- United States

- /

- Insurance

- /

- NYSE:AFG

American Financial Group (NYSE:AFG) Appoints New Directors Craig Lindner Jr and David Thompson Jr

Reviewed by Simply Wall St

American Financial Group (NYSE:AFG) recently announced executive and board changes, notably with the election of Craig Lindner Jr. and David L. Thompson Jr. as new directors, signaling a strategic shift in leadership. This period also saw James E. Evans announce his retirement, although he will continue as an Executive Consultant. Despite these transitions, AFG's stock registered a 2.52% decline over the past week. These leadership updates occurred amid broader market movements, including the Dow Jones and S&P 500's retreats after record highs and a correction in major stocks like Palantir and Walmart due to government budget cuts and disappointing outlooks, respectively. Additionally, financial markets had modest fluctuations with gold and oil prices trending upwards. While the overall market rose by 1.2% in the last seven days, AFG's shares diverged, reflecting specific company events against a backdrop of market volatility and shifts in investor sentiment.

See the full analysis report here for a deeper understanding of American Financial Group.

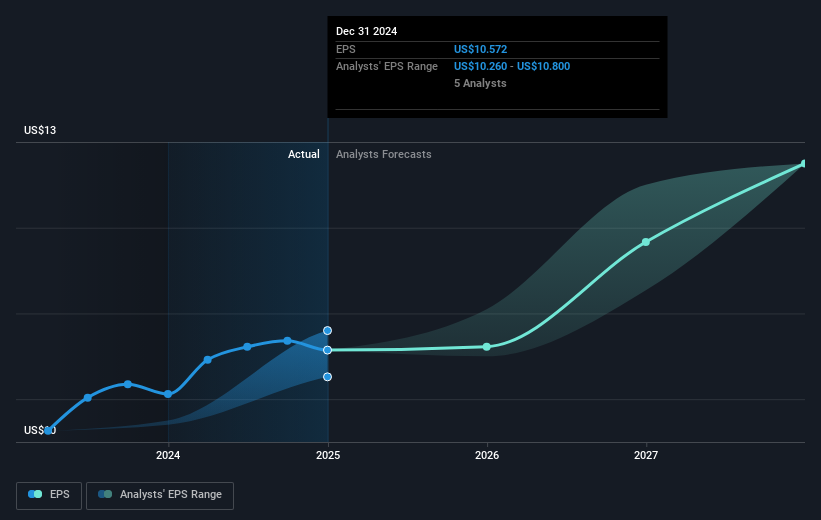

Over the last five years, American Financial Group (NYSE:AFG) has delivered a total shareholder return of 101.01%, showcasing substantial growth for its investors. This impressive performance can be partially attributed to consistent earnings growth, averaging 12.9% per year. Additionally, AFG's stock valuation metrics, such as its Price-To-Earnings Ratio of 11.5x compared to a higher fair estimated ratio, indicate the company might have been perceived as a value investment over this period. Investors also benefited from regular and special dividends, including a US$4.00 special dividend announced in November 2024, enhancing overall returns.

However, recent events have posed challenges. The company was embroiled in legal disputes after Brand Engagement Network Inc. terminated its agreement and initiated a lawsuit, potentially impacting investor sentiment. Moreover, AFG underperformed relative to both the US insurance industry and the broader market over the past year, which saw gains of 19% and 23.7% respectively, highlighting a shift in its market position.

- Get the full picture of American Financial Group's valuation metrics and investment prospects—click to explore.

- Gain insight into the risks facing American Financial Group and how they might influence its performance—click here to read more.

- Is American Financial Group part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AFG

American Financial Group

An insurance holding company, provides specialty property and casualty insurance products in the United States.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives