- United States

- /

- Insurance

- /

- NYSE:AIG

A Look at American International Group’s Valuation Following Recent Leadership Changes and Strategic Digital Shift

Reviewed by Kshitija Bhandaru

American International Group (AIG) is navigating a wave of executive changes this month, naming a new CFO for its EMEA operations and restructuring its North America commercial leadership. These shifts are part of AIG’s ongoing digital transformation efforts and evolving strategy.

See our latest analysis for American International Group.

After a minor dip this week, American International Group’s year-to-date share price return stands at 13.6%, reflecting continued investor optimism around its ongoing digital transformation and leadership realignment. Over the past five years, total shareholder return of 204% illustrates strong long-term momentum as AIG pivots towards technology-driven growth and efficiency.

If shifts like these have you interested in what else is making waves, now is a great moment to discover fast growing stocks with high insider ownership.

But with shares up over 13% so far this year, should investors see potential for more upside given AIG’s evolving strategy? Or is the market already reflecting all of its future growth prospects in the current price?

Most Popular Narrative: 6% Undervalued

Compared to AIG’s last close of $82.91, the most widely followed narrative assigns a fair value of $88.28, suggesting the stock is trading at a discount. This gap captures analysts’ expectations for digital transformation to deliver improved efficiency, higher profitability, and steadier earnings growth.

The acceleration of digitalization and artificial intelligence initiatives, such as the Gen AI deployment across underwriting and claims, positions AIG to enhance operational efficiency, improve underwriting precision, reduce fraud, and offer more tailored insurance products. This supports improved net margins and sustained earnings growth.

Want to uncover the numbers behind this narrative? The real drivers are ambitious profit targets, double-digit margin boosts, and a lower future valuation multiple. Which assumption will surprise you the most? See which one makes this fair value compelling.

Result: Fair Value of $88.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative's upside could be challenged if climate risks or increased competition put pressure on AIG’s margins and long-term earnings growth.

Find out about the key risks to this American International Group narrative.

Another View: Multiples Paint a Different Picture

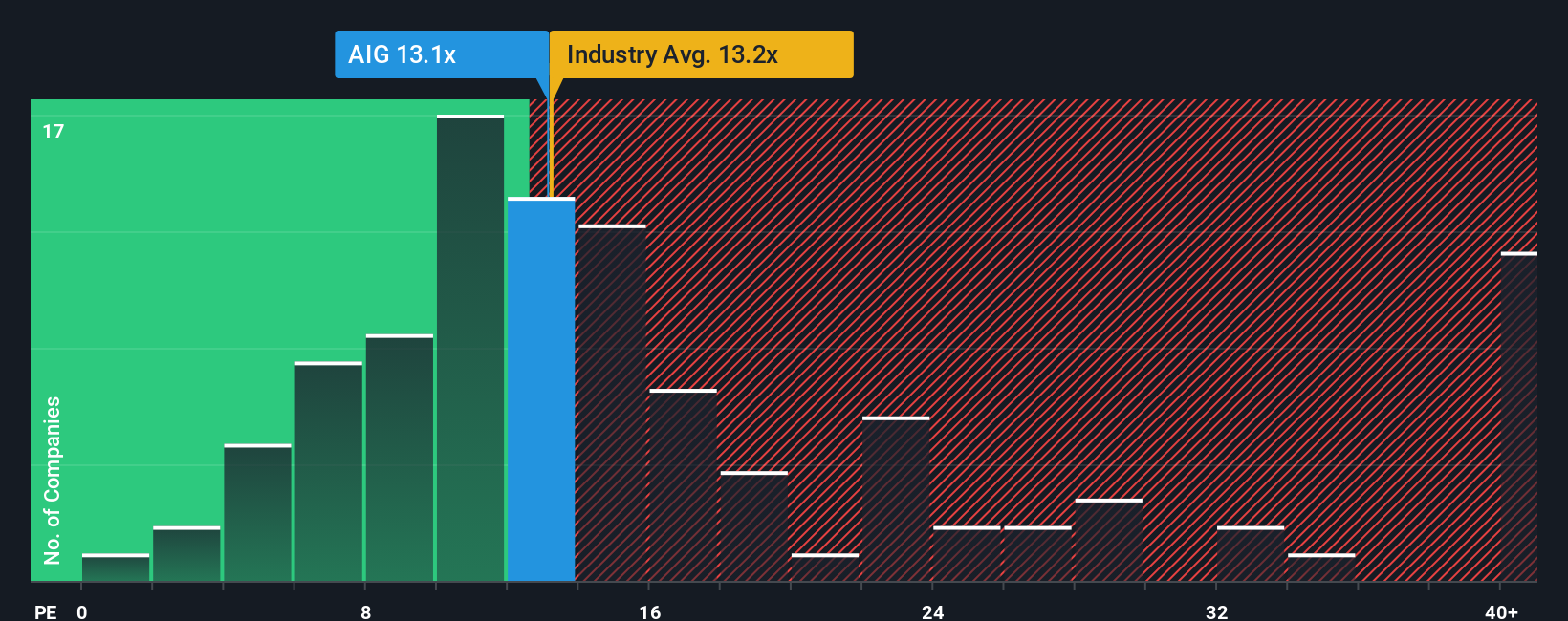

While some see AIG as undervalued, looking at the current price-to-earnings ratio of 14.1 tells a more cautious story. This figure sits above both the peer average of 12.5 and the US industry average of 13.9. This suggests the stock trades at a premium rather than a bargain. The fair ratio is 14.4, so there is little wiggle room for error. Is this higher multiple a sign of quality, or could it leave investors exposed if growth expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American International Group Narrative

If this analysis doesn’t fit your perspective, why not dig into the numbers and generate a personalized view of AIG’s story in just a few minutes? Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding American International Group.

Looking for more investment ideas?

Why stop here when you can target the next big opportunities? Now’s your chance to maximize your portfolio with strategies you won’t find elsewhere. Make your next move before these trends leave you behind.

- Capture reliable income streams by taking a look at these 18 dividend stocks with yields > 3% with attractive yields and robust track records.

- Join the AI revolution by seeking out the innovation leaders among these 24 AI penny stocks who are reshaping industries with artificial intelligence breakthroughs.

- Spot undervalued gems and get ahead of the market with these 877 undervalued stocks based on cash flows where growth potential and strong fundamentals meet value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIG

American International Group

Offers insurance products for commercial, institutional, and individual customers in North America and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives