- United States

- /

- Insurance

- /

- NasdaqCM:ACIC

US Market's Hidden Gems: 3 Promising Small Cap Stocks

Reviewed by Simply Wall St

As the U.S. stock market continues to reach new heights, with indices like the Nasdaq and S&P 500 posting record closing highs, investors are navigating a landscape marked by both optimism and uncertainty due to factors such as government shutdowns and fluctuating economic indicators. In this dynamic environment, identifying promising small-cap stocks can be particularly rewarding, as these companies often offer unique growth opportunities that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 117.38% | 8.87% | 4.89% | ★★★★★★ |

| Tri-County Financial Group | 82.51% | 3.15% | -17.04% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| SUI Group Holdings | NA | 16.40% | -30.66% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Elron Ventures | 5.70% | 13.72% | 25.56% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

American Coastal Insurance (ACIC)

Simply Wall St Value Rating: ★★★★★☆

Overview: American Coastal Insurance Corporation operates in the United States, focusing on commercial and personal property and casualty insurance, with a market cap of $568.60 million.

Operations: The company generates revenue primarily from its commercial lines business, which amounts to $320.07 million.

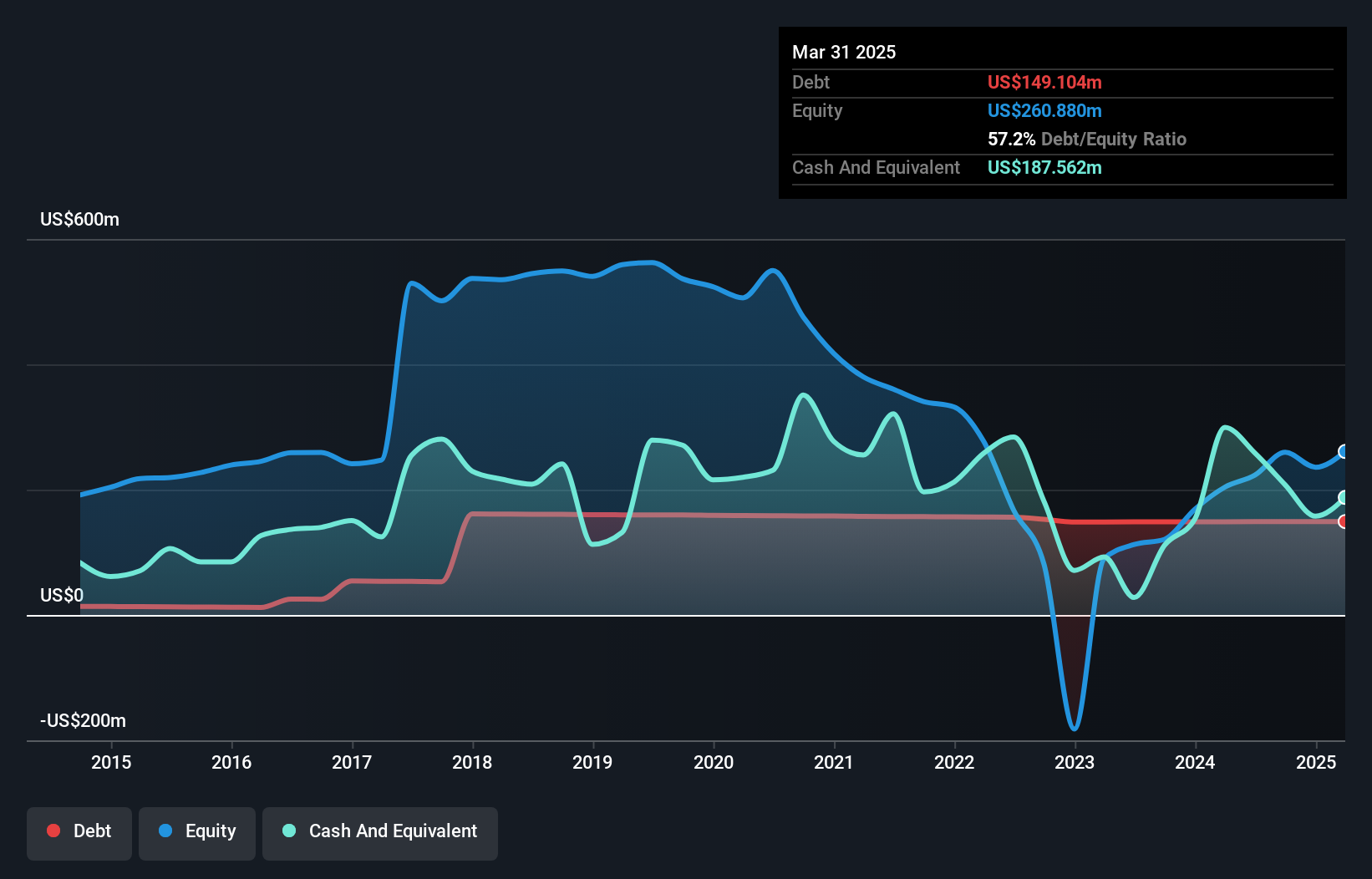

American Coastal Insurance is carving a niche with its earnings growth of 8.1% over the past year, outpacing the industry average of 6%. The company trades at a significant discount, valued at 71.9% below its estimated fair value, and maintains robust interest coverage with EBIT covering debt payments by 10.4 times. Despite an increase in debt-to-equity ratio from 28.8% to 51% over five years, it holds more cash than total debt, suggesting financial flexibility. However, challenges like hurricane risks and fluctuating reinsurance costs could impact profitability as profit margins might shrink from 25.4% to 20.8%.

Climb Global Solutions (CLMB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Climb Global Solutions, Inc. is a value-added IT distribution and solutions company operating in the United States, Canada, Europe, and the United Kingdom with a market cap of $634.40 million.

Operations: Climb Global Solutions generates revenue primarily from its Distribution segment, which accounts for $552.45 million, while the Solutions segment contributes $25.99 million.

Climb Global Solutions, a nimble player in the IT distribution sector, is making waves with its strategic focus on high-growth areas like cybersecurity and cloud solutions. The company has seen its earnings soar by 61.2% over the past year, outpacing the electronic industry average of -1.4%. With cash reserves exceeding total debt and trading at 21.4% below estimated fair value, Climb presents a compelling case for potential investors. Recent financials show sales climbing to US$159 million from US$92 million year-over-year, while net income improved to US$5.97 million from US$3.43 million, highlighting robust growth momentum despite challenges such as low profit margins and vendor dependencies.

United Fire Group (UFCS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: United Fire Group, Inc. offers property and casualty insurance services for individuals and businesses across the United States, with a market capitalization of approximately $783.62 million.

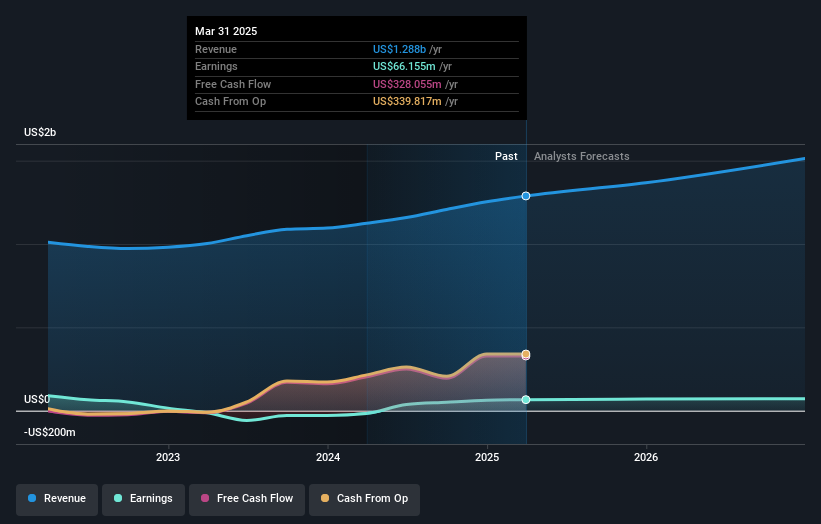

Operations: UFCS generates revenue primarily from its property and casualty insurance segment, amounting to $1.32 billion. The company's financial performance is reflected in a net profit margin, which has shown variability over recent periods.

United Fire Group, operating in the property and casualty insurance sector, showcases a blend of potential and challenges. The company has seen impressive earnings growth of 149.9% over the past year, outpacing industry averages. Its price-to-earnings ratio stands at 8.7x, notably below the US market average of 19.3x, suggesting it might be undervalued by some metrics. However, rising climate-related risks and reinsurance costs pose significant threats to profitability and premium retention. Recent strategic moves include appointing Gilda L. Spencer to its board for enhanced governance and risk management expertise amid these headwinds while maintaining a quarterly dividend payout of $0.16 per share indicates a commitment to shareholder returns amidst evolving market dynamics.

Make It Happen

- Discover the full array of 285 US Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ACIC

American Coastal Insurance

Through its subsidiaries, primarily engages in the commercial and personal property and casualty insurance business in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026