- United States

- /

- Insurance

- /

- NYSE:LMND

Assessing Lemonade (LMND) Valuation as Shares Surge Without Clear News

Reviewed by Kshitija Bhandaru

Lemonade (LMND) just grabbed investor attention again, and the move is getting people to ask whether something bigger is on the horizon for this US-based insurer. This week’s market action did not have a smoking-gun event behind it, but the sudden shift is still turning heads in a sector not usually known for big swings. When a stock starts to climb without clear external news, it raises a few eyebrows and some questions. Is the market sensing a change in the story, or is this just another short-term blip?

Performance-wise, Lemonade has become hard to ignore. After a sharp drop earlier in the week, it rebounded to deliver a 5% gain over the month and a remarkable 33% surge over the past three months. On the longer horizon, the stock has more than doubled in the past year. That kind of run, especially when not tied to major headlines, suggests investors may be warming to its growth narrative, or that risk perceptions are changing. At the same time, the company’s annual revenue growth, which approached 29%, hints at growing customer adoption even as net income remains in the red.

With that kind of upward motion already in the price, is Lemonade now offering a real buying opportunity, or has the market already baked in hopes of future success?

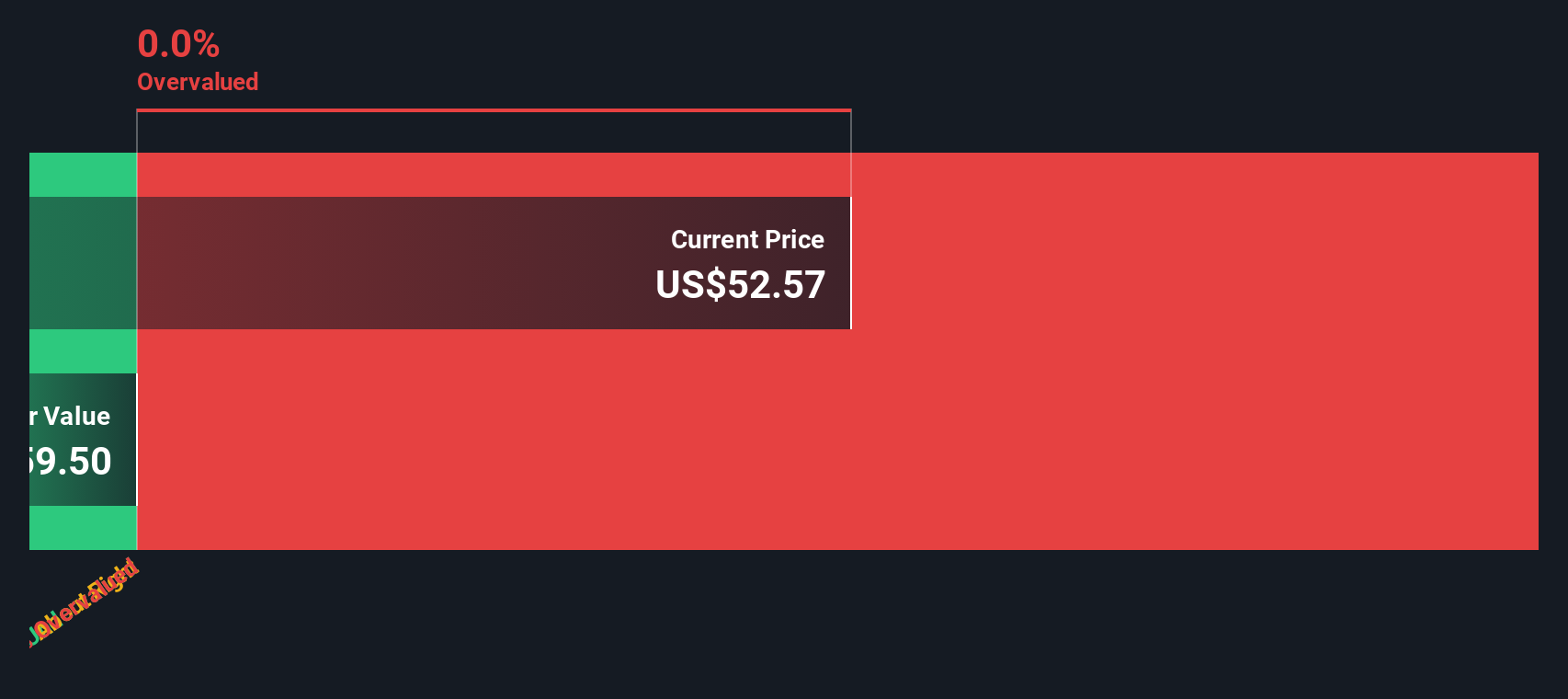

Most Popular Narrative: 32.3% Overvalued

According to the most widely followed narrative, Lemonade’s current share price stands significantly above what consensus analyst models suggest is a fair value. While analysts recognize the company’s dynamic expansion and technological edge, they see the stock trading at a steep premium compared to its underlying fundamentals.

Lemonade's heavy reliance on aggressive marketing spend and synthetic agent funding to acquire customers can increase operating leverage. However, if customer acquisition costs outpace customer lifetime value, this could pressure operating margins and delay the path to positive EBITDA. The company's lower reliance on quota share reinsurance increases revenue retention in the near term. At the same time, this also exposes Lemonade to higher risk from catastrophic events and volatility in claims costs, which could negatively impact gross profit and net margins if adverse climate or risk trends materialize.

Want to know why analysts see a gap between Lemonade’s momentum and its fair value? The consensus is powered by bold projections around future profits and a premium valuation multiple uncommon for this industry. Which core financial levers do they believe will push earnings up and justify a much lower price target? To discover the crucial expectations driving this hotly debated number, follow the narrative’s full calculus behind the valuation.

Result: Fair Value of $45.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rapid advances in AI-driven underwriting or accelerating growth in Europe could quickly challenge these cautious forecasts and reshape Lemonade’s valuation outlook.

Find out about the key risks to this Lemonade narrative.Another View: Discounted Cash Flow Model Weighs In

Taking a step back from analyst price targets, our SWS DCF model approaches Lemonade’s value by projecting its future cash flows. Interestingly, based on available data, this method does not indicate the stock is trading at a discount today. Does this reinforce the “overvalued” story, or is something being missed beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lemonade Narrative

It is worth noting that if you see things differently or want to dig into the numbers yourself, you can craft your own analysis in under three minutes. Do it your way.

A great starting point for your Lemonade research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investing toolkit and get ahead of the crowd with strategies that spotlight untapped growth. Stay a step ahead by exploring these hand-picked opportunities before everyone else.

- Tap into the surge of companies committed to long-term returns by browsing our picks for dividend stocks with yields > 3% yielding over 3% annually.

- Seize the future of healthcare by focusing on pioneers at the intersection of medicine and artificial intelligence with our healthcare AI stocks list.

- Get in early on tech disruptors by searching through potential high-flyers among penny stocks with strong financials leading the way in innovation and market breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMND

Lemonade

Provides various insurance products in the United States, Europe, and the United Kingdom.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives