- United States

- /

- Insurance

- /

- NYSE:AFL

Aflac (NYSE:AFL) Unveils Enhanced Accident Insurance With Improved Benefits Across 32 States

Reviewed by Simply Wall St

Aflac (NYSE:AFL) launched a new Accident Insurance product last week, providing enhanced financial protection and expanded access to services, which may have played a part in the company's modest 0.73% share price increase over the period. This introduction underscores Aflac’s commitment to addressing consumer needs for coverage beyond traditional health insurance. Meanwhile, the broader market faced challenges, with the S&P 500 and Nasdaq experiencing declines of 1% and 2% respectively, driven by a slump in tech stocks and concerns about the economic outlook. Despite the market's overall 3% pullback, Aflac's focus on product innovation and financial protection solutions may have helped it withstand wider market pressures better than some peers. The company's 0.1% price uptick contrasts with the downturn in major indexes, indicating a possible favorable reception to Aflac’s product developments amid uncertain market conditions.

Dig deeper into the specifics of Aflac here with our thorough analysis report.

Aflac's shares have delivered a total return of 159.71% over the past five years, showcasing remarkable performance compared to broader market trends. This impressive gain contrasts with the more modest performance of the US Insurance industry and the market as a whole over the last year. Several factors have likely driven this substantial return. A 16% increase in dividends announced in December 2024 illustrates Aflac's focus on rewarding shareholders, while consistent share repurchases, totaling 21.17 million shares in 2024 alone, further bolstered share value.

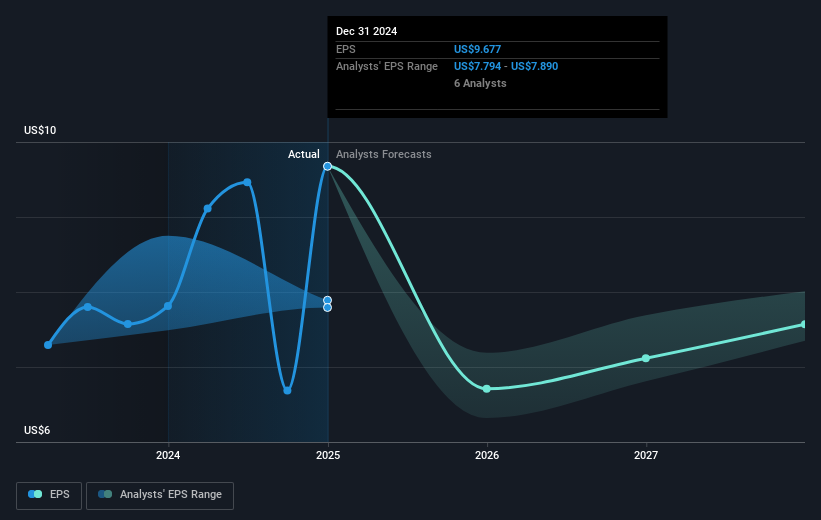

The company's enhancements of product offerings, including a new Accident Insurance product in February 2025, underscore its commitment to meeting consumer demands. Additionally, Aflac forged meaningful partnerships to expand reach, such as its collaboration with USAA in mid-2024. Despite forecasts of revenue and earnings declines, Aflac's strengthened profit margins and focus on quality earnings growth have significantly contributed to its positive share performance over the long term.

- See how Aflac measures up with our analysis of its intrinsic value versus market price.

- Discover the key vulnerabilities in Aflac's business with our detailed risk assessment.

- Is Aflac part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AFL

Aflac

Through its subsidiaries, provides supplemental health and life insurance products.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives