- United States

- /

- Insurance

- /

- NYSE:HCI

Earnings Beat and Record Stock Price Might Change the Case for Investing in HCI Group (HCI)

Reviewed by Simply Wall St

- HCI Group recently achieved an all-time high in its stock price following second quarter earnings that surpassed forecasts, supported by 16 years of consecutive dividend payments.

- This performance reflects not only efficient operations but also investor confidence in the company’s ability to maintain consistent capital generation and dividend stability.

- With quarterly earnings exceeding expectations, we'll explore how HCI Group’s solid financial results influence its investment narrative and outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

HCI Group Investment Narrative Recap

To be a shareholder in HCI Group, you need to believe the company can continue delivering solid capital generation, disciplined underwriting, and stable dividend payments despite a rapidly shifting insurance market in Florida. The Q2 earnings beat and all-time stock high reinforce HCI’s momentum, but they do not eliminate the most immediate risk: the company’s ongoing dependence on Citizens Insurance depopulation for policy growth, which is facing structural limits as the pool of attractive policies shrinks. Among recent company news, HCI’s decision to reorganize into two separate operating units, insurance and technology (Exzeo Group Inc.), stands out as particularly connected to this narrative. This change highlights HCI’s focus on extracting value from its technology platform, which has been key to its underwriting edge, a critical factor as competition for profitable new policies heats up. But on the other hand, investors should be aware that HCI remains highly concentrated in Florida and vulnerable to localized disaster risk if catastrophe events turn…

Read the full narrative on HCI Group (it's free!)

HCI Group's narrative projects $1.1 billion revenue and $342.7 million earnings by 2028. This requires 13.5% yearly revenue growth and a $205.1 million increase in earnings from $137.6 million today.

Uncover how HCI Group's forecasts yield a $202.50 fair value, a 9% upside to its current price.

Exploring Other Perspectives

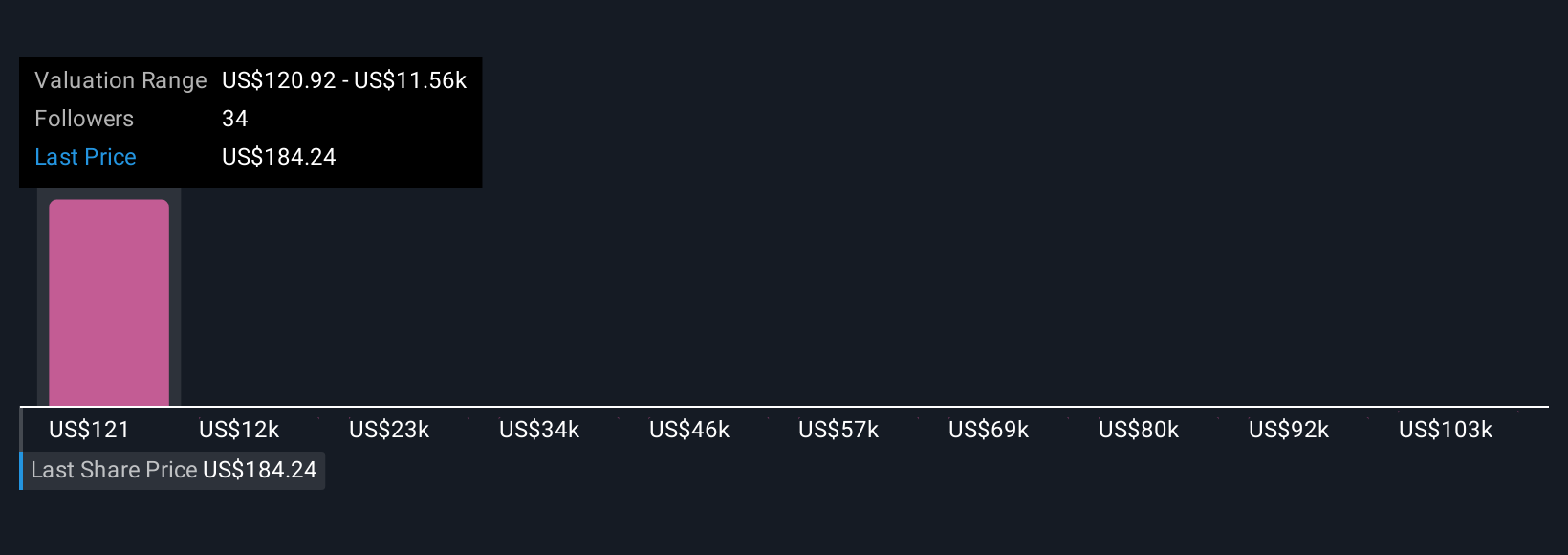

Seven individual fair value estimates from the Simply Wall St Community range widely from US$120.92 to US$114,561.05 per share. Investors are weighing these extremes against HCI’s ability to maintain profitable policy growth as the Citizens Insurance depopulation opportunity diminishes.

Explore 7 other fair value estimates on HCI Group - why the stock might be a potential multi-bagger!

Build Your Own HCI Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HCI Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free HCI Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HCI Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HCI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCI

HCI Group

Engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026