- United States

- /

- Insurance

- /

- NYSE:AGO

How Investors May Respond To Assured Guaranty (AGO) Surpassing Revenue Estimates by a Wide Margin

Reviewed by Sasha Jovanovic

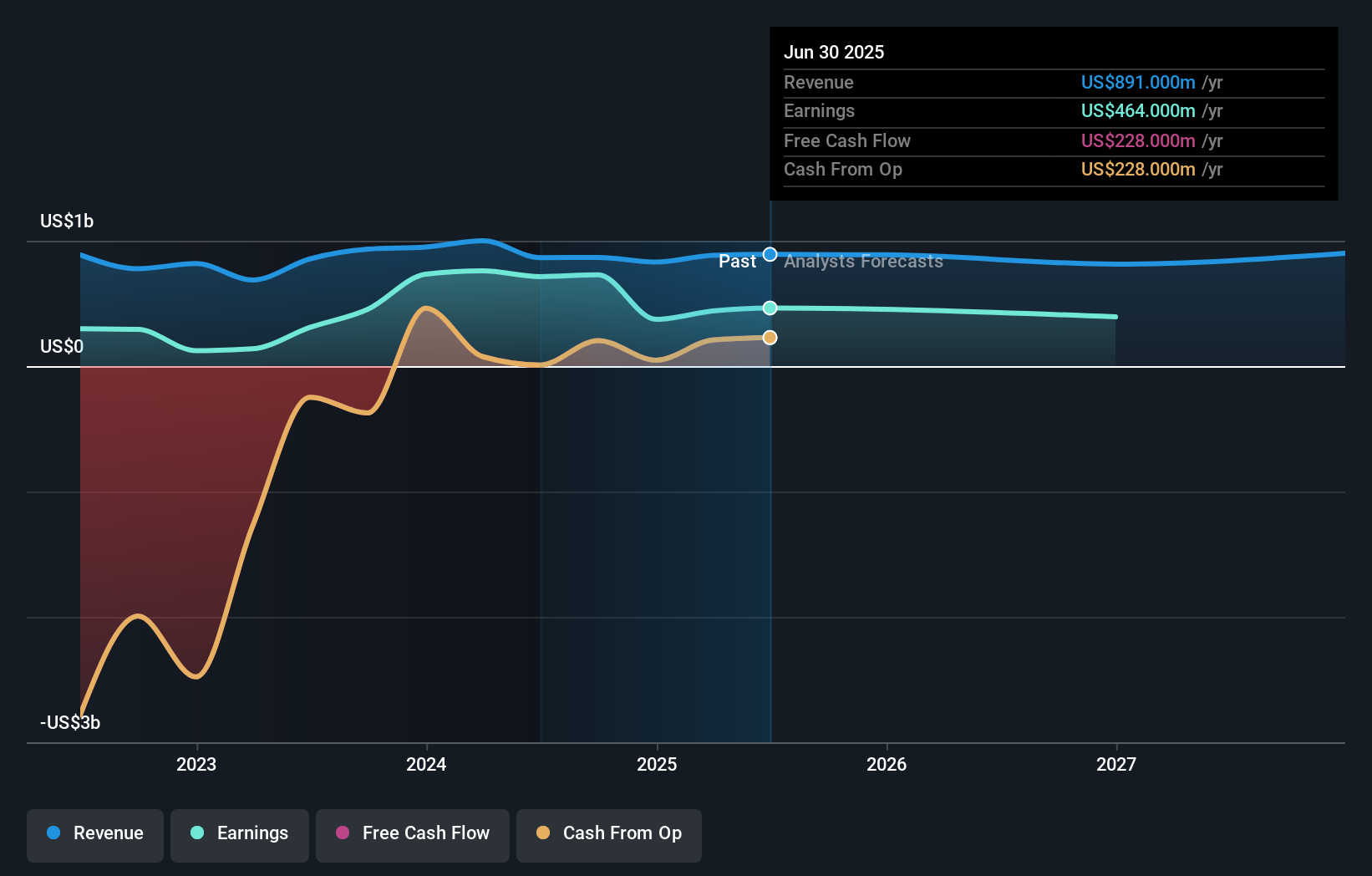

- Assured Guaranty reported a very large year-on-year revenue increase in the past quarter, surpassing analyst expectations by 51.2% even though earnings per share and net premiums earned missed forecasts.

- This revenue performance stood out among 33 property & casualty insurance peers, marking the most significant analyst estimates beat of the group for the quarter.

- We'll now examine how Assured Guaranty's standout revenue beat could reshape its forward-looking investment narrative and future expectations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Assured Guaranty Investment Narrative Recap

To be a shareholder in Assured Guaranty, you generally need confidence in the company’s ability to manage credit risk, capitalize on its global expansion, and navigate complex credit markets, especially as interest rate movements and exposure to distressed credits can swing results. The recent revenue surge was exceptional, but with earnings and net premiums earned missing forecasts, it does not materially shift the key catalyst: successful expansion into new markets. However, it does highlight the company’s revenue potential, while the primary risk remains the impact of interest rate fluctuations on book and operating value.

One announcement especially relevant to the current conversation is the company’s continued buyback activity, with nearly 2.4 million shares repurchased since April and a newly increased authorization of US$300 million. Coupled with the revenue beat, this underscores management's commitment to returning value to shareholders, against the backdrop of capital strength, a central narrative catalyst if new market expansion continues to progress as planned.

On the other hand, investors should be aware of the potential for volatility if interest rate shifts unexpectedly affect reported book value or...

Read the full narrative on Assured Guaranty (it's free!)

Assured Guaranty's narrative projects $830.5 million revenue and $262.6 million earnings by 2028. This requires a 2.1% annual revenue decline and a $177.4 million decrease in earnings from the current level of $440.0 million.

Uncover how Assured Guaranty's forecasts yield a $106.50 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Community member fair value estimates for Assured Guaranty are clustered at US$183.89, based on one unique forecast in the Simply Wall St Community. With interest rate volatility still a core business risk, keep in mind opinions may differ sharply when evaluating future outcomes.

Explore another fair value estimate on Assured Guaranty - why the stock might be worth over 2x more than the current price!

Build Your Own Assured Guaranty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Assured Guaranty research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Assured Guaranty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Assured Guaranty's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGO

Assured Guaranty

Provides credit protection products to public finance and structured finance markets in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives