- United States

- /

- Insurance

- /

- NYSE:ALL

Allstate (ALL): Exploring the Stock’s Valuation After Recent Shift in Investor Sentiment

Reviewed by Simply Wall St

Allstate (ALL) just made headlines, and investors are once again weighing their next move. While there might not have been a major event driving recent market chatter, the subtle shift in the stock’s momentum has definitely captured the attention of those keeping an eye on the insurance sector. With Allstate’s market presence and performance, even a quiet period can leave investors wondering if something deeper is signaling a change ahead.

Over the past year, Allstate’s stock has gained around 9%, displaying a steady, upward trajectory. Despite a slight setback over the past month, the longer-term momentum still leans positive. Pair this with annual revenue growth and a three-year return that significantly exceeds the broader market, and it is clear Allstate remains in the conversation for investors looking for growth and stability, even without a headline-grabbing catalyst.

So after a year marked by measured gains rather than volatility, is this a chance to pick up Allstate at an appealing valuation, or is the market already looking ahead and pricing in future upside?

Most Popular Narrative: 12.8% Undervalued

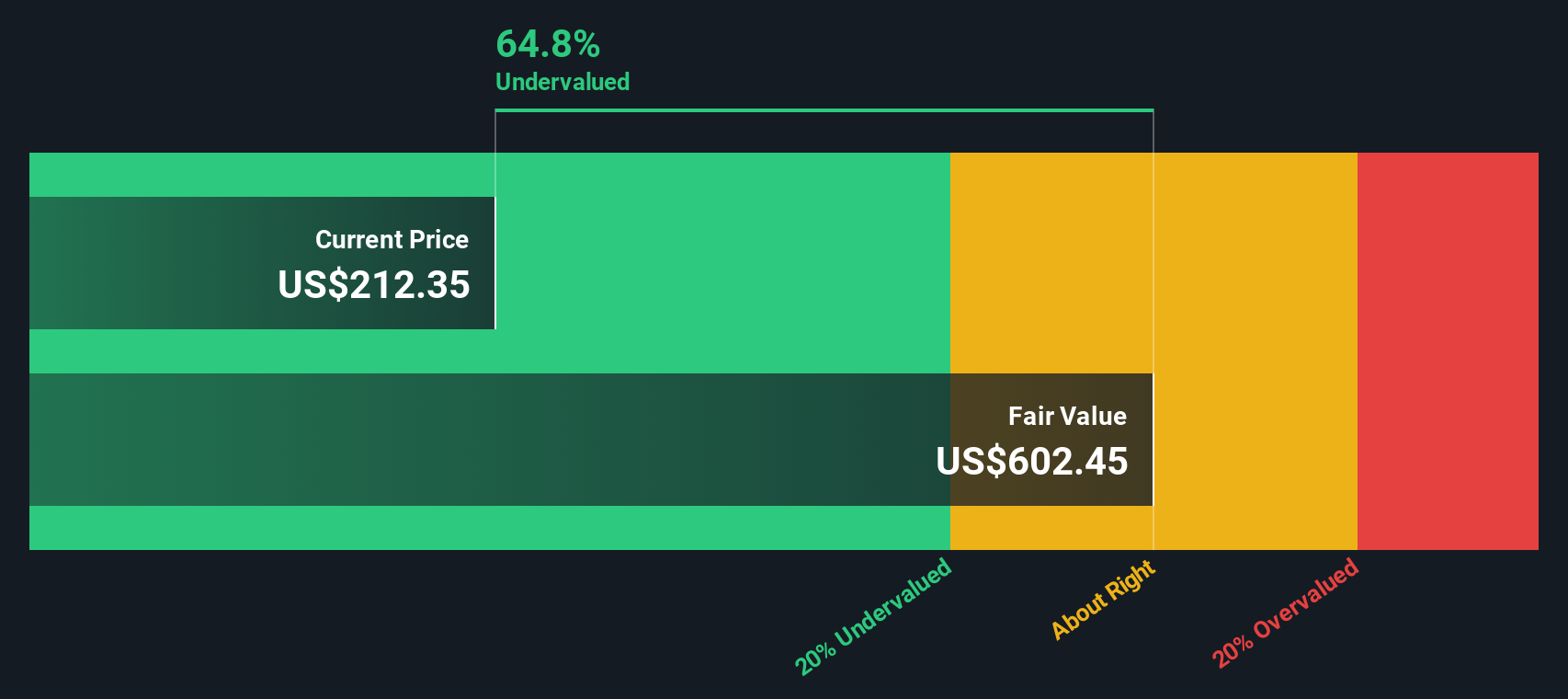

The most widely tracked narrative suggests that Allstate is currently underappreciated by the market, trading at a meaningful discount compared to its estimated fair value.

The rollout of Allstate's new digitally enabled, "Affordable, Simple, Connected" auto and homeowner products across multiple states, combined with sophisticated pricing and expanded distribution, is expected to drive profitable policy growth and improve top-line revenue as traditional and direct-to-consumer channels scale.

Want to know what sets Allstate’s future value apart? This narrative hints at a transformative formula hiding beneath the surface, combining evolving products, rapid tech adoption, and bold profit forecasts that may surprise investors. Ready to see which financial levers analysts are pulling for this valuation?

Result: Fair Value of $229.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges remain, as heightened climate risks and increased competition from digital-first insurers could disrupt Allstate’s future growth and margin expectations.

Find out about the key risks to this Allstate narrative.Another View: Sizing Up With the DCF Model

Looking through the lens of our DCF model gives a different reading. This method digs into Allstate’s future cash flows to judge value, and it also suggests the stock looks materially undervalued. Could both signals be missing something? Or is there still upside waiting to be claimed?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Allstate Narrative

If you want to dive deeper and put your own spin on Allstate’s outlook, you can easily shape your unique view in just a few minutes. Do it your way.

A great starting point for your Allstate research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your portfolio by actively seeking out companies reshaping entire industries. The right tool can help you spot the next big opportunity before everyone else.

- Tap into tomorrow’s breakthroughs by following quantum computing stocks, where cutting-edge computing meets real-world impact. See which companies are driving quantum leaps in innovation.

- Boost your potential income and uncover reliable payers with dividend stocks with yields > 3%, revealing stocks offering strong yields and consistent performance for steady growth.

- Speed ahead of the crowd and spot overlooked bargains through undervalued stocks based on cash flows, your shortcut to finding top stocks trading below their fair value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:ALL

Allstate

Provides property and casualty, and other insurance products in the United States and Canada.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)