- United States

- /

- Insurance

- /

- NYSE:MCY

Mercury General (MCY): Evaluating Valuation After Nevada Insurance Expansion and Improved Investor Sentiment

Reviewed by Kshitija Bhandaru

Mercury General (MCY) has recently rolled out its enhanced personal umbrella insurance policy in Nevada, responding to a marked rise in liability claim amounts since the pandemic. This move has put a spotlight on the company’s ability to adapt to changing industry conditions.

See our latest analysis for Mercury General.

Mercury General’s proactive launch of its expanded umbrella insurance in Nevada comes amid strong technical momentum. The stock has reached a fresh all-time high and is drawing positive investor sentiment. Over the past year, the company’s total shareholder return has climbed 0.35%, while projected revenue and improving earnings suggest underlying optimism for its long-term prospects.

If you’re interested in other standout performers, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares trading at all-time highs and optimism running high, is Mercury General undervalued and primed for further upside? Or has the market already factored in its future growth story?

Most Popular Narrative: 15.9% Undervalued

With Mercury General's fair value estimated at $100, a solid premium over its last close of $84.08, the narrative sets expectations for significant upside if advanced earnings and margin trends hold steady.

The company's core underlying business, excluding catastrophe losses, is strong with favorable underlying combined ratios in their personal auto and homeowners business. This suggests potential for improvement in future earnings stability and net margins.

Ever wondered what financial engine could justify such a bold valuation jump? Hint: Think improving fundamentals, locked-in profit margins, and ambitious long-term growth targets. There is a pivotal number in this forecast that may surprise even seasoned investors. Want to uncover which metric moves the dial? Dive into the narrative and see the deeper story behind the fair value.

Result: Fair Value of $100 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, large wildfire losses and potentially rising reinsurance costs remain material risks that could undermine Mercury General’s future earnings outlook.

Find out about the key risks to this Mercury General narrative.

Another View: What Do Market Ratios Say?

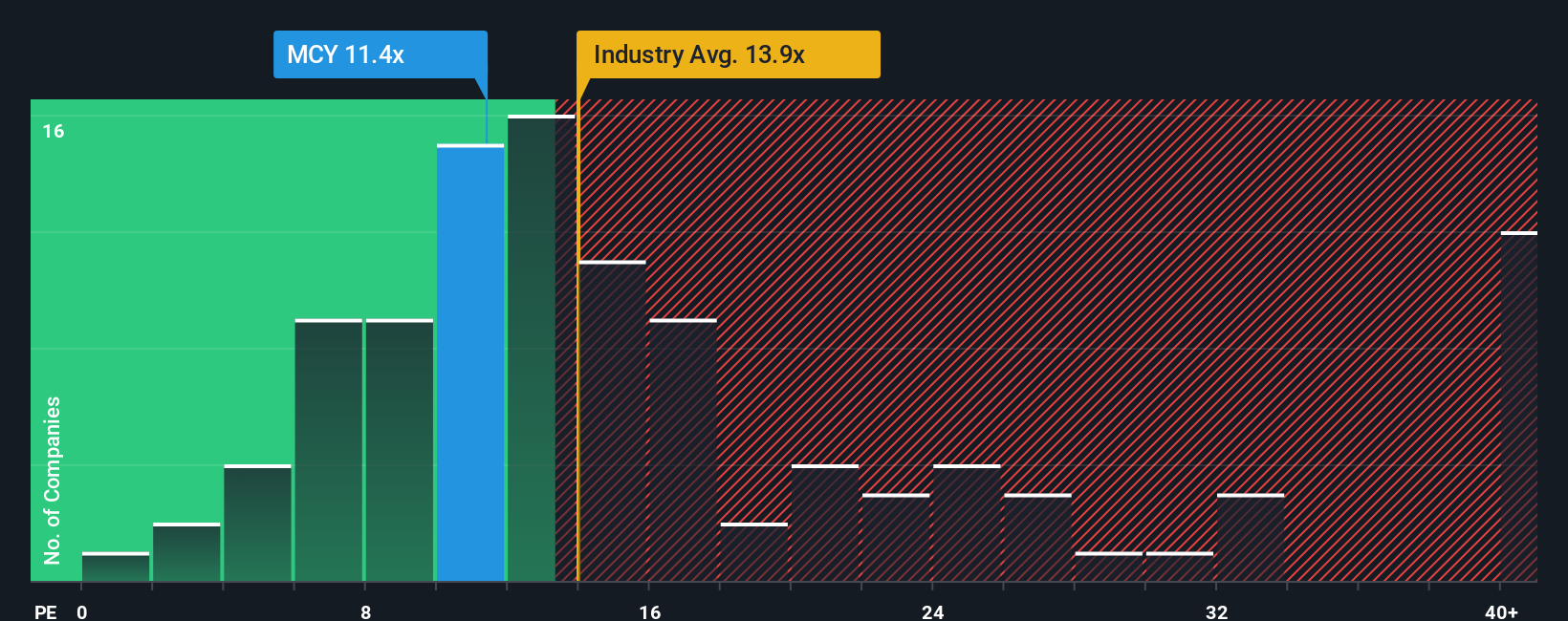

Looking through the lens of valuation ratios, Mercury General trades at a price-to-earnings ratio of 11.9x, which is noticeably below both its industry average (13.7x) and its peer group (15.2x). In addition, the current ratio is beneath the calculated fair ratio of 13.1x, hinting at an appealing discount and potential upside for investors. Of course, being below these benchmarks can also signal the market is skeptical of the company’s outlook. Are investors seeing risks others are missing, or is this a window of opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mercury General for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mercury General Narrative

If you think the story could go another way or want to chart your own analysis, you can build a completely custom narrative in just a few minutes, right from scratch. Do it your way

A great starting point for your Mercury General research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors constantly widen their horizons. Don’t let an opportunity pass you by. Now is the time to check out hand-picked stock ideas outside the insurance sector!

- Boost your potential returns by targeting underpriced opportunities through these 910 undervalued stocks based on cash flows, packed with companies trading below their intrinsic cash flow value.

- Tap into the unstoppable momentum of artificial intelligence by checking out these 24 AI penny stocks, shaping tomorrow’s economy across multiple industries.

- Strengthen your portfolio’s income stream and stability with these 19 dividend stocks with yields > 3%, featuring companies delivering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCY

Mercury General

Engages in writing personal automobile insurance in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives