- United States

- /

- Insurance

- /

- NYSE:ALL

Allstate (NYSE:ALL) Reaffirms Stable Dividends With $1.00 Common And Preferred Payments

Reviewed by Simply Wall St

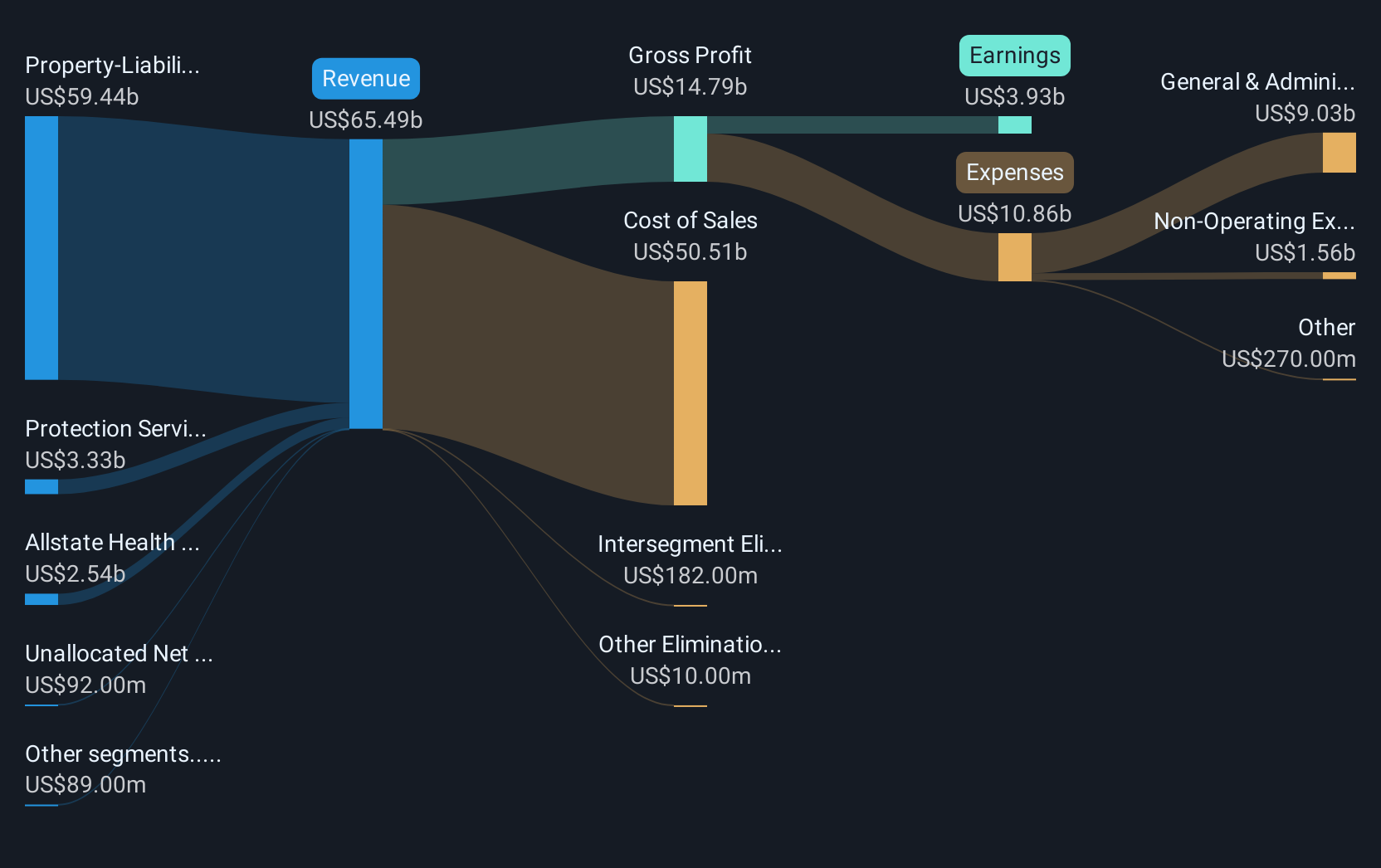

Allstate (NYSE:ALL) has recently announced a $1.00 per share dividend, reinforcing their commitment to shareholder value, further evidenced by last quarter’s 5% stock price increase. This period also saw preferred stock dividends amounting to $29.3 million. Concurrently, Allstate's Q1 2025 revenue growth of $16,452 million, despite a drop in net income to $595 million, hints at resilience against market challenges. Meanwhile, share buybacks totaling $104 million likely bolstered investor confidence. These developments occurred amid mixed market movements, where the S&P 500 experienced fluctuating gains influenced by factors such as Nvidia's strong performance and trade policy adjustments.

Be aware that Allstate is showing 1 possible red flag in our investment analysis.

The recent dividend announcement and share buybacks underscore Allstate's continued commitment to enhancing shareholder value. Over the past five years, Allstate's total shareholder return, including share price and dividends, amounted to 130.02%. This performance reflects a robust long-term trajectory despite short-term earnings challenges. The company's shares have outperformed the US Insurance industry over the past year, creating a positive backdrop for future growth potential.

The introduction of new insurance products is expected to bolster Allstate's market share in the Property-Liability sector, potentially increasing future revenue streams. With a $104 million share buyback and a $1.00 per share dividend, these moves could help maintain investor confidence amid volatile market conditions. However, challenges from catastrophe losses and regulatory constraints could still affect long-term profitability and net margins.

As of today, the share price stands at US$202.06, which is somewhat below the consensus price target of $226.59, indicating potential upside if company projections align with analyst expectations. Analysts foresee revenue growth from $65.30 billion today to $77.40 billion, with earnings per share reaching $20.04 by 2028. These forecasts hinge on successful execution of Allstate's growth strategies and effective cost management initiatives like the S.A.V.E. program. Investors should closely monitor these elements to gauge future performance relative to market expectations.

Explore historical data to track Allstate's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALL

Allstate

Provides property and casualty, and other insurance products in the United States and Canada.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives