perspectives don’t fully capture your views or you’d rather investigate independently, crafting a personalized take only takes a few minutes. Do it your way

A great starting point for your Mercury General research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investing is about spotting new trends before they take off. Don't let standout growth stories pass you by. Take action and tap into these handpicked opportunities right now:

- Uncover the market’s next big disruptors with these 24 AI penny stocks and position your portfolio at the forefront of artificial intelligence innovation.

- Boost your income potential by checking out these 19 dividend stocks with yields > 3%, featuring companies with yields above 3% and a strong track record of rewarding shareholders.

- Catch those flying under the radar and find tomorrow’s leaders among these 900 undervalued stocks based on cash flows, where cash flow metrics signal compelling upside others might be missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCY

Mercury General

Engages in writing personal automobile insurance in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)