- United States

- /

- IT

- /

- NYSE:SQSP

US Growth Stocks With Strong Insider Ownership To Watch

Reviewed by Simply Wall St

As the Dow Jones Industrial Average reaches new heights and indices like the Nasdaq Composite and S&P 500 continue their upward trajectory, investors are increasingly focusing on growth opportunities within the U.S. market. Amidst this backdrop, companies with strong insider ownership often attract attention due to their potential alignment of interests between management and shareholders, making them noteworthy candidates for those seeking growth stocks in today's market environment.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.4% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 26% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 33.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Let's dive into some prime choices out of the screener.

Bowman Consulting Group (NasdaqGM:BWMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bowman Consulting Group Ltd. offers a variety of real estate, energy, infrastructure, and environmental management solutions in the United States with a market capitalization of approximately $394.32 million.

Operations: The company's revenue is primarily derived from providing engineering and related professional services, amounting to $386.81 million.

Insider Ownership: 18.5%

Bowman Consulting Group demonstrates potential as a growth company with substantial insider ownership, supported by strategic contracts such as a $1.2 million deal in Texas and multiple projects with Virginia's Department of Transportation. Despite past shareholder dilution, the company is trading below estimated fair value and expected to achieve profitability within three years, outpacing average market growth. Recent leadership changes and an increased buyback plan further indicate Bowman's commitment to long-term expansion and shareholder value enhancement.

- Get an in-depth perspective on Bowman Consulting Group's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Bowman Consulting Group is trading behind its estimated value.

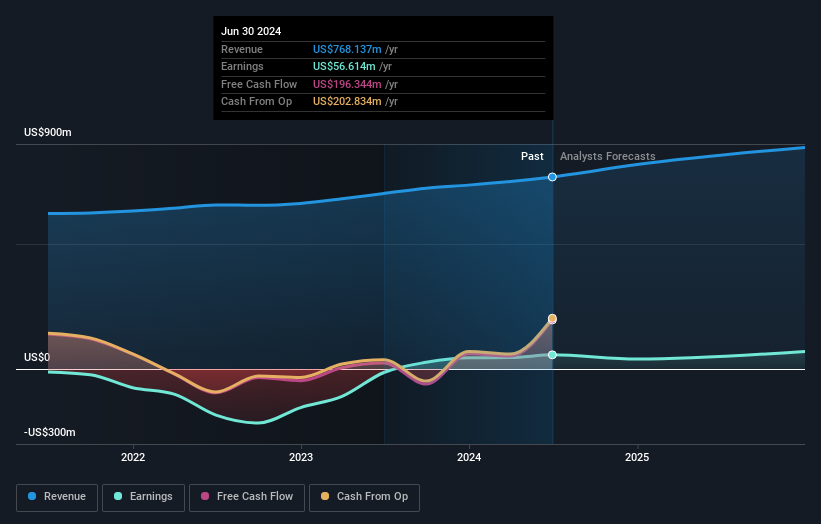

Heritage Insurance Holdings (NYSE:HRTG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Heritage Insurance Holdings, Inc. operates through its subsidiaries to offer personal and commercial residential insurance products, with a market cap of approximately $313.20 million.

Operations: The company generates revenue primarily from its Property & Casualty insurance segment, which amounts to $768.14 million.

Insider Ownership: 25.3%

Heritage Insurance Holdings shows promise with significant insider buying over the past three months, indicating confidence in its growth trajectory. The company reported substantial revenue and net income increases for Q2 2024, with earnings per share doubling compared to the previous year. Expected annual profit growth of 22% surpasses market averages, though share price volatility remains a concern. Trading at a low price-to-earnings ratio of 5.3x suggests good relative value despite recent shareholder dilution.

- Click to explore a detailed breakdown of our findings in Heritage Insurance Holdings' earnings growth report.

- Upon reviewing our latest valuation report, Heritage Insurance Holdings' share price might be too pessimistic.

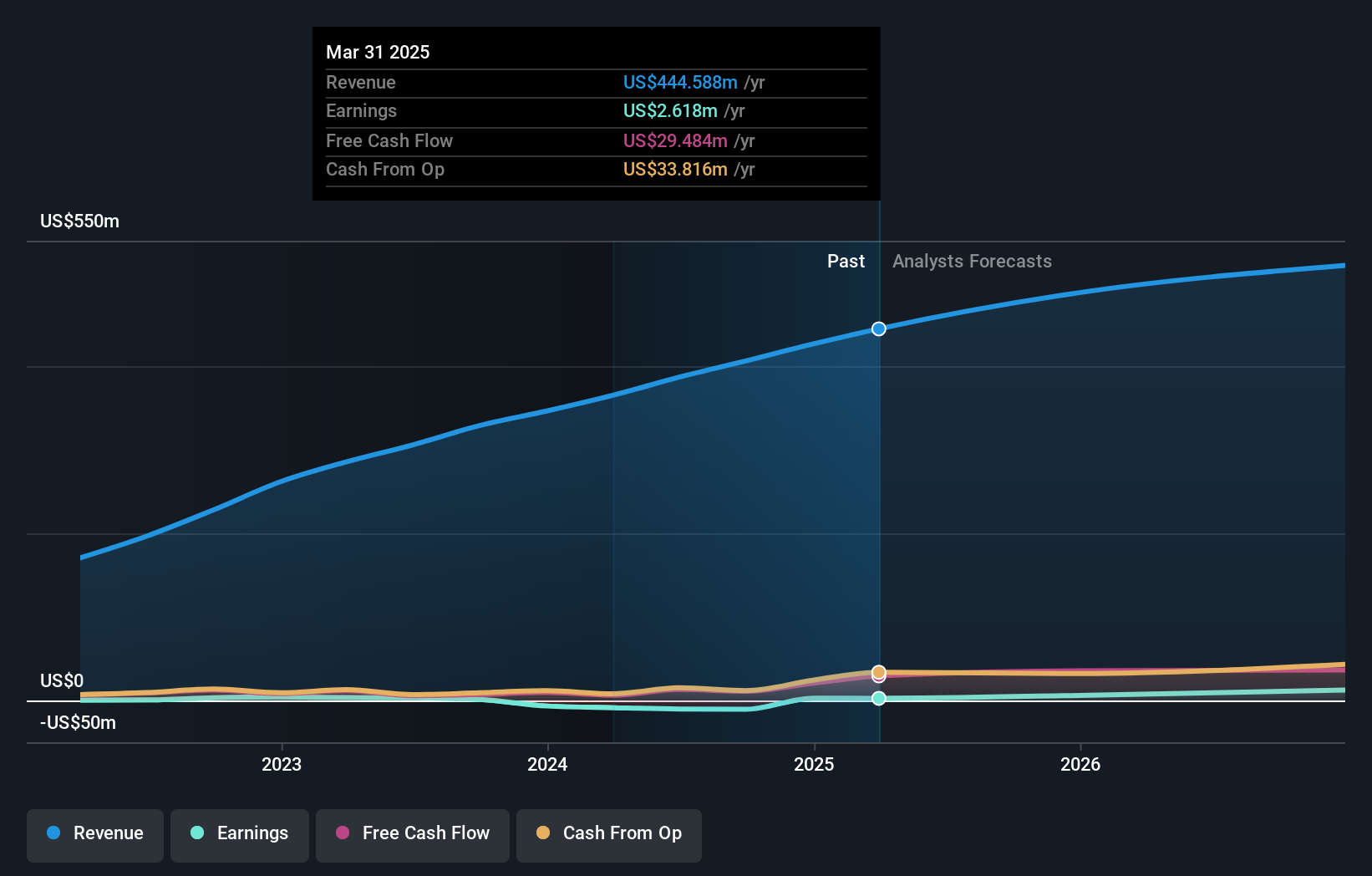

Squarespace (NYSE:SQSP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Squarespace, Inc. provides a platform for businesses and independent creators to establish an online presence and manage their brands globally, with a market cap of approximately $6.47 billion.

Operations: Squarespace generates revenue primarily from its Internet Software & Services segment, amounting to $1.11 billion.

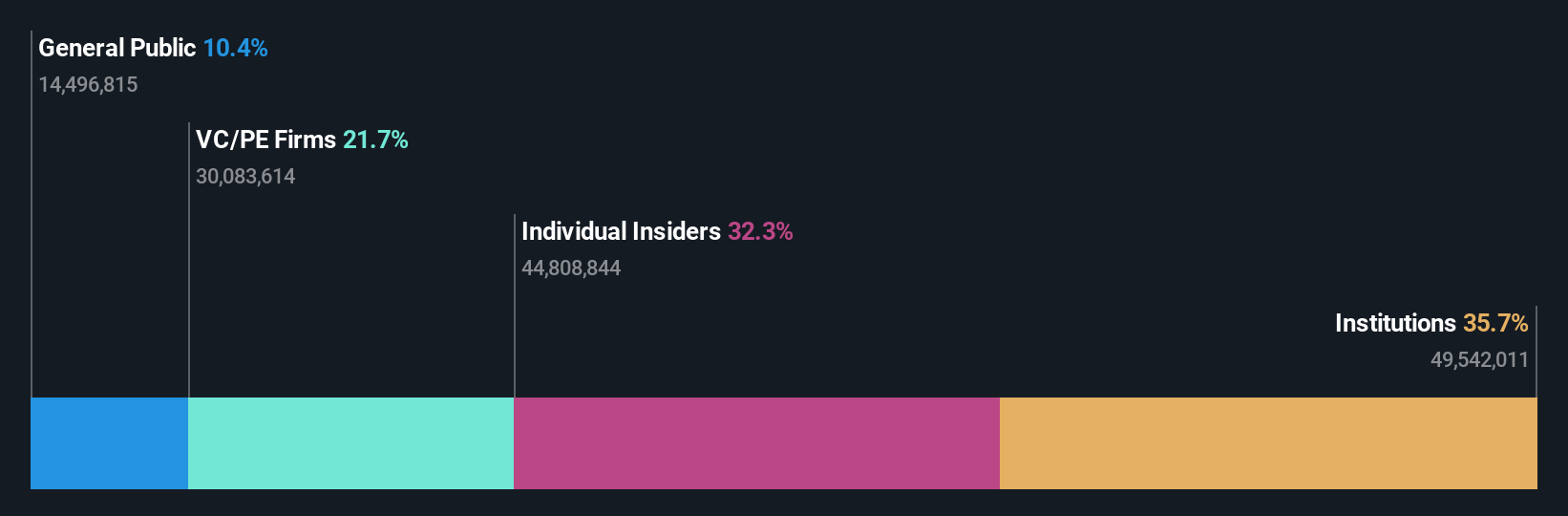

Insider Ownership: 32.3%

Squarespace recently completed a merger with Spaceship Group, making it a privately held entity. Founder Anthony Casalena retains significant insider ownership and leadership roles, underscoring continued confidence in the company's growth prospects. Despite past shareholder dilution and recent activist opposition to the acquisition terms, Squarespace's earnings have shown consistent improvement. The company reported US$296.77 million in Q2 sales, up from last year, with forecasts indicating robust annual profit growth exceeding market averages over the next three years.

- Take a closer look at Squarespace's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Squarespace shares in the market.

Taking Advantage

- Gain an insight into the universe of 186 Fast Growing US Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SQSP

Squarespace

Operates platform for businesses and independent creators to build online presence, grow their brands, and manage their businesses across the internet in the United States and internationally.

Reasonable growth potential low.