- United States

- /

- Insurance

- /

- NYSE:CB

Chubb (NYSE:CB) Appoints New Leaders and Launches North America Small & Lower Midmarket Division

Reviewed by Simply Wall St

Chubb (NYSE:CB) recently experienced a price movement of 8% over the last month, alongside significant leadership changes and business restructuring. The appointment of Rob Poliseno as Division President and Jason Ranucci as COO to lead the newly formed North America Small & Lower Midmarket division symbolizes a strategic alignment toward enhanced operational efficiency. Additionally, Chubb's affirmation of a quarterly dividend reflects its commitment to shareholder returns. Although the broader market experienced a 4% decline due to economic uncertainties and inflation concerns, Chubb's restructuring initiatives and leadership appointments might have acted as positive catalysts for its stock performance. Additionally, a moderate inflation report suggested a potential easing of interest rate hikes, which could have benefited financial stocks like Chubb. The company's efforts amid a challenging market environment may have supported investor confidence in its growth trajectory.

Click to explore a detailed breakdown of our findings in Chubb's financial health report.

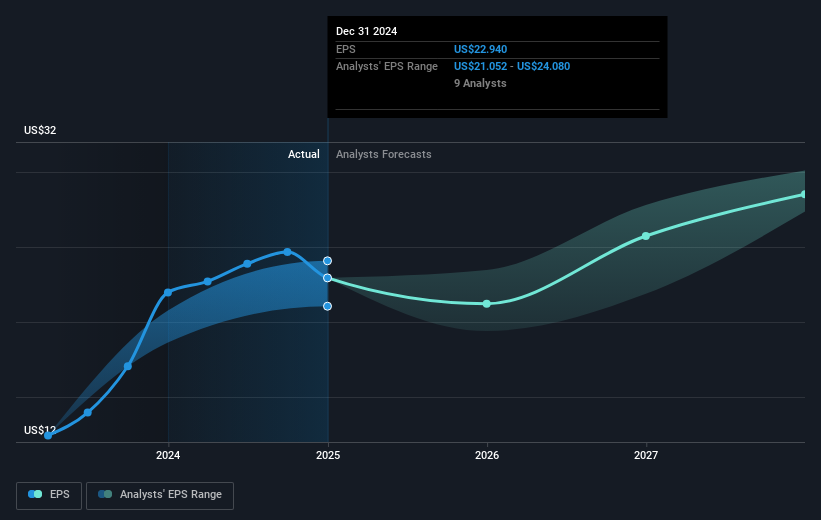

Over the last five years, Chubb's total shareholder return, including share price appreciation and dividends, was remarkable, reaching 188.76%. This performance was underpinned by strategic initiatives, such as the creation of divisions like North America Small & Lower Midmarket, which helped enhance operational focus. The company consistently improved its earnings, growing by 17.7% annually during this period, despite some recent deceleration. Additionally, Chubb's ongoing share buyback program, culminating in the repurchase of 13.66 million shares, emphasized its commitment to returning capital to shareholders. These efforts combined to position Chubb favorably compared to broader market trends.

Chubb's efforts to provide shareholder value were further supported by its consistent dividend policy, highlighted by a 3.75% increase in annual dividends, encouraging investor confidence amidst market turbulence. Although Chubb's recent one-year performance lagged the US Insurance industry, its valuation remained attractive, with its P/E ratio reflecting good value relative to both industry peers and its estimated fair value. These factors contributed cohesively to the company's successful long-term shareholder return.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CB

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives