- United States

- /

- Electrical

- /

- NasdaqCM:PSIX

Undiscovered Gems To Explore In The United States January 2025

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it has experienced a 24% rise over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying undiscovered gems involves seeking stocks that offer unique growth potential and align with these robust market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Power Solutions International (NasdaqCM:PSIX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Power Solutions International, Inc. designs, engineers, manufactures, markets, and sells engines and power systems globally with a market cap of $733.92 million.

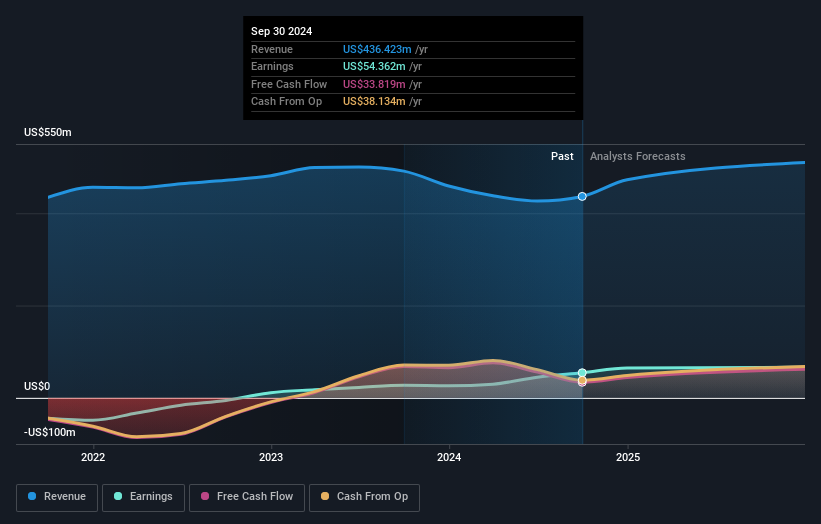

Operations: PSIX generates revenue primarily from its Engineered Integrated Electrical Power Generation Systems, amounting to $436.42 million.

Power Solutions International (PSI) has made notable strides, with its debt to equity ratio decreasing from 452.8% to 320.9% over five years, indicating improved financial management despite a high net debt to equity ratio of 224.8%. The company’s earnings growth of 99.5% over the past year surpasses industry averages, showcasing robust performance and potential value as it trades at a discount of 17.1% below estimated fair value. Recently added to the NASDAQ Composite Index, PSI reported significant earnings improvements for Q3 and nine months ending September 2024, with net income rising from US$7.8 million to US$17.34 million year-on-year for Q3 alone.

- Click to explore a detailed breakdown of our findings in Power Solutions International's health report.

Understand Power Solutions International's track record by examining our Past report.

Five Point Holdings (NYSE:FPH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Five Point Holdings, LLC, operates through its subsidiary to own and develop mixed-use and planned communities in Orange County, Los Angeles County, and San Francisco County, with a market cap of approximately $924.46 million.

Operations: Five Point generates revenue primarily from its Valencia and Great Park segments, with $140.84 million and $708.76 million respectively. The San Francisco segment contributes a smaller amount at $0.68 million.

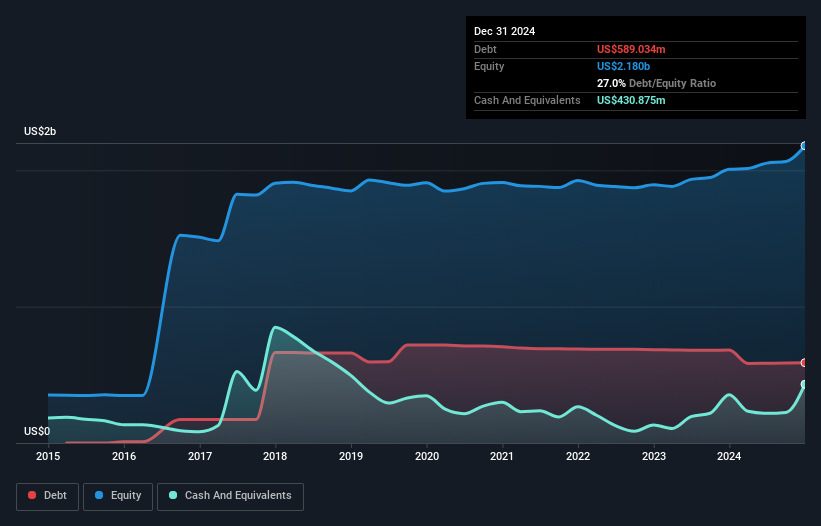

Five Point Holdings, a nimble player in real estate, has shown robust earnings growth of 23.9% over the past year, outpacing its industry peers who saw a -1.4% change. Its price-to-earnings ratio stands attractively at 6.1x, significantly lower than the US market average of 18.9x, suggesting potential value for investors. The company has effectively reduced its debt to equity ratio from 37.6% to 27% over five years and maintains satisfactory net debt levels at just 7.3%. Recent results highlight an increase in net income to $68 million for the year ended December 2024 from $55 million previously, reflecting strong financial health and operational efficiency going forward into 2025 with expected earnings growth around $200 million if local processes align as anticipated.

- Dive into the specifics of Five Point Holdings here with our thorough health report.

Evaluate Five Point Holdings' historical performance by accessing our past performance report.

Heritage Insurance Holdings (NYSE:HRTG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Heritage Insurance Holdings, Inc. operates through its subsidiaries to offer personal and commercial residential insurance products, with a market capitalization of approximately $331.26 million.

Operations: Heritage generates revenue primarily from its property and casualty insurance segment, amounting to $793.69 million.

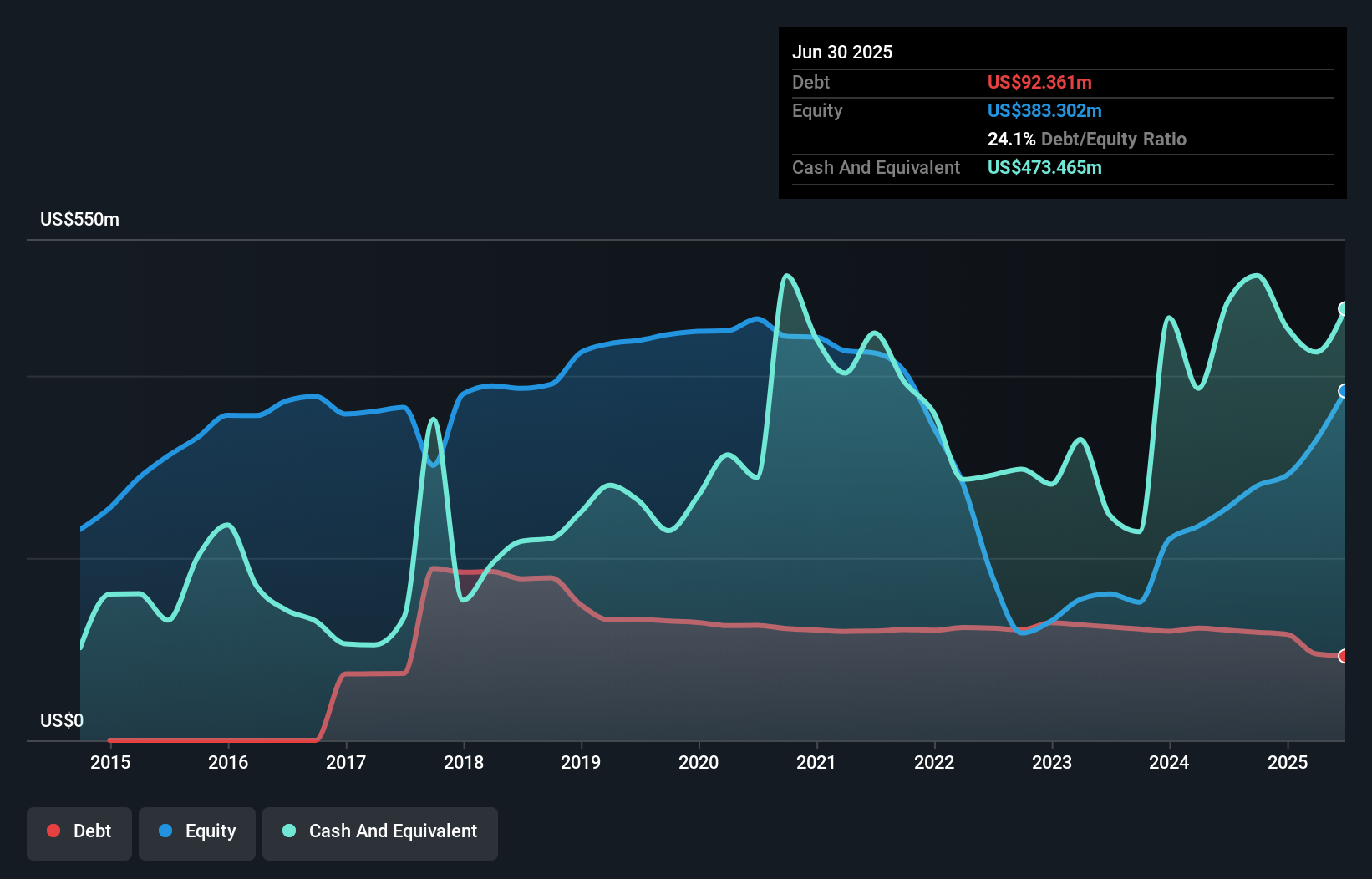

Heritage Insurance Holdings seems to be a promising player in the insurance sector, with earnings growth of 168.7% last year, outpacing the industry average of 35.6%. Trading at a price-to-earnings ratio of 4.6x, it offers good value compared to the US market's 18.9x. The company has more cash than its total debt and is free cash flow positive, indicating financial stability despite its rising debt-to-equity ratio from 29.4% to 42.4% over five years. Heritage's strategic focus on underwriting and Florida reforms could bolster future profits amid challenges like catastrophe losses and claims volatility.

Key Takeaways

- Access the full spectrum of 269 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PSIX

Power Solutions International

Designs, engineers, manufactures, markets, and sells engines and power systems in the United States, North America, the Pacific Rim, Europe, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives