- United States

- /

- Insurance

- /

- NYSE:MCY

Cautious Investors Not Rewarding Mercury General Corporation's (NYSE:MCY) Performance Completely

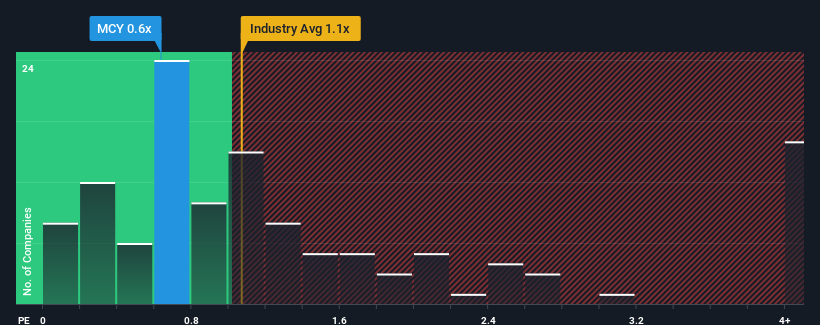

There wouldn't be many who think Mercury General Corporation's (NYSE:MCY) price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S for the Insurance industry in the United States is similar at about 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Mercury General

What Does Mercury General's Recent Performance Look Like?

Mercury General's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on Mercury General will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Mercury General?

In order to justify its P/S ratio, Mercury General would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. As a result, it also grew revenue by 18% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 15% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 6.1%, which is noticeably less attractive.

With this information, we find it interesting that Mercury General is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Mercury General currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Mercury General you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MCY

Mercury General

Engages in writing personal automobile insurance in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives