- United States

- /

- Insurance

- /

- NYSE:ARX

October 2025's Leading Insider-Owned Growth Stocks

Reviewed by Simply Wall St

As the U.S. stock market continues to show resilience amidst a government shutdown, with major indices like the Dow Jones and S&P 500 hitting record highs, investors are keenly observing growth companies with significant insider ownership. In such a climate, businesses where insiders hold substantial stakes often signal strong confidence in their long-term potential and alignment of interests with shareholders, making them noteworthy considerations for those tracking market trends.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 93.2% |

| Prairie Operating (PROP) | 31.3% | 86.6% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 67.4% |

| Hesai Group (HSAI) | 14.9% | 41.5% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.1% | 33.7% |

| Celsius Holdings (CELH) | 10.8% | 32% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

Let's dive into some prime choices out of the screener.

Accelerant Holdings (ARX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Accelerant Holdings operates a data-driven risk exchange that connects specialty insurance underwriters with risk capital partners and has a market cap of $3.28 billion.

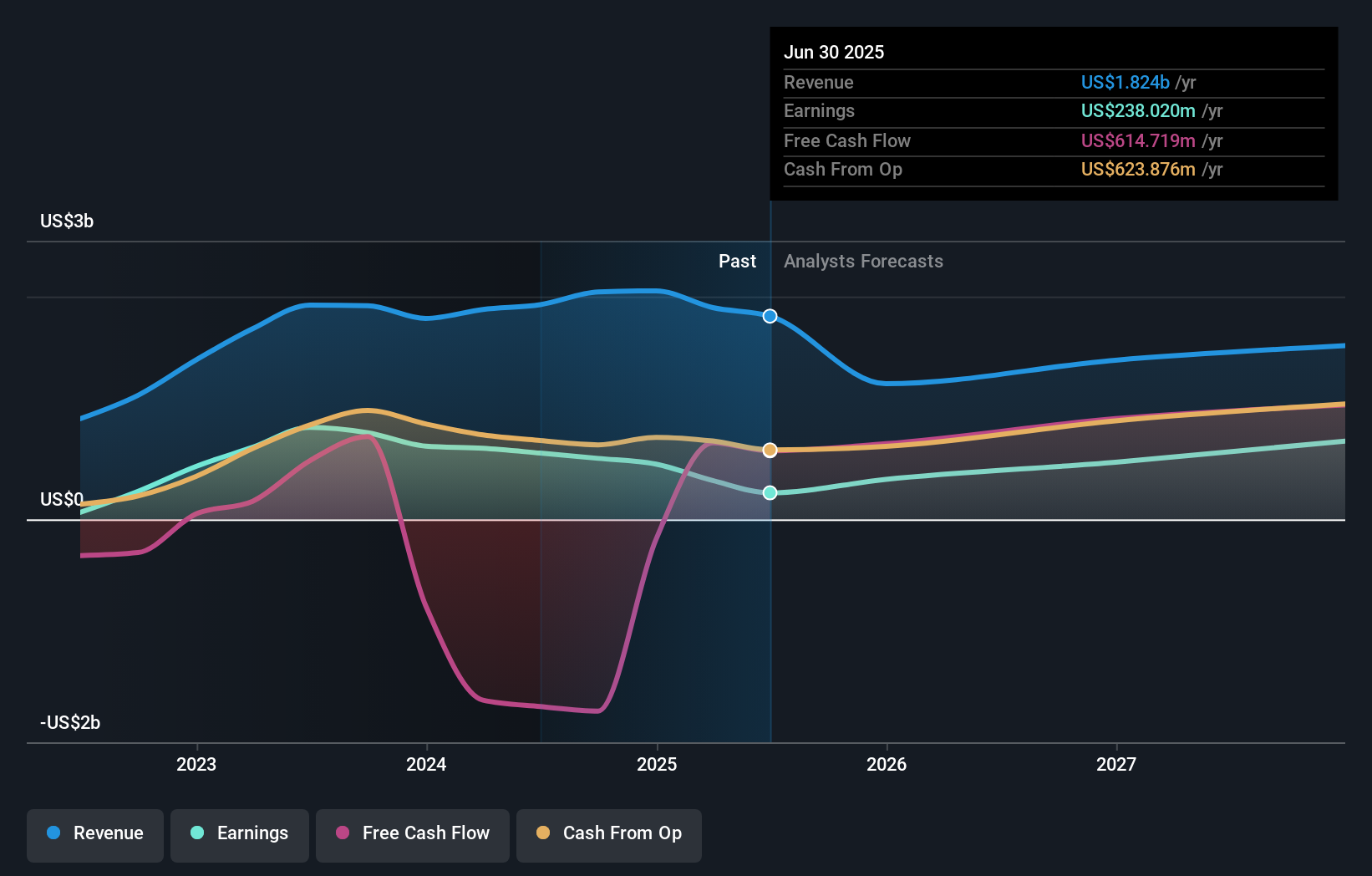

Operations: The company's revenue is derived from three main segments: Underwriting ($345.30 million), MGA Operations ($190.80 million), and Exchange Services ($281.40 million).

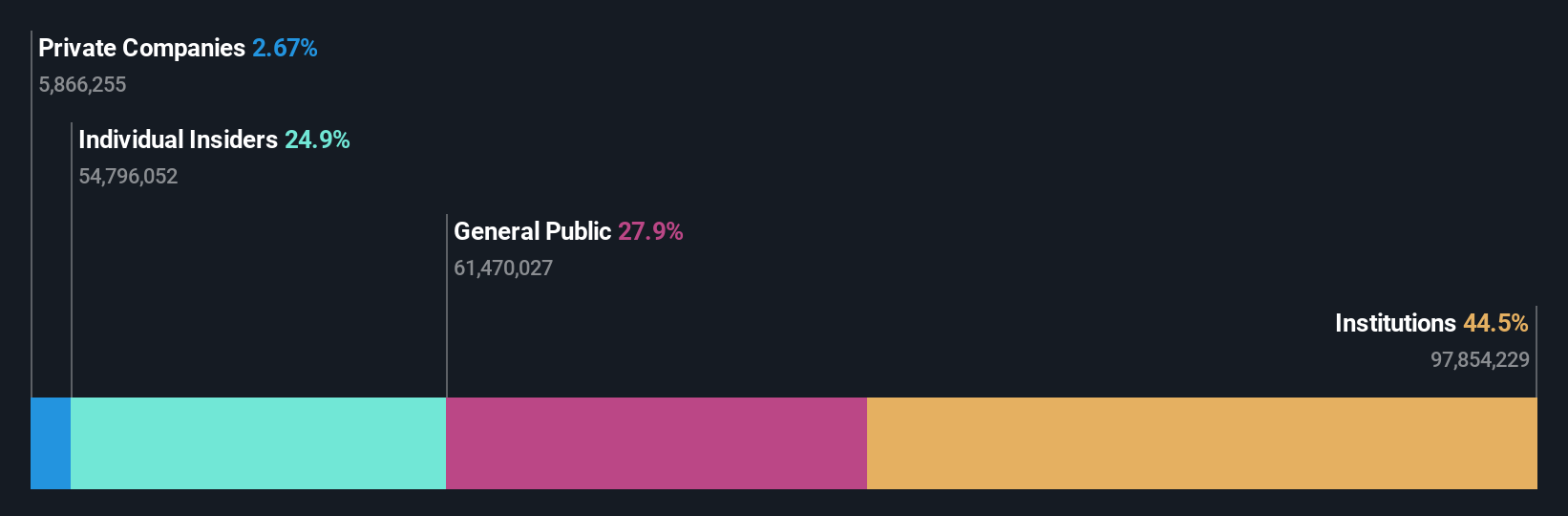

Insider Ownership: 24.9%

Accelerant Holdings, with a recent IPO raising US$723.68 million, is poised for growth with forecasted earnings expansion of 64.3% annually, outpacing the US market average. The company has secured a new risk capital partnership with AF Specialty, enhancing its capacity on the Accelerant Risk Exchange platform. While insider buying has occurred recently without significant volume, no substantial selling was noted. However, investors should be aware of potential volatility and anti-takeover provisions in its bylaws.

- Click here and access our complete growth analysis report to understand the dynamics of Accelerant Holdings.

- The analysis detailed in our Accelerant Holdings valuation report hints at an inflated share price compared to its estimated value.

Frontline (FRO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Frontline plc is a shipping company involved in the ownership and operation of oil and product tankers globally, with a market cap of $5.16 billion.

Operations: The company's revenue is primarily derived from its tanker segment, amounting to $1.82 billion.

Insider Ownership: 35.9%

Frontline's earnings are projected to grow significantly at 41% annually, surpassing the US market average, though revenue is expected to decline by 4.4% per year. The company's Return on Equity is forecasted to remain high at 26%. Despite trading well below estimated fair value, its financial position shows interest payments not fully covered by earnings. Recent results revealed a drop in net income and revenue compared to last year, with no substantial insider trading activity noted recently.

- Click to explore a detailed breakdown of our findings in Frontline's earnings growth report.

- Our valuation report here indicates Frontline may be undervalued.

Sable Offshore (SOC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sable Offshore Corp. is an independent oil and gas company operating in the United States with a market cap of approximately $1.90 billion.

Operations: Sable Offshore generates revenue through its operations in the oil and gas sector within the United States.

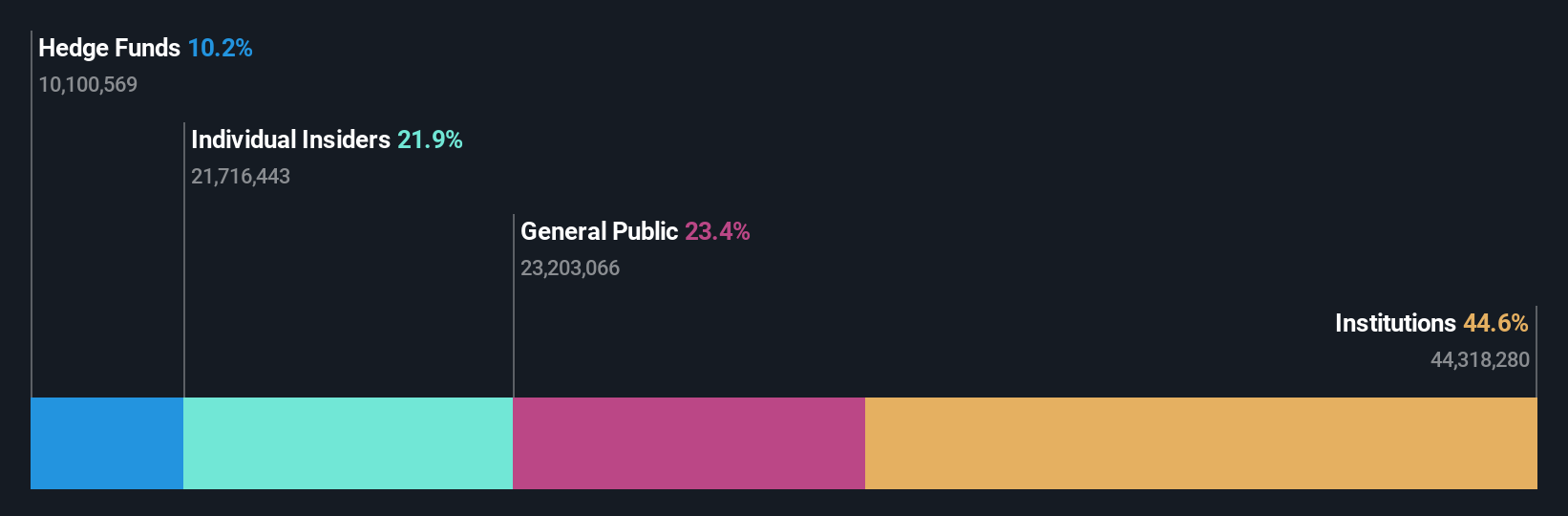

Insider Ownership: 21.8%

Sable Offshore's revenue is forecast to grow rapidly at 57.1% annually, outpacing the US market. Despite trading significantly below its estimated fair value, recent earnings show a reduced net loss of US$128.07 million for Q2 2025 compared to last year. Legal challenges include a class action lawsuit alleging securities fraud and ongoing disputes with the California Coastal Commission over operational permits, impacting investor sentiment and operational stability.

- Unlock comprehensive insights into our analysis of Sable Offshore stock in this growth report.

- Our valuation report unveils the possibility Sable Offshore's shares may be trading at a discount.

Taking Advantage

- Access the full spectrum of 201 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARX

Accelerant Holdings

Accelerant Holdings, together with its subsidiaries, operate a data-driven risk exchange that connects selected specialty insurance underwriters with risk capital partners.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives