- United States

- /

- Insurance

- /

- NYSE:FAF

Revisiting First American Financial’s Valuation After Its Recent Share Price Rebound

Reviewed by Simply Wall St

First American Financial (FAF) has quietly outperformed the broader insurance space over the past month, and that move is getting investors to revisit what they are really paying for this real estate focused franchise.

See our latest analysis for First American Financial.

The stock is now trading around $64.77. That modest 30 day share price return of 4.23 percent comes after a choppier stretch where the year to date share price return is still positive at 4.65 percent, but the 1 year total shareholder return is slightly negative. Even so, long term holders are sitting on solid total shareholder returns of 37.9 percent over three years and 52.1 percent over five years, suggesting momentum is rebuilding as the market reassesses both growth prospects and real estate related risks.

If FAF has you rethinking where the next steady compounder might come from, this could be a good moment to explore fast growing stocks with high insider ownership.

With earnings still growing, a near 19 percent discount to analyst targets and a long real estate cycle ahead, investors now face a key question: is FAF attractively valued at today’s levels, or is the market already pricing in that future growth?

Most Popular Narrative: 17.5% Undervalued

With First American Financial closing at $64.77 against a narrative fair value of $78.50, the story hinges on whether accelerating earnings can sustain that valuation gap.

The anticipated normalization and eventual rebound in U.S. home purchase volumes driven by demographic tailwinds as Millennials and Gen Z enter prime homebuying years positions First American to benefit from increased transaction activity, underpinning future revenue growth and operating leverage.

Want to see how rising volumes, expanding margins, and a lower future earnings multiple can still justify a higher value? The narrative’s math may surprise you.

Result: Fair Value of $78.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubbornly weak housing demand and the normalization of currently strong commercial activity could quickly narrow margins and challenge the optimistic earnings trajectory.

Find out about the key risks to this First American Financial narrative.

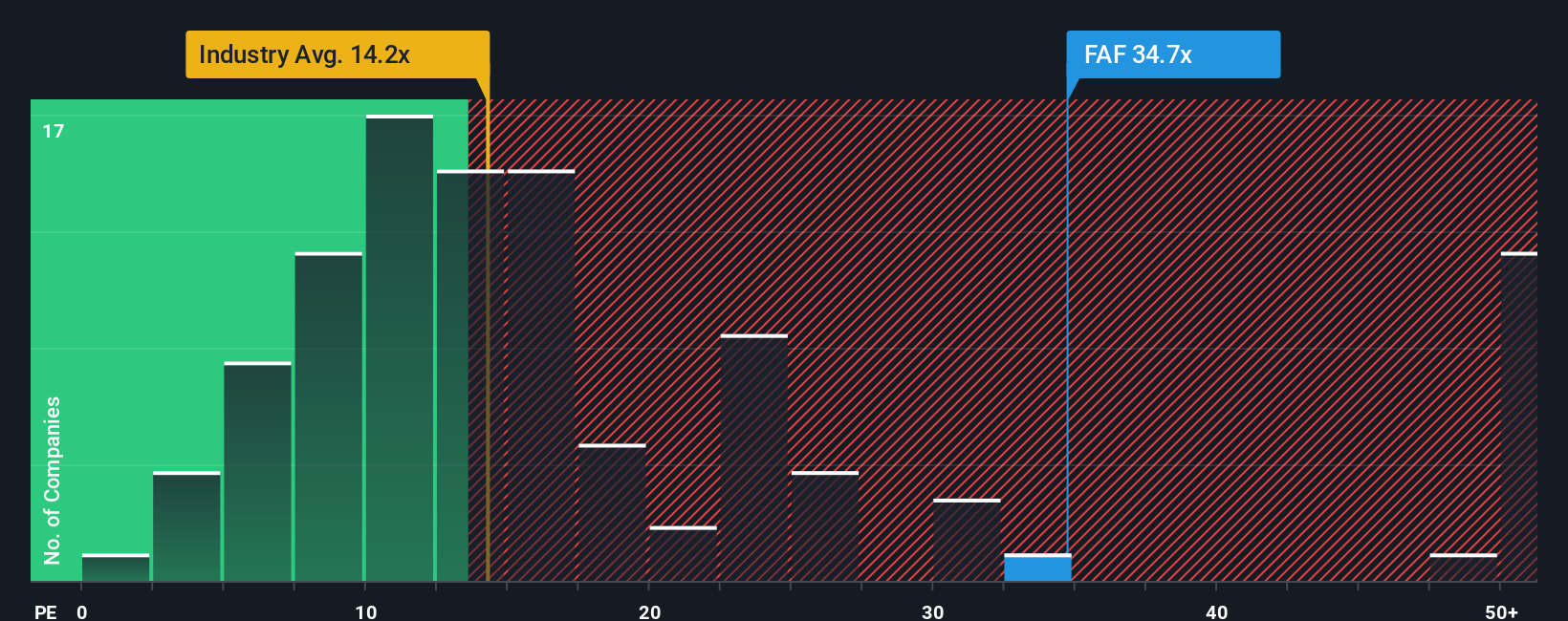

Another View: Market Ratios Send a Different Signal

While the narrative fair value points to upside, our checks on simple valuation ratios paint a cooler picture. FAF trades on a 13.7x price to earnings ratio, slightly above the US Insurance industry at 13.1x and well ahead of peer averages at 11.1x, suggesting less obvious bargain territory.

The fair ratio for FAF sits a touch higher at 14.5x, implying the market is not wildly offside but also not leaving large mispricing on the table. With the share price already above our estimate of fair value at $18.20 based on cash flows, investors need to ask how much margin of safety they really have if growth underwhelms or real estate headwinds persist.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First American Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First American Financial Narrative

If this perspective does not quite align with your own, or you would rather dig into the numbers yourself, you can craft a personalized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding First American Financial.

Looking for more investment ideas?

Do not stop your research with FAF alone. Use the Simply Wall St Screener to uncover fresh opportunities before the crowd moves on them.

- Capture potential mispricings by scanning these 915 undervalued stocks based on cash flows that combine solid fundamentals with attractive valuations others may be overlooking.

- Position yourself for the next wave of innovation by targeting these 25 AI penny stocks poised to benefit from accelerating adoption of intelligent technologies.

- Strengthen your income stream by zeroing in on these 14 dividend stocks with yields > 3% that can help anchor your portfolio with reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FAF

First American Financial

Through its subsidiaries, provides financial services.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026