- United States

- /

- Insurance

- /

- NYSE:CIA

There's Reason For Concern Over Citizens, Inc.'s (NYSE:CIA) Massive 35% Price Jump

Citizens, Inc. (NYSE:CIA) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 52% in the last year.

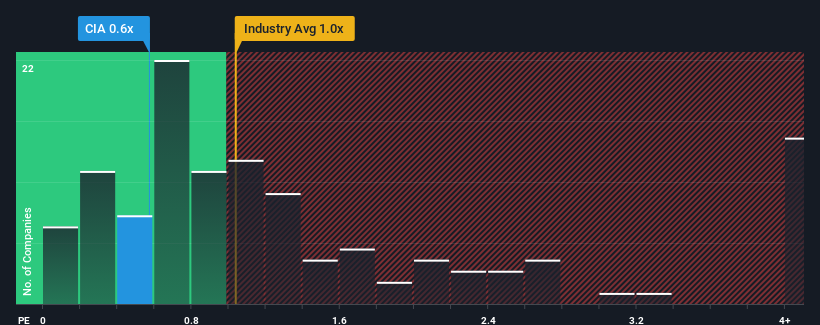

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Citizens' P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Insurance industry in the United States is also close to 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Citizens

How Citizens Has Been Performing

Recent times haven't been great for Citizens as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Citizens.What Are Revenue Growth Metrics Telling Us About The P/S?

Citizens' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.0%. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 2.7% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 6.1%, which is noticeably more attractive.

With this in mind, we find it intriguing that Citizens' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Citizens' P/S?

Its shares have lifted substantially and now Citizens' P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Citizens' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Before you take the next step, you should know about the 1 warning sign for Citizens that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CIA

Citizens

An insurance holding company, provides life insurance products in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives