- United States

- /

- Insurance

- /

- NYSE:CB

Chubb (NYSE:CB) Enacts Share Buyback, Reveals Capital Changes & Dividend Increase

Reviewed by Simply Wall St

Chubb (NYSE:CB) recently announced a 6.6% increase in its annual dividend, marking its 32nd consecutive increase, alongside a substantial $5 billion share repurchase program and updates to its company bylaws. These developments likely provided additional support to its stock, which saw a 10.41% price move over the last quarter. During this period, broader market trends reflected an upward momentum with the S&P 500 showing notable gains, suggesting that Chubb's performance aligned with the overall positive sentiment in the market, rather than standing out on its own.

Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

The recent increase in Chubb's dividend and its $5 billion share repurchase program may bolster the company’s appeal to investors, potentially providing a supportive backdrop for its revenue and earnings forecasts. With dividends rising for 32 consecutive years, Chubb continues to emphasize shareholder returns. However, the narrative indicates potential challenges such as economic uncertainties and foreign exchange volatility, which could still affect profitability and growth projections.

Over the past five years, Chubb's total shareholder return, encompassing both share price and dividends, was 181.17%. For context, this performance provides a solid foundation for evaluating its long-term strength, despite the recent underperformance compared to the US Insurance industry, which saw a return of 16.4% over the past year.

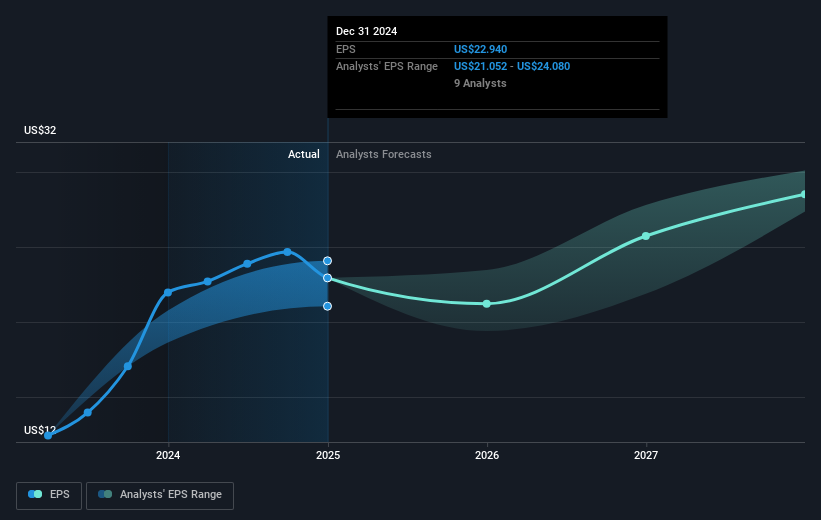

The price movement is modestly aligned with the analysts' consensus price target. Current analyst expectations put Chubb's fair value at US$303.71, which is slightly above the current share price of US$289. The relatively small share price discount to the price target indicates a perceived fair pricing. Whether this valuation holds will depend on Chubb's ability to meet revenue and earnings expectations, which are forecast to see a slight annual decline and growth, respectively.

Navigate through the intricacies of Chubb with our comprehensive balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CB

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives