- United States

- /

- Insurance

- /

- NYSE:CNA

There's No Escaping CNA Financial Corporation's (NYSE:CNA) Muted Earnings

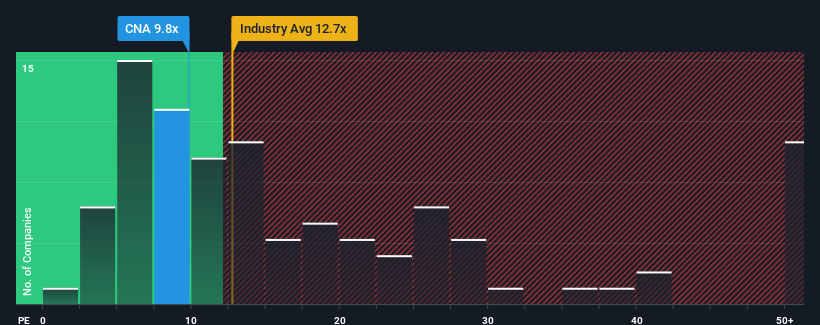

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may consider CNA Financial Corporation (NYSE:CNA) as an attractive investment with its 9.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

CNA Financial certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for CNA Financial

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like CNA Financial's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 82% gain to the company's bottom line. EPS has also lifted 17% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 7.5% over the next year. With the market predicted to deliver 13% growth , the company is positioned for a weaker earnings result.

With this information, we can see why CNA Financial is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that CNA Financial maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with CNA Financial, and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CNA

CNA Financial

An insurance holding company, primarily provides commercial property and casualty insurance products in the United States and internationally.

Established dividend payer and fair value.